- ECB’s President Lagarde said the market moves wouldn’t lead the monetary policy.

- US ADP survey showed that the private sector added 517K new jobs in March.

- EUR/USD is still at risk of falling in the near-term, but it depends on Biden’s words.

The American dollar retained its strength during the Asian session, pushing EUR/USD to a fresh 2021 low at 1.1703. As the day went by, demand for the greenback receded, with the pair reaching 1.1759. Wall Street posted modest gains, while US Treasury yields ticked lower, reflecting a better market mood. After Wall Street’s close, US President Joe Biden is expected to offer a speech.

European Central Bank President Christine Lagarde helped the shared currency, as she said that short-term economic moves wouldn’t guide policymakers. “The market can test us as much as they want,” she said, adding that the central bank will adjust its monetary policy as needed depending on financial conditions.

Data wise, EU inflation missed expectations, according to preliminary estimates, as the core annual reading came in at 0.9%. US data was also below expected, as the ADP survey on private jobs creation printed at 517K vs the 550K forecast. Still, it is a nice bounce from the previous 176K. February Pending Home Sales fell 10.6% against the -2.6% expected.

On Thursday, Germany will publish February Retail Sales, seen up by 2% MoM, while Markit will release the final readings of its Manufacturing PMIs. In the US, the focus will be on weekly unemployment claims and the March official ISM Manufacturing PMI.

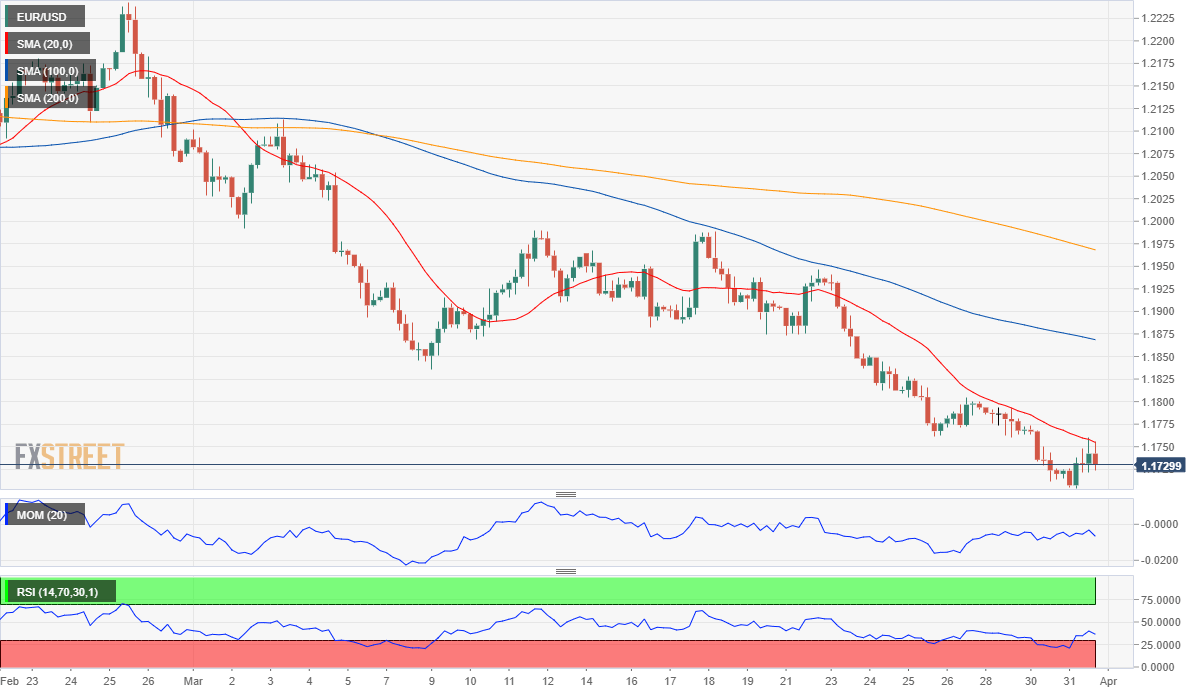

The EUR/USD pair is trading around 1.1735, with its bearish potential intact in the near-term. Technical indicators in the 4-hour chart corrected oversold readings before resuming their declines within negative levels. A bearish 20 SMA provides resistance around the daily high, while the longer moving averages also head lower, far above the current level. The pair will likely accelerate its slump on a break below the daily low.

Support levels: 1.1705 1.1665 1.1620

Resistance levels: 1.1760 1.1810 1.1850

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.