- Australia to release March manufacturing PMIs this Thursday.

- The aussie is under pressure, despite US equities advanced.

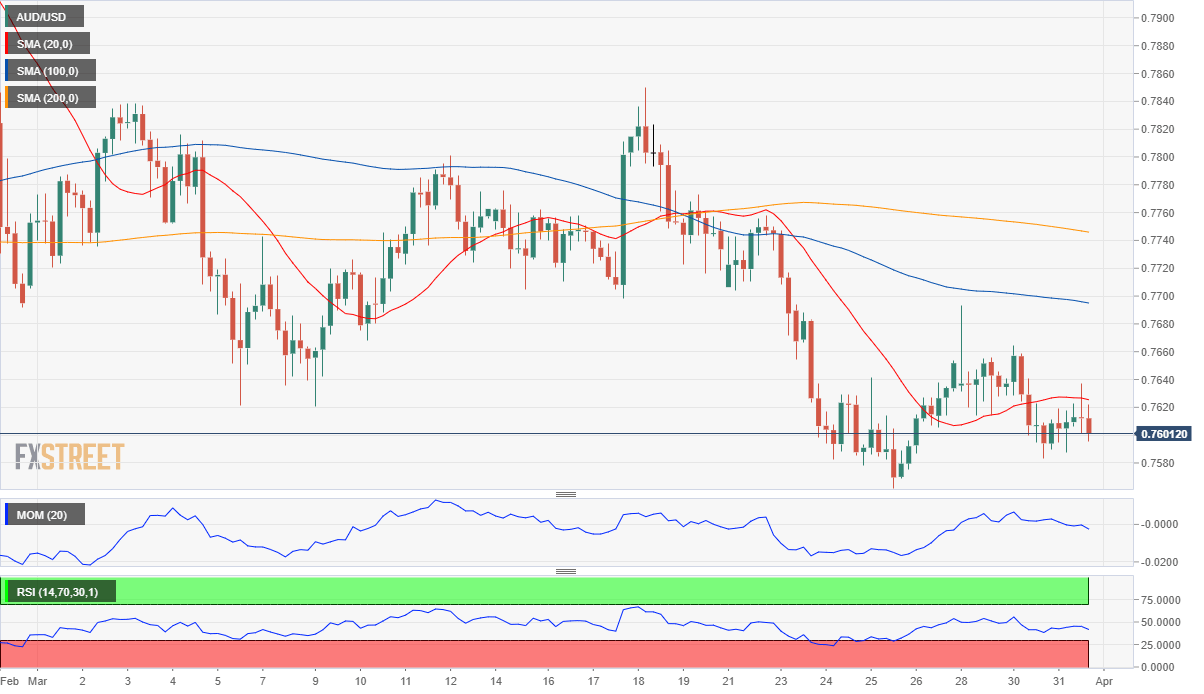

- AUD/USD is technically bearish in the near-term, critical support at 0.7560.

The AUD/USD pair settled in the 0.7600 price zone, gaining some modest 10 pips on the day. The market is all about the greenback and Treasury yields, both easing this Wednesday. The dollar reached overbought conditions after the yield on the 10-year Treasury note hit a 14-month high of 1.77%, and speculative interest took some profits out of the table as they keep waiting for US President Joe Biden.

Australia published February Private Sector Credit, which was up by 0.2% MoM and 1.6% YoY. This Thursday, the country will release the March AIG Performance of Manufacturing Index, previously at 58.8, and the Commonwealth Bank Manufacturing PMI, previously at 57. Later in the day, the country will publish the February Trade Balance and the final reading of Retail Sales for the same month.

The AUD/USD pair remains at risk of falling. The 4-hour chart shows that it was unable to settle above a flat 20 SMA, while the longer moving averages maintain their bearish slops above it. Technical indicators resumed their declines within negative levels, although their bearish strength is limited.

Support levels: 0.7560 0.7515 0.7470

Resistance levels: 0.7620 0.7665 0.7710

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.