- EUR/USD trades on the defensive and challenges 1.2100.

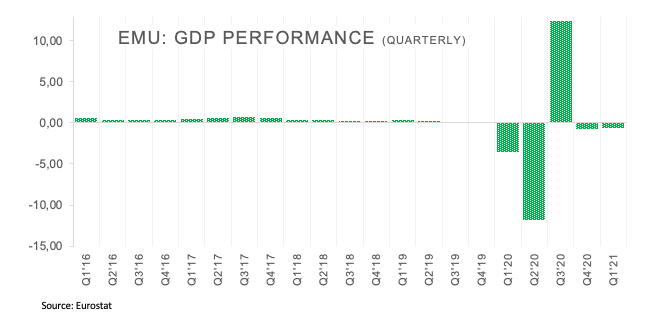

- EMU’s flash Q1 GDP came in at -0.6% QoQ, -1.8% YoY.

- EMU’s advanced Core CPI rose 0.8% YoY in April.

Sellers gain further momentum and drag EUR/USD to fresh 2-day lows in the sub-1.2100 region at the end of the week.

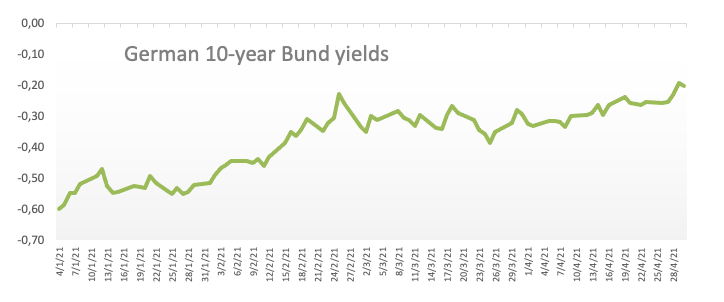

EUR/USD retreats for the second consecutive session on Friday and returns to levels below 1.2100 the figure after reaching new monthly peaks around 1.2150 on the previous session. The recent climb in the pair has been also helped by the improved traction in yields of the German Bunds.

Higher US yields in combination with positive results in US fundamentals lent further legs to the dollar’s recovery from recent multi-week lows and forced the pair to fade the recent advance well north of the 1.2100 yardstick.

Data releases in both Germany and the broader euro area did not help the single currency either. In fact, preliminary Q1 GDP figures showed the economy in Germany is seen contracting 1.7% QoQ, while the economy in the bloc is also expected to shrink -0.6% inter-quarter. Still in Euroland, headline consumer prices are forecast to have risen 1.6% on a year to April and 0.8% YoY when comes to the core reading, as per advanced inflation figures. Additional data saw the Unemployment Rate ticking lower to 8.1% during March (from 8.2%).

Later in the NA session, the PCE will be in the centre of the debate seconded by the U-Mich Index and Personal Income/Spending.

EUR/USD’s upside momentum reached the 1.2150 level before losing some vigour on Thursday, always against the broader backdrop of the persevering selling bias surrounding the greenback, which gained extra pace following the dovish tone from the FOMC event (Wednesday). Also propping up the better mood in the European currency appears the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace. In addition, solid results from key fundamentals pari passu with the surging morale in the bloc also collaborate with the monthly recovery in the pair (from the vicinity of 1.1700 to the monthly highs round 1.2150 so far).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

So far, spot is losing 0.19% at 1.2094 and a breach of 1.2064 (38.2% Fibo of the November-January rally) would target 1.2052 (100-day SMA) en route to 1.1993 (low Apr.22). On the other hand, the next hurdle emerges at 1.2150 (monthly high Apr.29) followed by 1.2243 (monthly high Feb.25) and finally 1.2349 (2021 high Jan.6).