The official April non-manufacturing and manufacturing PMIs have been revealed as follows:

- Chinese Non-Manufacturing PMI Apr: 54.9 (exp 56.1; prev 56.3).

- Chinese Manufacturing PMI Apr: 51.1 (exp 51.8; prev 51.9).

The data has missed expatiations but the Aussie is steady.

The Markit/Caixin Manufacturing PMI is due 45 minutes later; it was a modest 50.6 in March.

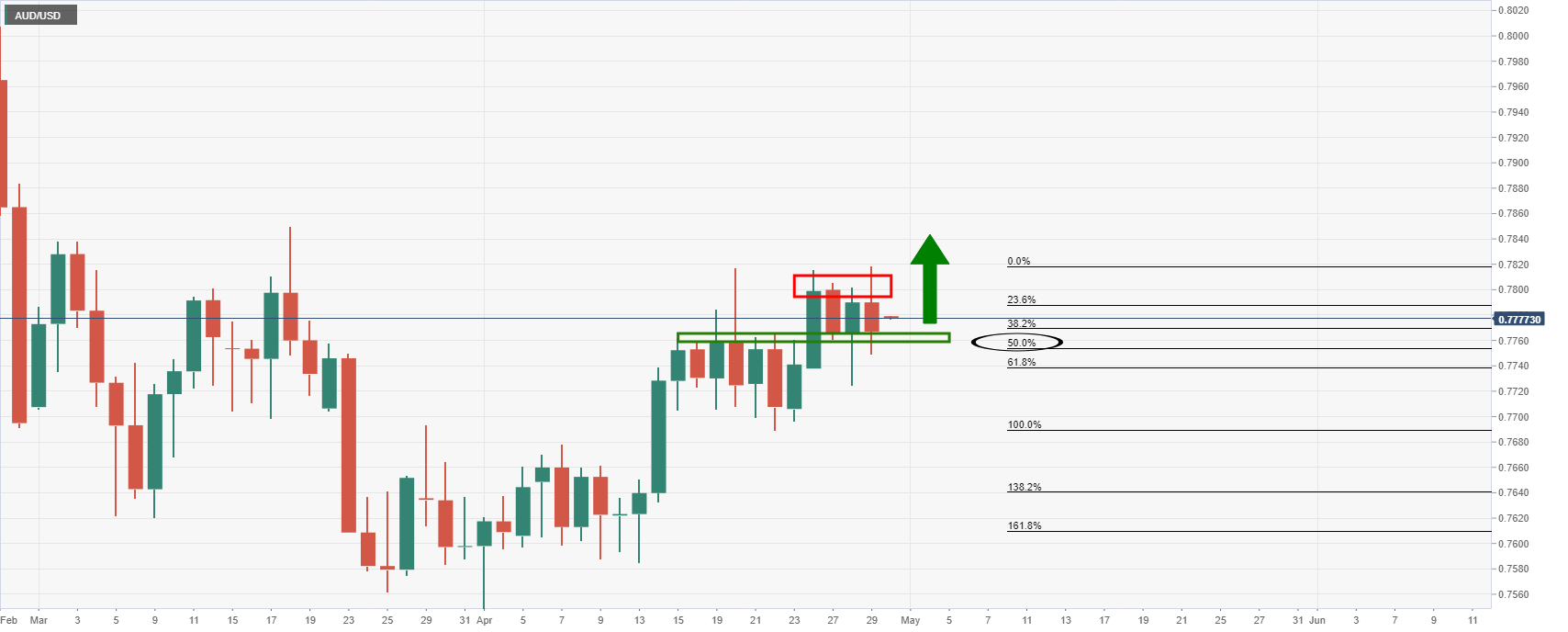

Meanwhile, the Aussie has been boosted by a soft US dollar and a promising outlook for a global growth recovery which is supporting the commodity complex.

The Manufacturing Purchasing Managers Index (PMI) released by the China Federation of Logistics and Purchasing (CFLP) studies business conditions in the Chinese manufacturing sector.

Any reading above 50 signals expansion, while a reading under 50 shows contraction.

As the Chinese economy has influence on the global economy, this economic indicator would have an impact on the Forex market.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.