- Enjin Coin price overcomes the well-established resistance of a broadening descending wedge pattern.

- ENJ clears the neckline of head-and-shoulders bottom on an intra-day chart.

- An advance of over 70% in six days is a reason to consolidate.

Enjin price strength has made ENJ one of the more notable cryptocurrencies since April 23, registering a 75% gain from the absolute low and, more importantly, installing it in a stronger position to attack the all-time high in the coming weeks.

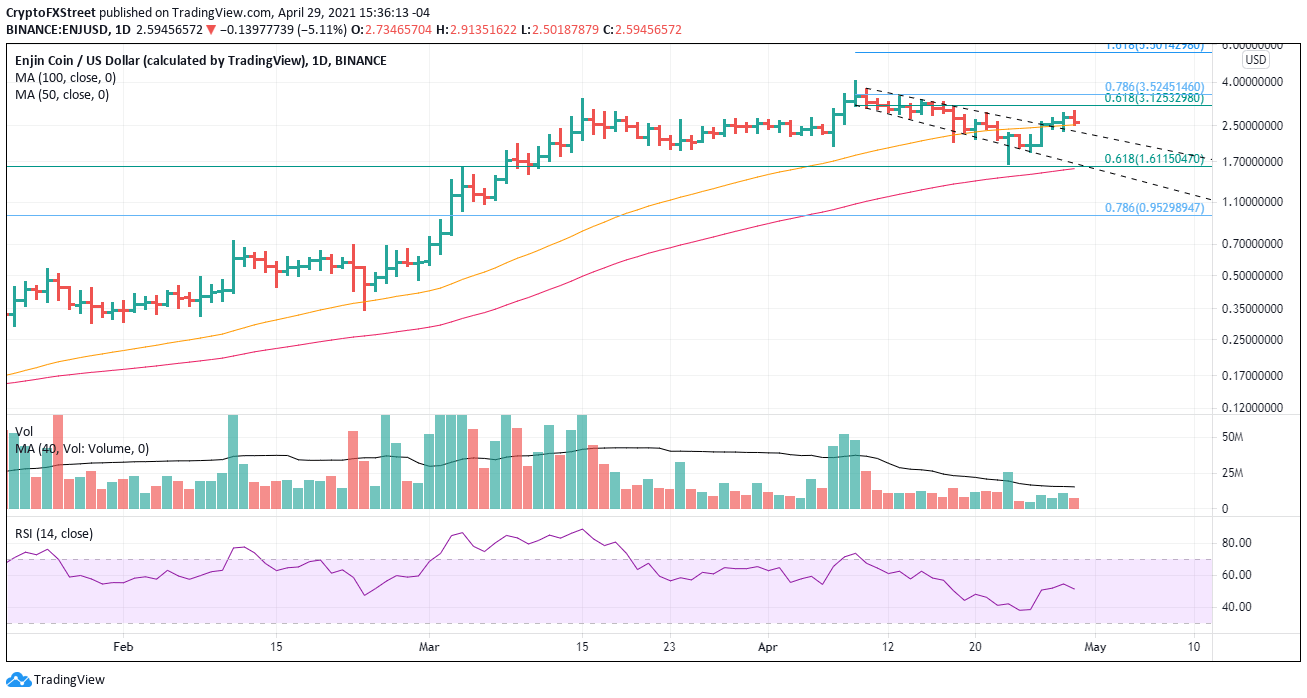

The breakout above the wedge’s trend line and the 50-day simple moving average (SMA) on April 27 was a pivotal development in the ENJ bottoming process. Yesterday’s bullish outside day and push above the April 21 high at $2.85 was a welcomed secondary confirmation.

After a sizeable rally of 75% in a short time, it can be anticipated ENJ will fortify the progress with a mild consolidation along the 50-day SMA at $2.53, with some potential to weaken down to the wedge’s upper trend line at $2.36.

Once the consolidation is complete, ENJ should enter stage 2 of the rebound, carrying the altcoin through the 61.8% and 78.6% Fibonacci retracement levels of the April decline at $3.12 and $3.52, respectively.

The all-time high at $4.03 will be a challenging level, but if ENJ generates a similar momentum surge as the first half of the rally, it should carry Enjin Coin price to the 161.8% extension of the April decline at $5.50.

ENJ/USD daily chart

A reversal back into the broadening descending wedge pattern would discredit the stated bullish outlook and inform market operators that a more complex consolidation is developing or ENJ is bracing for a new correction low.

Early support is the April 25 low at $1.88, which corresponds closely with the March 24 low at $1.92. The dominant price level to watch is $1.60, the intersection of the wedge’s lower trend line with the 61.8% retracement of the 2021 advance and the 100-day SMA. Any further weakness would have long-term bearish implications.