The S&P 500 index and Dow Jones Industrial Average roared higher over President Joe Biden’s first 100 days in office, outmatched in the same stretch only in 1933, when Franklin D. Roosevelt held office.

The S&P 500

SPX,

+0.68%

gained 10.86% as of Thursday’s close in the 100 days since Biden took office on Jan. 20, while the blue-chip Dow

DJIA,

+0.71%

advanced 10.12% over the same stretch, according to Dow Jones Market Data.

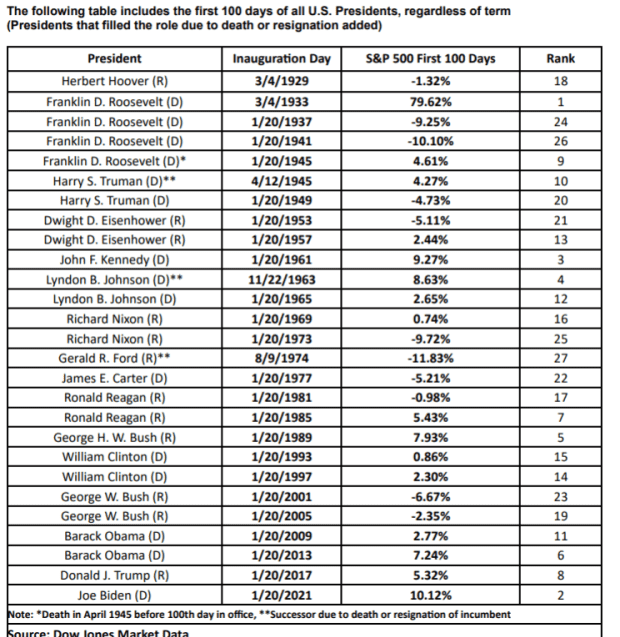

The gains marked the second-largest on record under any U.S. president at the 100-day mark, behind only the S&P 500’s 79.62% surge and the Dow’s 75.4% advance during the same stretch of Roosevelt’s first of four historic terms, which were underscored by an expansion of the nation’s social safety-net, environmental protections and its military supremacy.

This chart shows S&P 500 gains, and losses, in the first 100 days of each American presidential term since 1929:

Dow Jones Market Data

Overall, stocks tend to perform better during the first few months of each new term when a Democratic president sits the Oval Office, rather than a Republican.

While the S&P 500 rose 3.25% on average in the first 100 days of each presidential term, regardless of party, it shot up an average 6.92% after Democrats took the White House and fell 1.34% under Republicans, according to Dow Jones Market Data.

Biden’s first 100 days have been underscored by a stock market that’s soared to record highs as trillions worth of fiscal and monetary stimulus slosh through the economy. However, the economic and health crisis brought on by COVID-19 has widened the gap between the nation’s rich and poor, even as a flood of fresh pandemic aid has been aimed at helping hard-hit families and businesses.

See: What has Biden gotten wrong in his first 100 days? Done right? Analysts sound off.

The new administration has also overseen roughly 43% of the U.S. population getting at least one shot of a COVID-19 vaccine, exceeding its initial goals, while India and other parts of the world battle against time to contain surging infection rates.

Spending also has surged under the Biden administration, even before including his proposed $2.3 trillion infrastructure package or latest slate of planned aid unveiled Wednesday evening to bolster children and families.

Read: Here’s what’s in Biden’s $1.8 trillion ‘American Families Plan’

While the U.S. economic outlook has brightened since Biden took office, it also has been helped by the Federal Reserve’s unwavering support since the onset of the pandemic. Fed Chairman Jerome Powell reaffirmed on Wednesday his vow to keep monetary conditions loose for some time to come, even as some worry that inflation could range out of control and markets might overheat.

Up Next: Fed’s Powell ‘doesn’t blink,’ and 5 other things we learned from his press conference