- US GDP surged to 6.4% in the first quarter of the year, beating expectations.

- Germany and the EU will report on Q1 growth on Friday.

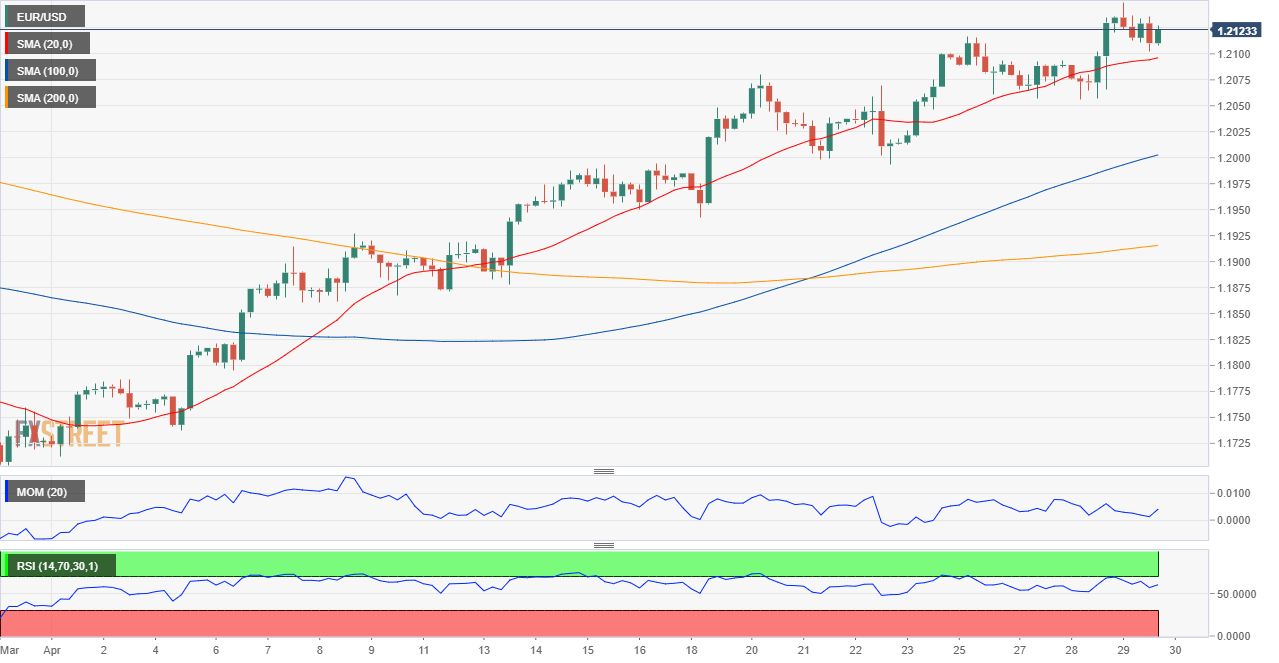

- EUR/USD has lost bullish momentum, but there are no signs of an upcoming slide.

The EUR/USD pair advanced to a fresh monthly high of 1.2145 this Thursday but retreated from the level to finish the day in the 1.2120 price zone. The dollar rose modestly in the American afternoon as Wall Street edged lower, despite upbeat macroeconomic data. Ahead of the close, US indexes bounced back, posting daily gains.

Germany published inflation figures, which were upbeat. According to preliminary estimates, the April Consumer Price Index reached 2% YoY. Meanwhile, the EU April Economic Sentiment Indicator came in at 110.3, largely surpassing the 102.2 expected. In the US, the Q1 Gross Domestic Product posted 6.4% according to preliminary estimates, beating the market’s expectations of 6.1% and indicating substantial economic growth.

On Friday, Germany will publish the preliminary estimate of its Q1 GDP, foreseen at -1.5% QoQ, while the figure for the EU is expected at -0.8%. The US will publish March Personal Income and Personal Spending, and the final reading of the April Michigan Consumer Sentiment Index, expected to be upwardly revised to 87.5.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair trade has lost bullish strength, but there are no signs of a bearish extension coming soon. The 4-hour chart shows that the pair remains above all of its moving averages, with the 20 SMA providing dynamic support at around 1.2090. The longer moving averages remain below the shorter one, with the 100 SMA maintaining its bullish slope. Technical indicators have retreated from daily highs but remain above their midlines, with the RSI currently flat at around 58.

Support levels: 1.2090 1.2050 1.2005

Resistance levels: 1.2150 1.2195 1.2240

View Live Chart for the EUR/USD

Image Sourced from Pixabay