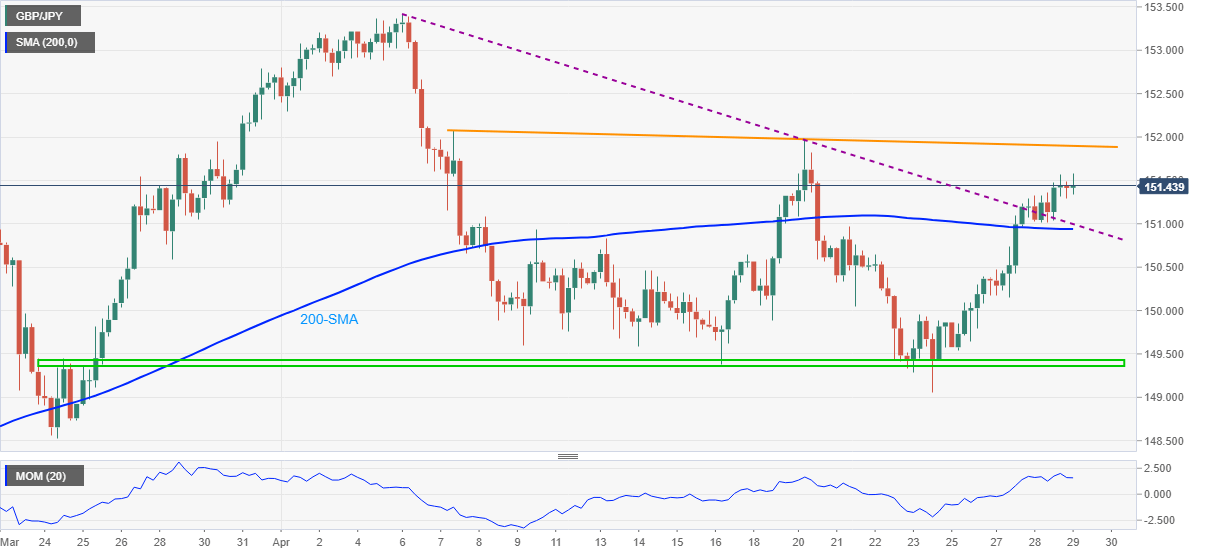

- GBP/JPY steps back from weekly high, keeps upside break of 200-SMA, 17-day-old trend line.

- Strong Momentum line propels buyers toward downward sloping resistance line from April 07.

- Horizontal area comprising multiple levels since March 23 adds to the downside filters.

GBP/JPY retreats to 151.45 while trimming the intraday gains to 0.8% during early Thursday. Even so, the quote holds on to the bullish bias backed by the upside break of short-term key resistance, now support, as well as 200-SMA.

Given the strong Momentum, a three-week-long resistance line near 152.00 gains the market’s attention. However, any further upside needs validation from early April tops near 152.10 before targeting the monthly top near 153.40.

During the run-up, the 153.00 round-figure should act as an intermediate halt.

Meanwhile, pullback moves need to conquer the 151.00-150.90 support confluence including 200-SMA and aforementioned support line, previous resistance, to recall GBP/JPY sellers.

Although the quote sustained weakness past-150.90 will easily attack the 150.00 psychological magnet, an area between 149.45 and 149.35, including multiple levels marked since late March, becomes the tough nut to crack for the bears.

Overall, GBP/JPY remains on the upward trajectory but short-term pullbacks can’t be ruled out.

Trend: Bullish