- EUR/USD loses further momentum in the 1.1870/65 band.

- EMU’s flash CPI showed inflation pressure lost traction in June.

- US ADP report came it stronger at 692K during last month.

Sellers remain in control of the sentiment around the European currency and now force EUR/USD to slip back to the 1.1870 region, or new multi-day lows.

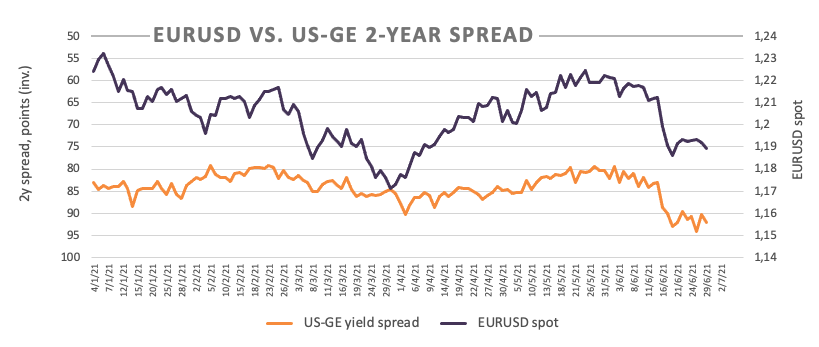

EUR/USD intensifies the leg lower and records new weekly lows near 1.1870 as the demand for the greenback remains solid on the back of the rebound in yields in the shorter end of the curve.

In addition, better-than-forecast ADP results lend extra legs to the buck after the US private sector added 692K jobs in June (vs. 600K exp.). These results add to the prevailing optimism ahead of the more relevant Nonfarm Payrolls due in the second half of the week.

Earlier in the session, advanced June inflation figures in the broader euro area showed headline consumer prices rising 1.9% over the last twelve months, and core prices gaining 0.9% YoY, both prints easing some upside traction vs. the previous month.

Additional data saw the Chicago PMI at 66.1 (vs. 70.0 exp.) ahead of Pending Home Sales and the weekly report on the US crude oil supplies by the EIA.

Sellers seem to have regained the upper hand and drag EUR/USD back to the area below the 1.1900 key support. In the meantime, price action in spot is expected to monitor the dollar dynamics, particularly following the latest FOMC gathering, prospects of higher inflation and potential tapering before anticipated. Further out, support for the European currency comes in the form of auspicious results from fundamentals in the bloc coupled with higher morale, prospects of a strong rebound in the economic activity and the investors’ appetite for riskier assets.

Key events in the euro area this week: German Retail Sales, Final Manufacturing PMIs in the euro area, EMU Unemployment Rate, ECB’s Lagarde.

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities.

So far, spot is losing 0.20% at 1.1871 and a break below 1.1847 (monthly low Jun.18) would target 1.1835 (low Mar.9) and route to 1.1704 (2021 low Mar.31). On the other hand, the next resistance emerges at 1.1976 (50% Fibo of the November-January rally) followed by 1.1995 (200-day SMA) and finally 1.2000 (psychological level).