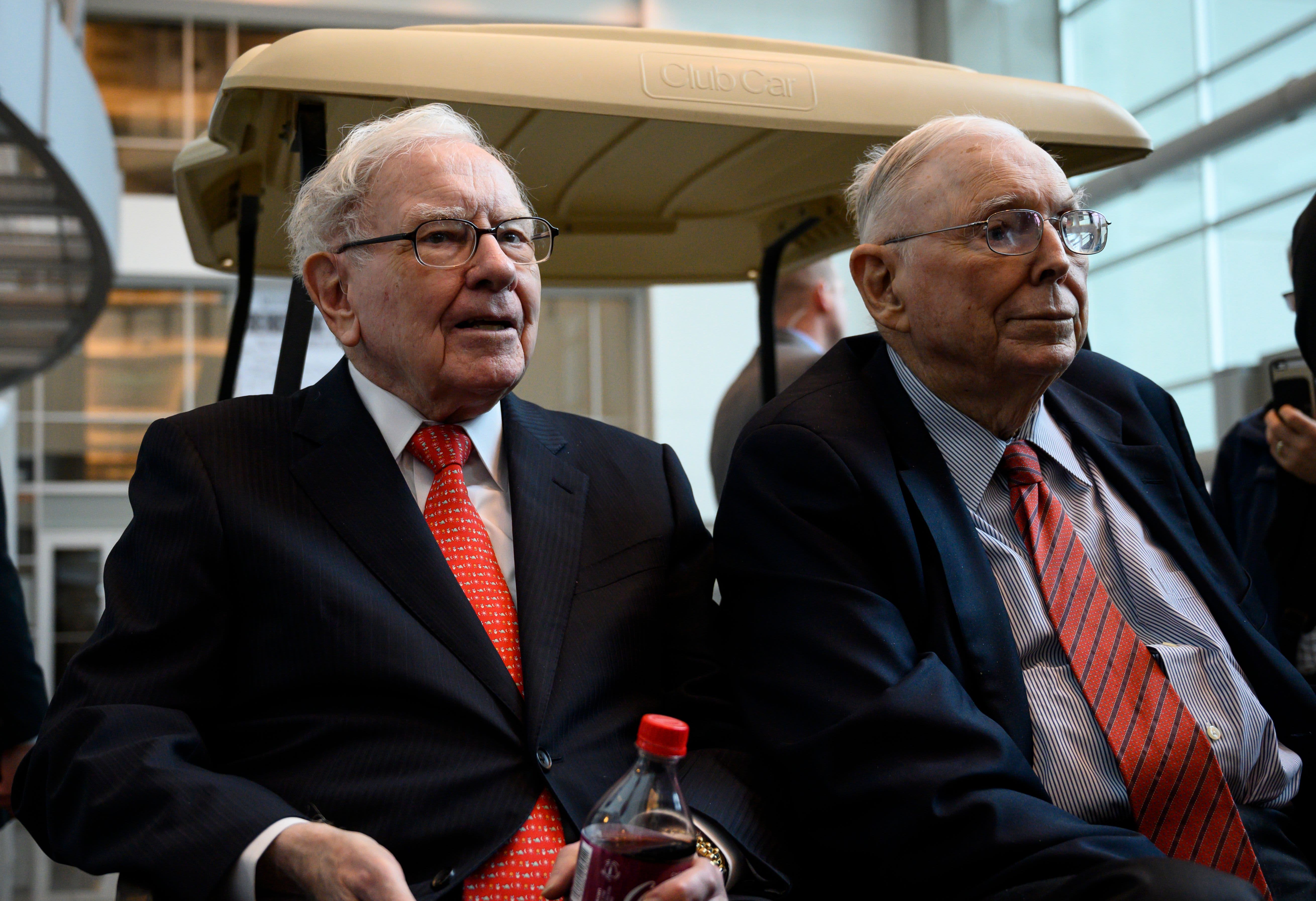

Warren Buffett and Charlie Munger were merely two guys from Omaha, Nebraska, who, supposedly, looked a lot alike before becoming renowned business partners and leading the Berkshire Hathaway company. They learned this thanks to Dr. Edwin Davis, a well-known doctor in town who told Buffett in a 1957 encounter that he trusted him to manage money because the investor reminded him of someone named Charlie Munger. Buffett responded to Davis, “Well, I don’t know who Charlie Munger is, but I like him,” the investing giant recounted in an interview with CNBC’s Becky Quick, which aired Tuesday as part of a series called “Buffett & Munger: A Wealth of Wisdom.” On May 3, 2019, Berkshire Hathaway CEO Warren Buffett (L) and Vice Chairman Charlie Munger attend the 2019 annual shareholders meeting in Omaha, Nebraska. Getty Images | Johannes Eisele | AFP According to Buffett, Davis and his wife Dorothy made it a purpose to eventually connect Buffett and Munger. It happened over dinner two years later, in 1959, when Munger, then a lawyer in Los Angeles, returned to Omaha following the death of his father, Alfred. “After about five minutes, Charlie was rolling on the floor laughing at his own jokes, which is precisely what I did,” Buffett, 90, added. “I was thinking to myself, ‘I’m not going to find another person like this,’ and then we just clicked.” “”What I enjoy about Warren is his irreverence,” stated Munger, who is 97 years old. The arrogant heads of all civilizations are not automatically revered.” As Buffett built his investing firm and Munger worked in law, their friendship and business relationship grew stronger. Munger stated he ultimately listened to Buffett’s counsel about his career path in the early 1960s. “It took me a long time to realize that [Buffett] was making more money than I was. However, he eventually persuaded me that I was wasting my time.” According to Buffett’s renowned 1984 essay, “The Superinvestors of Graham-and-Doddsville,” Munger created his own investment firm, which would go on to generate an average annual compound rate of 19.8 percent between 1962 and 1975, significantly better than the Dow Jones Industrial Average’s 5%. Buffett recalled having lengthy phone chats with Munger at the time. “We had fun in the early days because it was like hunting adventures,” Munger added. Buffett began buying Berkshire Hathaway stock in 1962, eventually gaining control three years later and transforming the business into the powerful behemoth it is today. He is the chairman and CEO of the company. Munger was appointed vice chairman of Berkshire Hathaway in 1978, a position he still maintains. “I just knew right away that Charlie was the kind of guy I was going to enjoy and learn from,” Buffett recalled of their first meeting. “It wasn’t a deliberate move, a decision, or anything like that. It was entirely natural. And we’ve had a great time thus far.” Continue reading

Buffett reflects on his first meeting with Munger: ‘I’m not going to find another guy like this’

2021-06-30T01:01:57-04:00June 30th, 2021|