- US Treasury yields jumped to 14-month highs ahead of US President Biden’s speech.

- US Consumer Confidence soared in March amid hopes for an economic comeback.

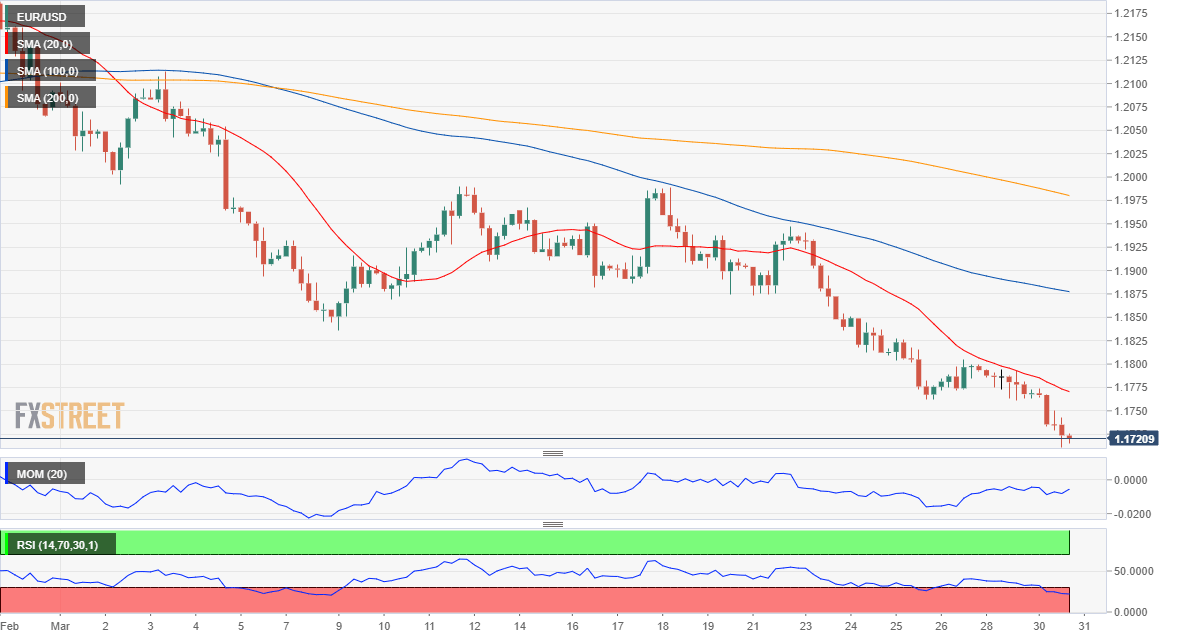

- EUR/USD trades at yearly lows. but the slide is not yet over.

The EUR/USD pair fell to 1.1710. a fresh 2021 low, as the dollar return by the hand of US Treasury yields, which advanced to over one-year tops. The yield on the benchmark 10-year Treasury note rose to 1.77%. its highest since January 2020. Investors are betting that US President Joe Biden’s spending plan will further boost the economic recovery and hence inflation.

US data provided additional support to the greenback, as CB Consumer Confidence jumped to 109.7 in March, surpassing the expected 96.9. Earlier in the day, the EU published the March Economic Sentiment Indicator, which improved to 101 from 93.4, beating expectations. German inflation came as expected at 1.7% YoY in March, according to preliminary estimates. The US will publish some minor figures and CB Consumer Confidence, foreseen at 96.9 in March from 91.3 in the previous month.

On Wednesday, the EU will publish the preliminary estimate of March inflation data, while the US will release the March ADP survey on private employment, foreseen at 550K from 117K in the previous month. The event of the day will be US President Biden’s speech, expected to announce an up to $3 trillion infrastructure investment program, which is also expected to include taxes hikes.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is near the mentioned daily low, with the risk still skewed to the downside. The 4-hour chart shows that technical indicators have stabilized well into negative territory, losing their bearish strength but without signs of downward exhaustion. The 20 SMA heads firmly lower above the current level, providing dynamic resistance at 1.1770, while the longer ones also head south above the shorter one.

Support levels: 1.1710 1.1665 1.1620

Resistance levels: 1.1770 1.1810 1.1850

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.