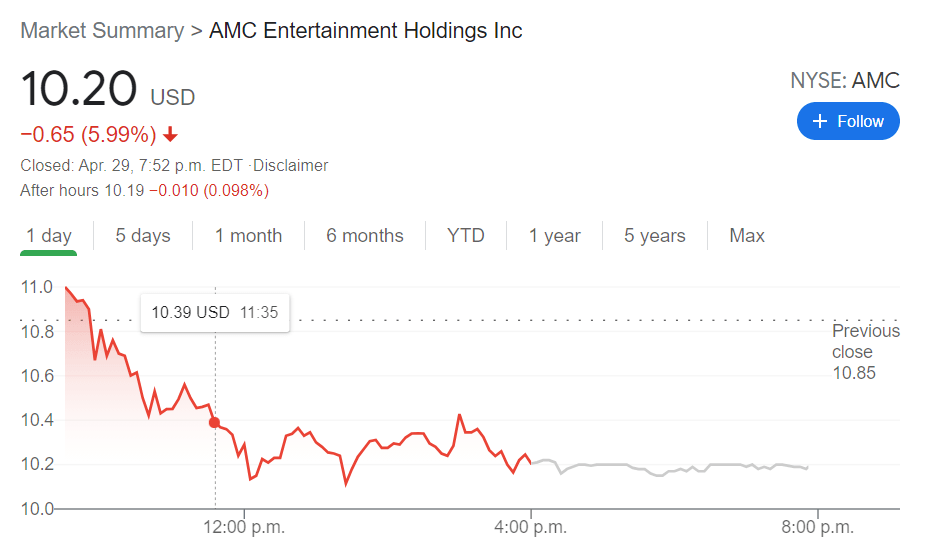

- NYSE:AMC fell by 5.99% on Thursday as the broader markets fell after big tech earnings.

- Disney and Sony reached an agreement on movies going direct to streaming.

- AMC investors still have a 500 million share weight hanging over their heads.

NYSE:AMC has continued along its volatile path set earlier in the year by the meme stock short squeeze, with another turbulent month in April. On Thursday, shares fell 5.99% to close the trading session at $10.20, alongside a selloff for the broader markets. It is the second straight trading day where AMC has crashed, after several microeconomic factors have caused investor sentiment to sour. AMC experienced a small surge after all of its cinema locations were able to open after most U.S. states received reopening orders following a mass COVID-19 vaccination effort.

Stay up to speed with hot stocks’ news!

One of the main catalysts is movie giant Walt Disney (NYSE:DIS) which has made numerous efforts to continue utilizing its Disney+ streaming service to launch new movies. Disney also made an agreement with Sony (NYSE:SONY) to stream its movies in the U.S. following the theatrical releases. While this is not a direct hit to AMC and movie goers, if consumers know that certain Sony movies will be airing on a platform like Disney+ that they already subscribe to, they may be less willing to pay for tickets at a theater. Earlier this week, Pixar employees state their disappointment that some movies will be going straight to Disney+ without playing in movie theaters in the future.

AMC investors are also hesitant knowing that the company does have 500 million outstanding shares that may be exercised in the future to raise capital or mitigate debt. CEO Adam Aron has reassured shareholders that AMC will not be offering those shares this year, but that it still has authorization to offer 43 million shares which would represent a near 10% dilution of current shareholder equity.