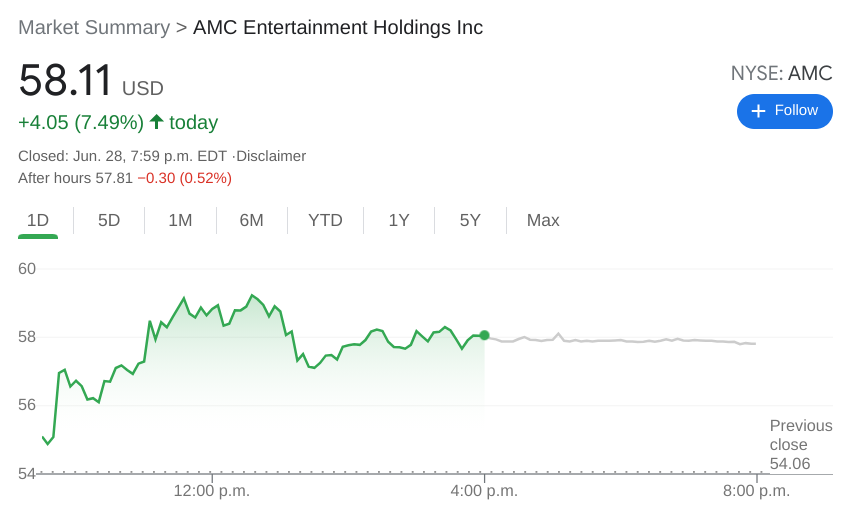

- NYSE:AMC gained 7.49% on Monday amidst a mixed day for the broader markets.

- AMC reported impressive theater attendance numbers from the weekend.

- Baird has stopped coverage of GameStop over volatility of meme stocks.

NYSE:AMC seems to always rise back up from the ashes, whenever Wall Street is ready to count them and their millions of retail apes out. On Monday, shares of AMC jumped 7.49% and closed the trading day at $58.11, amidst a fairly choppy day for the broader markets. The NASDAQ and S&P 500 powered to new all-time highs once again, as growth and tech stocks ruled the day. AMC still had lower than average trading volume on Monday, with only 99 million shares being traded compared to its recent daily average of 155 million shares per day.

Stay up to speed with hot stocks’ news!

AMC apes can rejoice as the company reported some very strong attendance numbers from over the weekend, another sign that the U.S. is ready to open back up after COVID-19. The company stated that between June 24th and 27th, more than 2 million people attended theaters in the country, with 500,000 more attending its various locations overseas. One of the catalysts is the much anticipated release of F9: The Fast Saga, the latest iteration in the long-running Fast & Furious series. The action film brought in an estimated $70 million in ticket revenues on its debut weekend.

AMC’s partner in crime, GameStop (NYSE:GME), also saw a small surge on Monday after being added to the Russell 1000 index last week. Not everyone is impressed though as investment analyst firm Baird has reported it has ceased coverage of the stock, given the ongoing volatility from meme investors that have separated the valuation of the stock from the fundamentals of the company.