It looks like Wall Street might be getting the memo.

Debt markets have become less concerned about the path of expected future interest rate increases from the Federal Reserve, even as the U.S. economic outlook brightens.

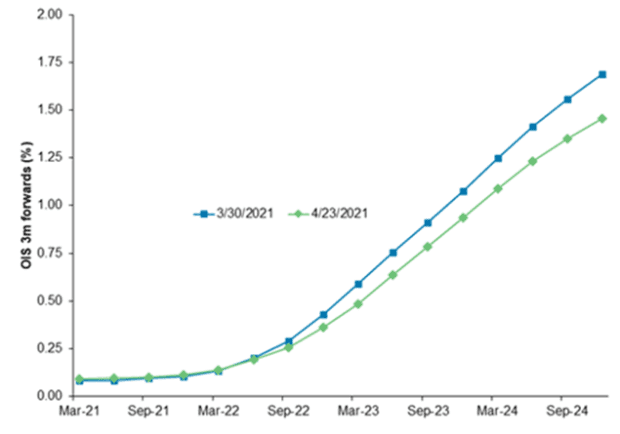

This chart compares Wall Street forecasts in March and April for the path of the federal funds rate over roughly the next 3½ years, which now points to a more gradual slope higher for benchmark rates.

BNP Paribas

The chart shows traders still expect short-term (3 month) rates to first increase above the Fed’s current range of zero to 0.25% around Sept. 2023, but then for the path toward 1.5% to get slower.

The Fed has signaled it does not expect to lift rates above near-zero until 2024, and that there would be no rush to decrease its massive $120 billion a month bond-buying program.

Read: Tone of next week’s U.S. economic data on track to be positive but the Fed will remain tone-deaf

But as Fed officials have pointed to an improving outlook for jobs and economic growth as more of the U.S. population gets vaccinated, the chart also shows betting markets lately have embraced the Fed’s more gradual view for tightening monetary policy, wrote Daniel Ahn, Chief US Economist at BNP Paribas, in a Tuesday note.

“Recent market behavior seems to have internalized this consistent messaging from the Fed, with the market pricing out a rate hike since the last three weeks, but still seeing about 3-4 hikes by end of 2023.”

Ahn stressed that Fed officials at the previous Federal Open Market Committee meeting in March “already unveiled significantly higher growth and inflation forecasts, which the most recent slew of data is justifying,” and likely means “the first hint” about tapering its monthly asset purchases won’t come until August, with implementation not likely until early 2022.

U.S. consumer confidence leapt again in April to a 14-month high as rising vaccinations, falling coronavirus cases and a hiring surge eased pandemic-related anxieties, while home prices surge 12% in February, the biggest jump since 2006.

Stocks were modestly lower Tuesday, ahead of the Fed policy update and a day after the S&P 500 index

SPX,

-0.02%

and Nasdaq Composite Index

COMP,

-0.35%

closed at all-time records. The 10-year U.S. Treasury

BX:TMUBMUSD10Y

yield was about 5 basis points higher at 1.62%.

Read: Why the Fed’s focus on those hardest-hit by the pandemic matters for markets