- Australian inflation is expected to have remained subdued in Q1 2021.

- The poor performance of equities undermined the bullish potential of AUD/USD.

- AUD/USD has limited bearish potential as long as it holds above 0.7690.

The AUD/USD pair ended Tuesday with losses in the 0.7760 price zone, unable to extend gains beyond the 0.7800 level but retaining a limited bearish scope. The pair eased despite limited demand for the greenback, undermined by the poor performance of global equities, which closed mixed around their opening levels.

Australia will publish this Wednesday inflation data for the first quarter of the year. The quarterly Consumer Price Index is expected to have held steady at 0.9%, while the RBA Trimmed Mean CPI for the same period is expected to have improved from 0.4% to 0.5%.

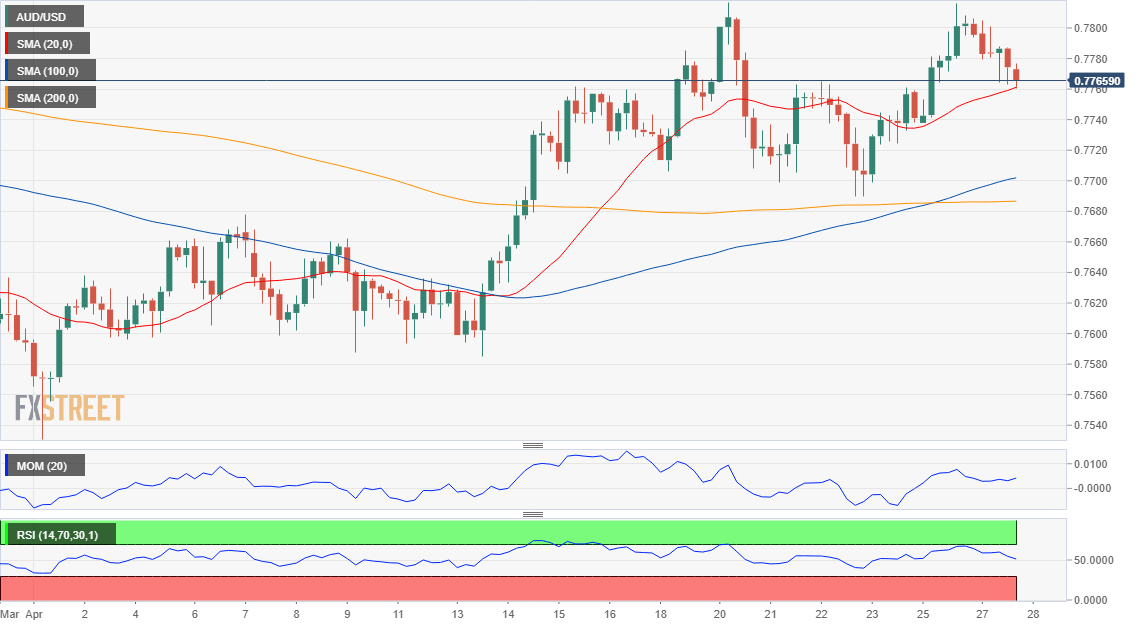

AUD/USD Short-Term Technical Outlook

The AUD/USD pair trades near a daily low at 0.7761, but its bullish potential is limited. The 4-hour chart shows that the pair is near but above a directionless 20 SMA, while the longer moving averages remain well below it. Technical indicators have retreated from near overbought readings but lost bearish strength once near their midlines, indicating subdued selling interest. Bears could stir the slide if the pair breaks below the 0.7730 support level.

Support levels: 0.7730 0.7690 0.7650

Resistance levels: 0.7820 0.7850 0.7890

View Live Chart for the AUD/USD

Image Sourced from Pixabay