- Copper price rally remains unabated on dovish Fed, economic optimism.

- Comex copper tracks the futures on LME higher, as LME prices test $10K.

- Stockpiles have been declining and mine disruptions in Chile extend.

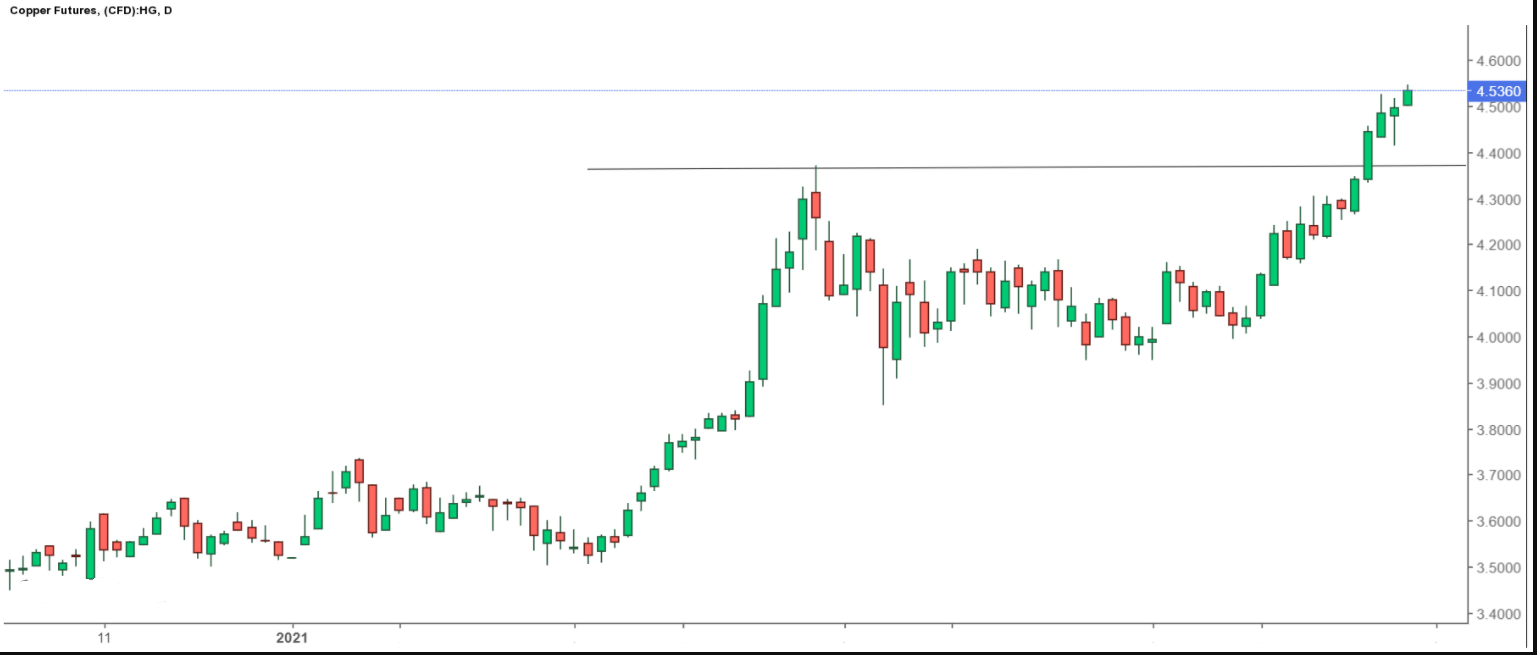

The price of copper (futures on Comex) is extending its vertical rise for the fifth straight day on Thursday, refreshing the highest levels since 2011 at $4.5462.

Among various supportive fundamental factors, the biggest catalysts remain the US and Chinese economic growth narratives, especially in light of the covid vaccine success so far.

Further, the Fed’s dovish take on the monetary policy on Wednesday, implies that the central bank stimulus will continue in the coming months, which boosts hopes for faster recovery while improving the demand prospects for the economic bell-weather.

Meanwhile, US President Joe Biden’s massive infrastructure spending package also adds to the bullish sentiment around the copper.

Potential growth in demand for the non-ferrous metal is likely to exacerbate the supply-side issue amid ongoing mining disruptions in Chile and falling stockpiles in LME and Comex warehouses. Chile is the world’s leading copper-producing country.

Going forward, a test of the all-time highs reached in 2011 at $4.6495 looks inevitable as the futures on LME threaten the $10,000 mark. The price of copper is up more than 25% so far this year.