Wall Street was set to close out May on a high note with a winning week. Of course, the month saw its ups and downs, but it’s nice to go into the long weekend with some optimism. Investors continued to digest economic optimism, with inflation concerns and the back-and-forth in Washington over the $2+ trillion infrastructure package, which Republicans unveiled a $928 billion counteroffer. The Dow Jones gained 150 points, the S&P 500 rose 0.4%, and the Nasdaq

NDAQ

popped 0.4%. Salesforce

CRM

popped 7% on the back of solid earnings, while AMC surged by over 30% thanks to the WallStreetBets crowd once again taking control. Ford also rose again amid optimism with its EV push. If you’re looking for a way to play this market, the deep learning algorithms at Q.ai have crunched the data to give you a set of Top Shorts. Our Artificial Intelligence (“AI”) systems assessed each firm on parameters of Technicals, Growth, Low Volatility Momentum, and Quality Value to find the best short plays.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

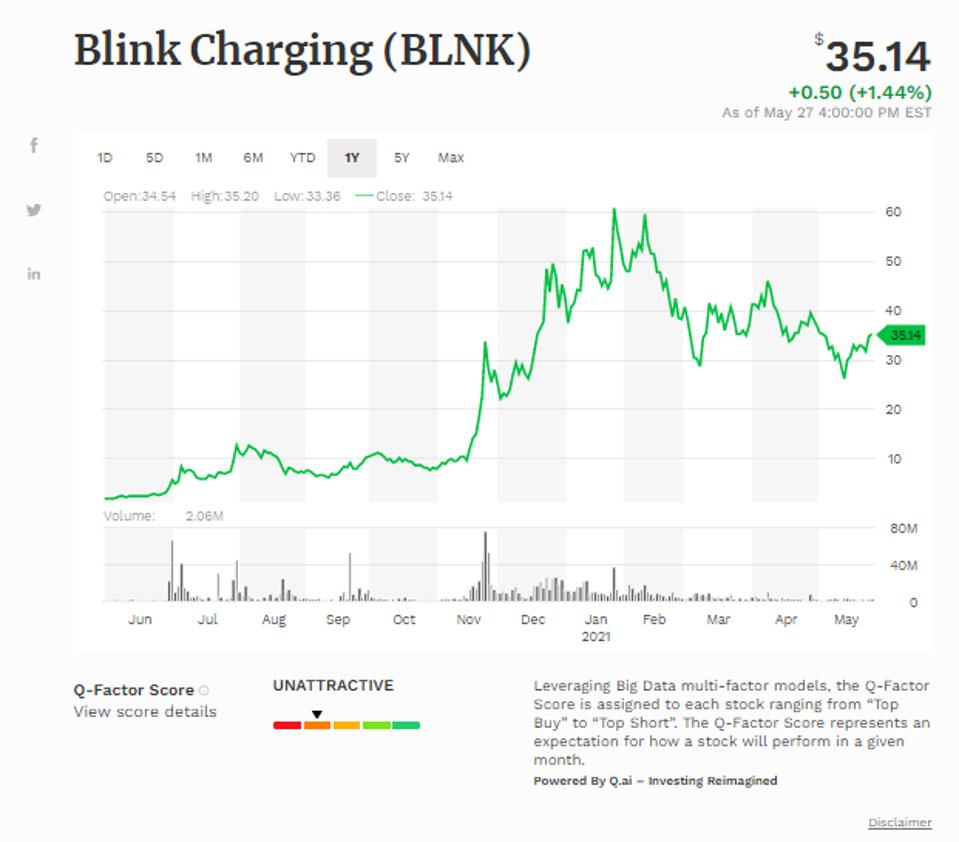

Blink Charging Co (BLNK)

Blink Charging Co is our first Top Short, on our list for the third day in a row. Blink Charging Co provides fast, level 2 EV Charging Stations and Networks for both homes and businesses. Our AI systems rated the company D in Technicals, F in Growth, F in Low Volatility Momentum, and C in Quality Value. The stock closed up 1.44% to $35.14 on volume of 2,108,514 vs its 10-day price average of $32.67 and its 22-day price average of $33.08, and is down 6.31% for the year. Revenue grew by 14.98% in the last fiscal year and grew by 166.67% over the last three fiscal years, while EPS grew by -49.11% over the last three fiscal years. Revenue was $6.23M in the last fiscal year compared to $2.69M three years ago, Operating Income was $(17.39)M in the last fiscal year compared to $(11.61)M three years ago, EPS was $(0.59) in the last fiscal year compared to $(1.3) three years ago, and ROE was (103.16%) in the last year. Forward 12M Revenue is also expected to grow by 17.76% over the next 12 months.

MORE FROM FORBESBlink Charging (BLNK)

Forbes AI Investor

MORE FOR YOU

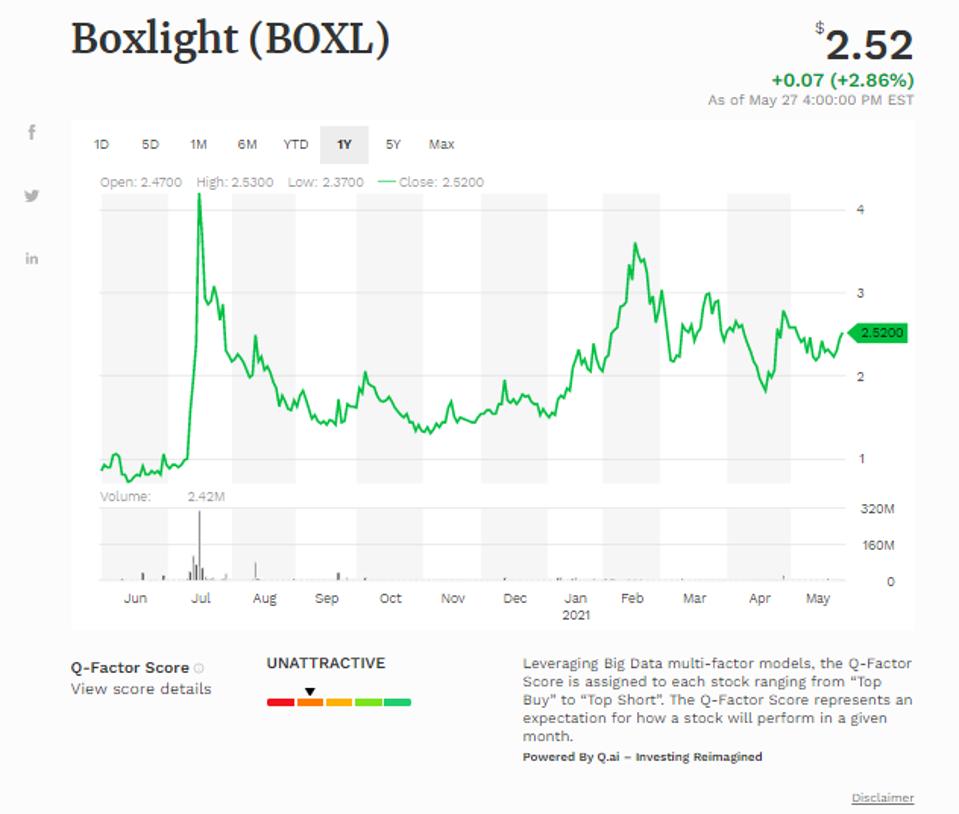

Boxlight Corp (BOXL)

Boxlight Corp is also on our list of Top Shorts for the third time this week. Boxlight Corp is an education technology solutions provider for the global learning market. Our AI rated F in Technicals, F in Growth, F in Low Volatility Momentum, and F in Quality Value. The stock closed up 2.86% to $2.52 on volume of 2,435,669 vs its 10-day price average of $2.33 and its 22-day price average of $2.41, and is up 69.13% for the year. Revenue grew by 50.47% in the last fiscal year and grew by 118.26% over the last three fiscal years, Operating Income grew by -8.09% in the last fiscal year, and EPS grew by -3.06% in the last fiscal year and grew by -47.63% over the last three fiscal years. Revenue was $54.89M in the last fiscal year compared to $37.84M three years ago, Operating Income was $(7.9)M in the last fiscal year compared to $(7.0)M three years ago, EPS was $(0.39) in the last fiscal year compared to $(0.72) three years ago, and ROE was (44.44%) in the last year compared to (84.35%) three years ago. Forward 12M Revenue is also expected to grow by 2.39% over the next 12 months.

MORE FROM FORBESBoxlight (BOXL)

Forbes AI Investor

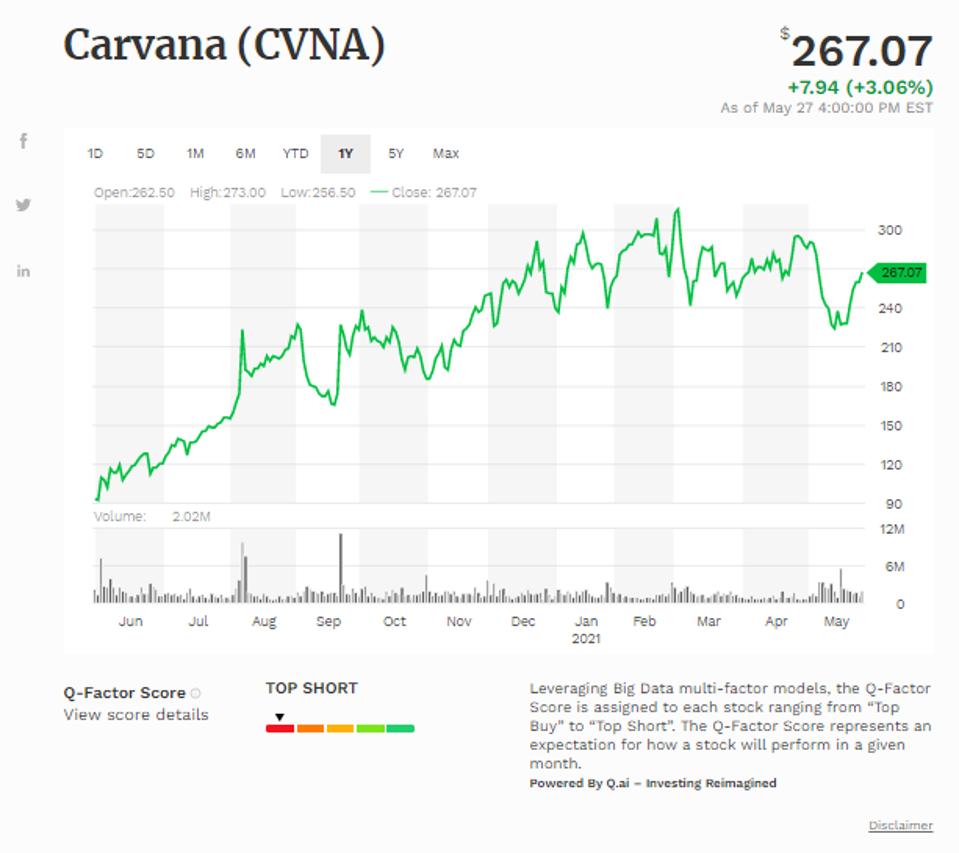

Carvana Co (CVNA)

Carvana is our third Top Short. The company is a major innovator and disruptor in the car industry, and is a robust online used car dealer. Our AI systems rated Carvana C in Technicals, F in Growth, D in Low Volatility Momentum, and F in Quality Value. The stock closed up 3.06% to $267.07 on volume of 2,025,016 vs its 10-day price average of $244.75 and its 22-day price average of $255.36, and is up 13.04% for the year. Revenue grew by 20.53% in the last fiscal year and grew by 244.35% over the last three fiscal years, Operating Income grew by -23.77% in the last fiscal year, and EPS grew by -22.3% in the last fiscal year. Revenue was $5586.56M in the last fiscal year compared to $1955.47M three years ago, Operating Income was $(332.4)M in the last fiscal year compared to $(220.73)M three years ago, EPS was $(2.63) in the last fiscal year compared to $(2.03) three years ago, and ROE was (93.05%) in the last year compared to (100.5%) three years ago. Forward 12M Revenue is also expected to grow by 6.39% over the next 12 months.

MORE FROM FORBESCarvana (CVNA)

Forbes AI Investor

Livent Corp (LTHM)

Livent Corp is our next Top Short. Livent is a chemical manufacturing and lithium tech company focused on very in-demand lithium-based products such as electric vehicle batteries, handheld devices, and more. Our AI systems rated the company D in Technicals, D in Growth, F in Low Volatility Momentum, and D in Quality Value. The stock closed up 6.25% to $19.88 on volume of 4,148,155 vs its 10-day price average of $18.09 and its 22-day price average of $17.91, and is up 5.86% for the year. Revenue grew by 8.05% in the last fiscal year, and EPS grew by -5.85% in the last fiscal year. Revenue was $288.2M in the last fiscal year compared to $442.5M three years ago, Operating Income was $(10.8)M in the last fiscal year compared to $165.7M three years ago, EPS was $(0.13) in the last fiscal year compared to $0.99 three years ago, and ROE was (3.41%) in the last year compared to 28.94% three years ago. Forward 12M Revenue is expected to grow by 1.51% over the next 12 months, and the stock is trading with a Forward 12M P/E of 134.87.

Forbes AI Investor

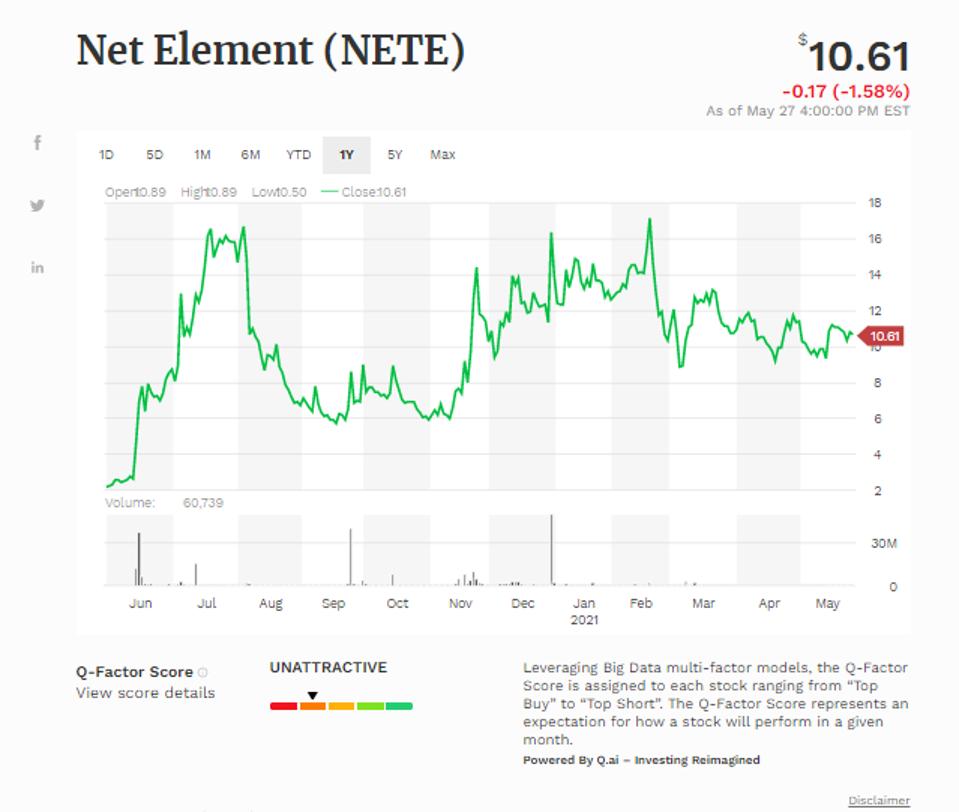

Net Element Inc (NETE)

Net Element Inc is today’s final Top Short. The company is a global technology-driven firm specializing in mobile payments and value-added transactional services. Our AI systems rated Net Element F in Technicals, F in Growth, F in Low Volatility Momentum, and D in Quality Value. The stock closed down 1.58% to $10.61 on volume of 61,267 vs its 10-day price average of $10.81 and its 22-day price average of $10.48, and is down 14.09% for the year. Revenue grew by 12.09% in the last fiscal year and grew by 11.95% over the last three fiscal years, Operating Income grew by -15.23% in the last fiscal year and grew by -12.06% over the last three fiscal years, and EPS grew by -34.94% in the last fiscal year and grew by -31.47% over the last three fiscal years. Revenue was $65.71M in the last fiscal year compared to $65.79M three years ago, Operating Income was $(4.49)M in the last fiscal year compared to $(4.33)M three years ago, EPS was $(1.34) in the last fiscal year compared to $(1.28) three years ago, and ROE was (183.25%) in the last year compared to (46.21%) three years ago. Forward 12M Revenue is also expected to grow by 2.95% over the next 12 months.

MORE FROM FORBESNet Element (NETE)

Forbes AI Investor

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.

/https://specials-images.forbesimg.com/imageserve/604a42d90228b4a7adb701dd/0x0.jpg)