- GBP/USD firms on a sofer dollar post-Fed statement.

- Markets will now hear from Fed’s chair Powell.

GBP/USD was pressured as the US dollar firmed following the Federal Reserve’s interest rate decision and statement.

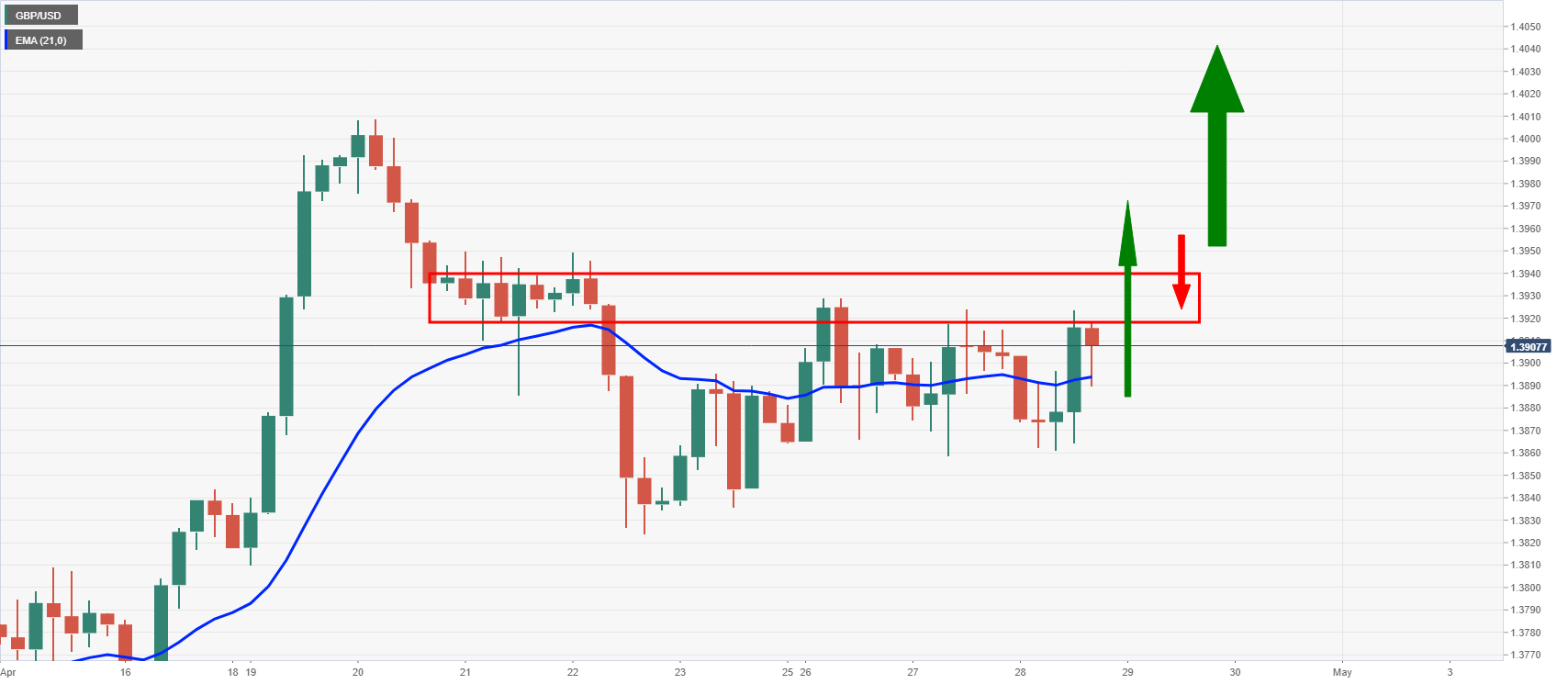

However, the market is flippant and from a low of 1.3889, GBP/USD is currently trading back above 1.3900. The range on the day so far has been between 1.3860 and 1.3923.

The statement has said that the Fed will continue increasing bond purchases by at least $80 bln/month of treasuries, $40 bln/month of MBS until ‘substantial further progress’ has been made on maximum employment and price stability goals.

Meanwhile, the benchmark interest rate was unchanged with the target range standing at 0.00% – 0.25% with the interest rate on excess reserves also unchanged at 0.10%.

Markets will now await the presser where Fed’s chair Jerome Powell is expected to maintain the status quo in rhetoric.

That said, markets are starting to look for signs of tapering and Powell will surely be asked about the timing.

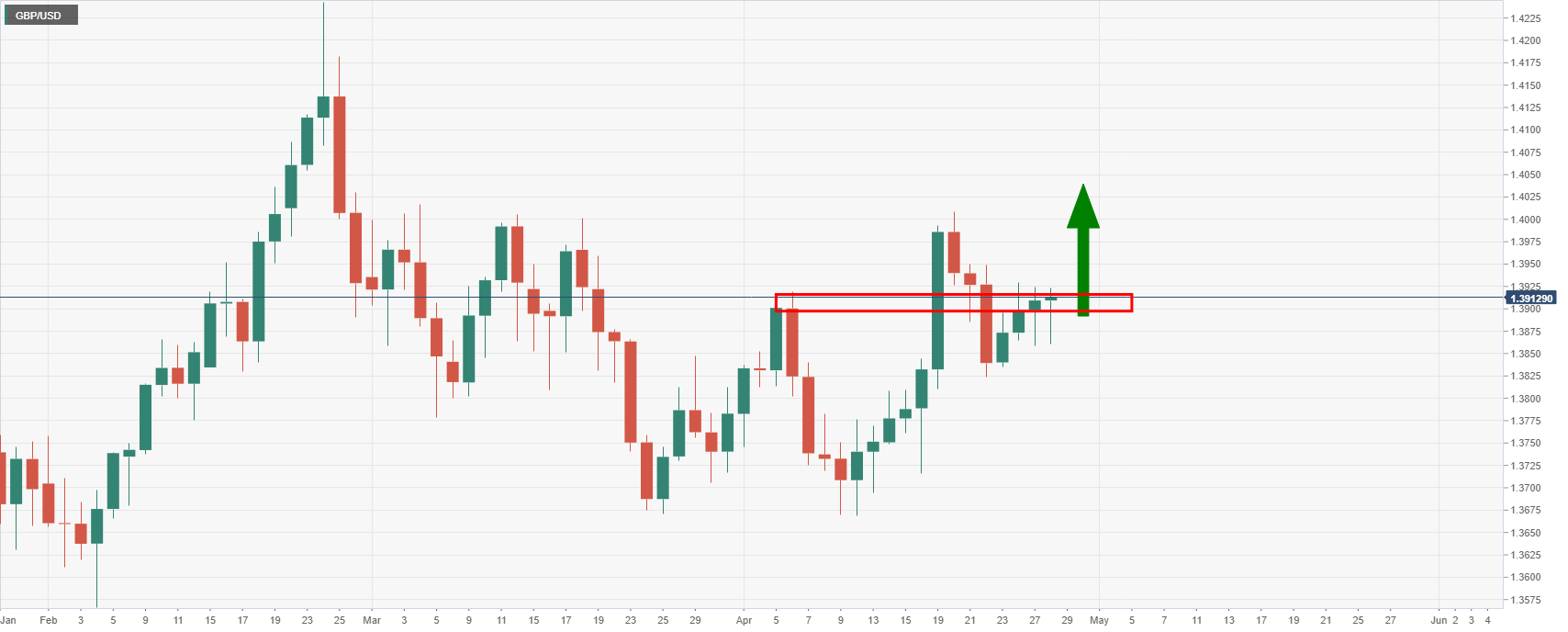

As per the prior analysis, GBP/USD Price Analysis: All eyes on 4-hour resistance, the bulls are testing the critical resistance and the outlook is bullish above: