Australian Consumer Price Index was seen steady in the first quarter after last quarter’s deceleration.

A positive surprise would have been expected to fuel a policy change debate for the central bank but the data has missed expectations and the Aussie is under pressure.

The outcome was as follows:

- Australian CPI (QoQ) Q1: 0.6% (exp 0.9%; prev 0.9%).

- CPI (YoY) Q1: 1.1% (exp 1.4%; prev 0.9%).

- CPI Trimmed Mean (QoQ) Q1: 0.3% (exp 0.5%; prev 0.4%).

- CPI Trimmed Mean (YoY) Q1: 1.1% (exp 1.2%; prev 1.2%).

- CPI Weighted Median (QoQ) Q1: 0.4% (exp 0.5%; prev 0.5%).

- CPI Weighted Median (YoY) Q1: 1.3% (exp 1.3%; R prev 1.3%).

”Government assistance has had a big impact on the CPI and for the next few quarters the unwinding of those packages is set to boost inflation,” analysts at Westpac said.

AUD/USD has dropped on the data as traders await the outcome of the Federal Reserve’s interest rate decision.

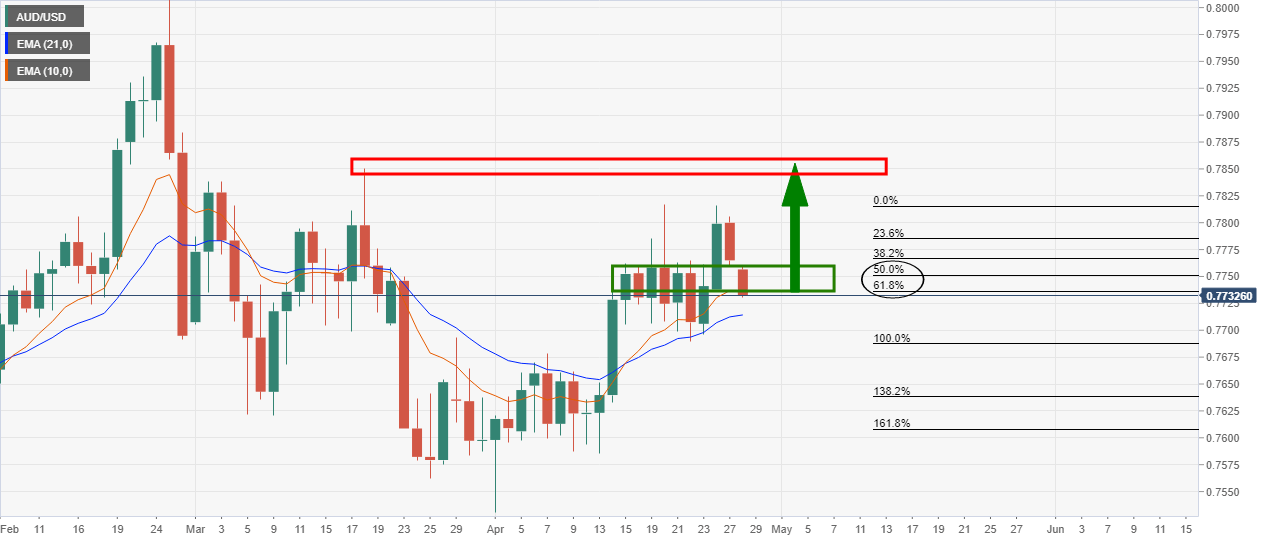

From a longer-term perspective, the daily chart shows that the price may stall on the offer at an important structure of confluence where the 61.8% Fibo meets the 10-day EMA as a keen target to the downside within the support structure that would be expected to be the last defence.

Related analysis: AUD/NZD Price Analysis: Bulls holding the fort

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The trimmed mean is calculated as the weighted mean of the central 70% of the quarterly price change distribution of all CPI components, with the annual rates based on compounded quarterly calculations.