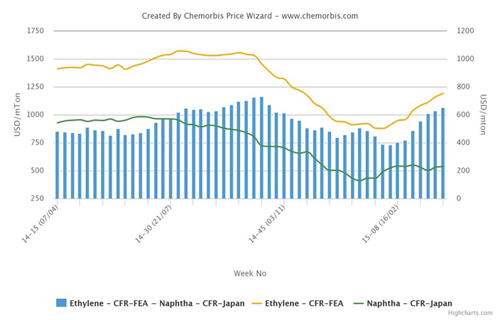

Despite strong ethylene supply additions, we believe the ethylene-naphtha spread should remain at US$390-415/t during 2021-2022F, which is above the pre-Covid-19 levels of US$375/t in 2019.

The strong demand for ethylene derivatives, particularly polyethylene (PE), and limited arrival of US cargoes should be able to offset the new supply pressure, in our view. In the case of excess supply, we believe the producers at the high end of the cost curve, such as methanol-based producers, are likely to lose market share to the low-cost players (most likely crude-oil-to-chemical complexes). Post 2023F, ethylene capacity additions should fall to 4-5mtpa.

In Jun 20, the National Development and Reform Commission of China (NDRC) granted approval to Shangdong Yulong Petrochemical to build a 400k bbl/day refinery and a 3mtpa ethylene plant (2 lines, 1.5mtpa each) in Shangdong province. The project was previously delayed due to the lack of state approval (reflecting excess domestic refinery capacity).

We believe that the ethylene project is likely to be completed by 2024F, given typical construction lead time of 3-4 years for ethylene projects in China. Some of the projects are being executed outside China. In Sep 20, Hengyi Brunei announced the second phase of its refinery project (280k bbl/day) and a chemical expansion project which included 1.65mtpa of ethylene and 2.5mtpa of purified terephthalate acid at Palau Muara Besar.

The commercial startup target is in mid-2024F. Chandra Asri and Lotte Chemical Titan are looking to add 1.0- 1.2mtpa of ethylene cracker in Indonesia. Siam Cement is also building a new mixed-feed ethylene plant in Vietnam (likely to be completed in 2023F). The US ethane cracker expansion looks slim after 2024F. The projects under construction are Shell at Monaca (1.5mtpa, to start production within 2021F), and Exxon-Sabic JV (1.8mtpa; to start commercial operations in 2022F). PTTGC’s plan to invest in a new ethane cracker of 1. mtpa is still suspended as

of 1Q21, pending the search for a new co-investor after Daelim Industrial withdrew from the project in 2020. The risk to our long-term ethylene demand-supply forecast is more naphtha cracker projects announced by Chinese producers which have a strong execution track record of shortening the construction cycle to less than 4 years.

More MEG expansion with lower focus on PE We estimate that global PE supply additions would reach 6.9-7.4mtpa vs. demand growth of 5.5mtpa during 2021-2022F. Thanks to supply outages in the US, Asian PE prices should remain robust over the next six months, especially with the strong support from plastic packaging and agricultural film demand. As the US PE production could resume to normal operating rates in late-2021F, some pull-back in Asian PE prices is likely but we expect average PE-naphtha spread to hold up at US$550-610/t during 2021-2022F vs. pre-Covid-19 levels of US$410/t in 2019.

As low density polyethylene (LDPE) supply growth remains relatively lower than that of high density polyethylene (HDPE) and linear low density polyethylene (LLDPE), LDPE-naphtha spread should continue to stay higher than HDPE-naphtha and LLDPE-naphtha during 2021-2022F, in our view

Post 2022F, we see rising interest in building new mono ethylene glycol (MEG) capacity, given that Chinese-based ethylene projects are executed by the companies that have existing polyester operations. Zhejiang Petrochemical Company plans to add 1.45mtpa of MEG along with 1.55mtpa of H/L/LLDPE.

The extreme case is seen for Jiangsu Eastern Shenghong which announced in 2019 that it would divert all ethylene produced from the new ethylene plant for MEG expansion (2mtpa) and cancel all PE projects. Hengyi Petrochemical will also use ethylene output to facilitate MEG expansion of 1.2mtpa. This would lead to MEG supply glut in the long term while supply risk would look relatively lower for all PE products, in our view. In particular, we estimate that global MEG supply growth would reach 5.1-5.9mtpa, outstripping the demand growth of c.2mtpa during 2021-2023F.

– By CIMB Bank Research