- Soaring base metal prices maintained the Aussie afloat despite renewed greenback’s demand.

- Chinese PMIs could introduce some noise to currencies’ behavior on Friday.

- AUD/USD is technically neutral in the near-term, but sellers have limited chances.

The AUD/USD pair heads into the Asian opening trading around 0.7770, modestly down on a daily basis. The pair peaked at 0.7817 amid the broad greenback’s weakness at the beginning of the day and following rising equities. The pair retreated as speculative interest turned into the American currency on Wall Street’s decline but held on to the upper end of its recent range as base metals kept soaring. Palladium and Cooper reached record highs on the back of hopes for a global recovery from the ongoing pandemic. Gold, on the other hand, finished the day with modest losses around $ 1,773 a troy ounce.

At the beginning of the day, Australia published the Q1 Import Price Index, which came in at 11.2% and the Export Price Index for the same period at 0.2%, both beating the market’s expectations. Early on Friday, the country will release the Q1 Producer Price Index and March Private Sector Credit. Investors will also look at the Chinese NBS Manufacturing PMI, expected at 51.7 and the services index for the same month, foreseen at 52.6.

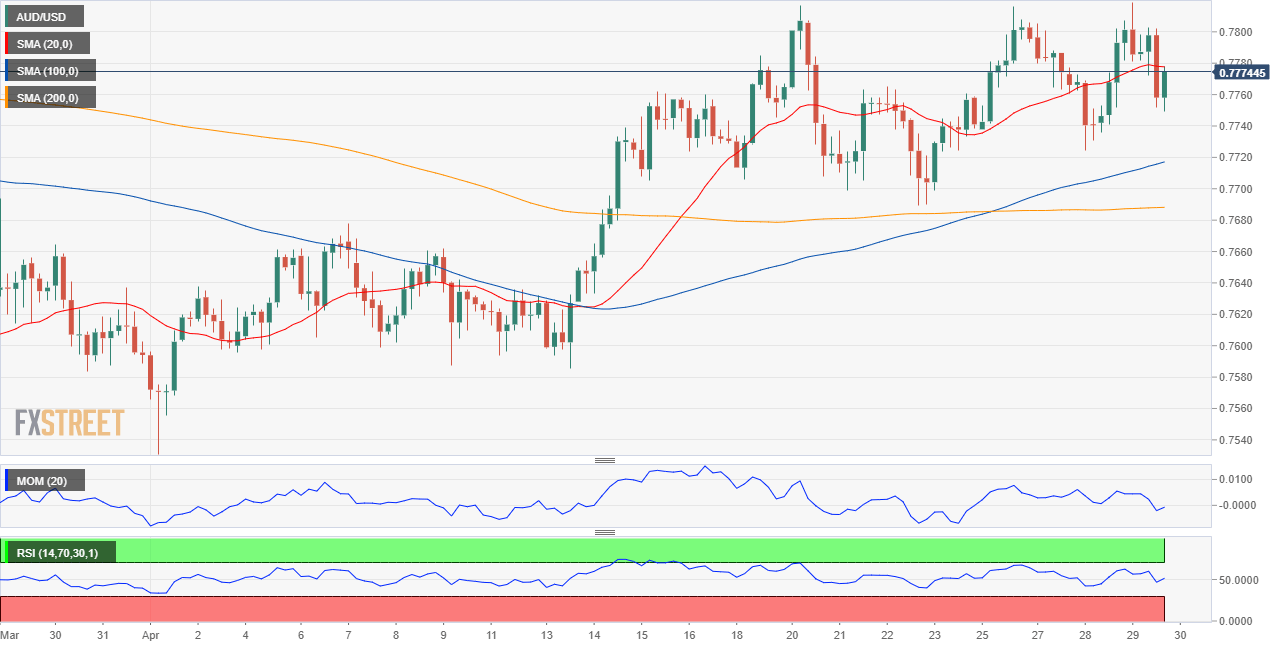

AUD/USD Short-Term Technical Outlook

The AUD/USD pair keeps consolidating at a higher ground, neutral in the near-term. The 4-hour chart shows that it has settled a few pips below its 20 SMA but also that it remains above the longer one. Technical indicators lack directional strength, with the Momentum stuck around its 100 line and the RSI flat around 49.

Support levels: 0.7730 0.7690 0.7650

Resistance levels: 0.7820 0.7850 0.7890

View Live Chart for the AUD/USD

Image Sourced from Pixabay