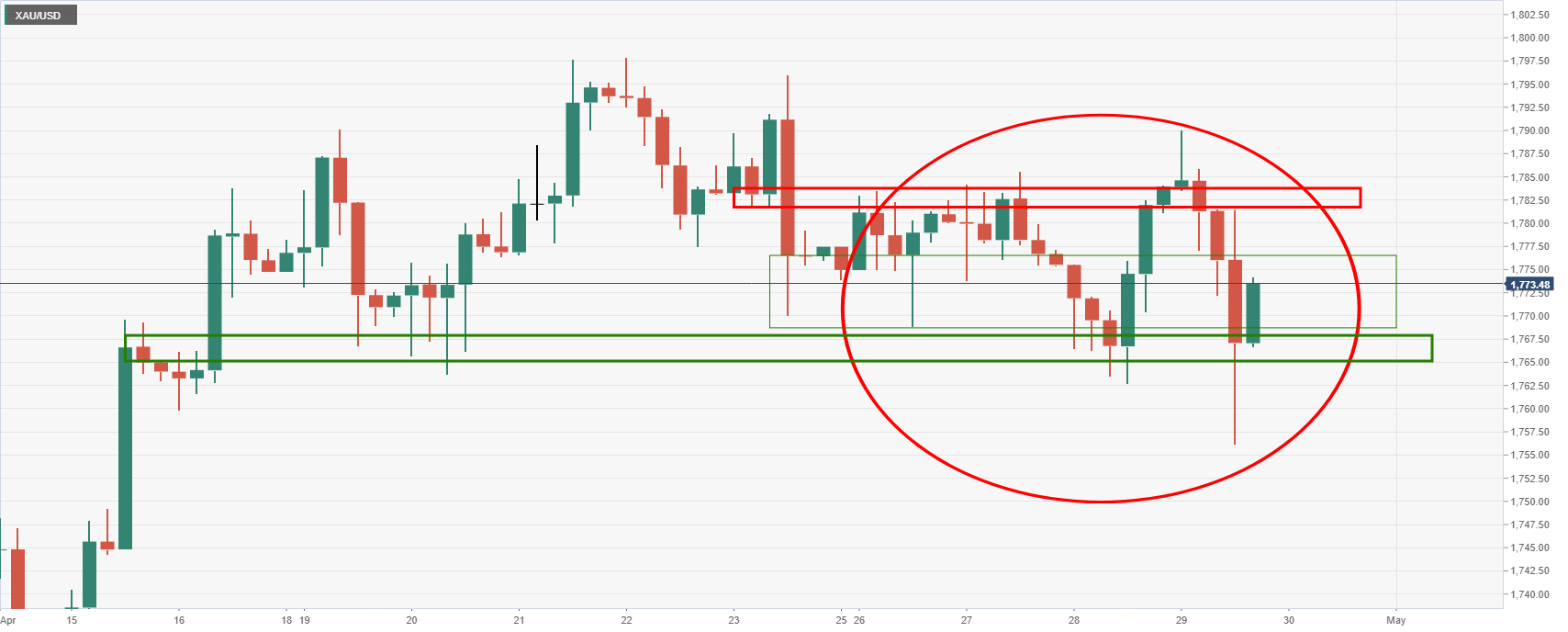

- The price of gold is trapped in daily support and resistance but pressured at 4-hour resistance.

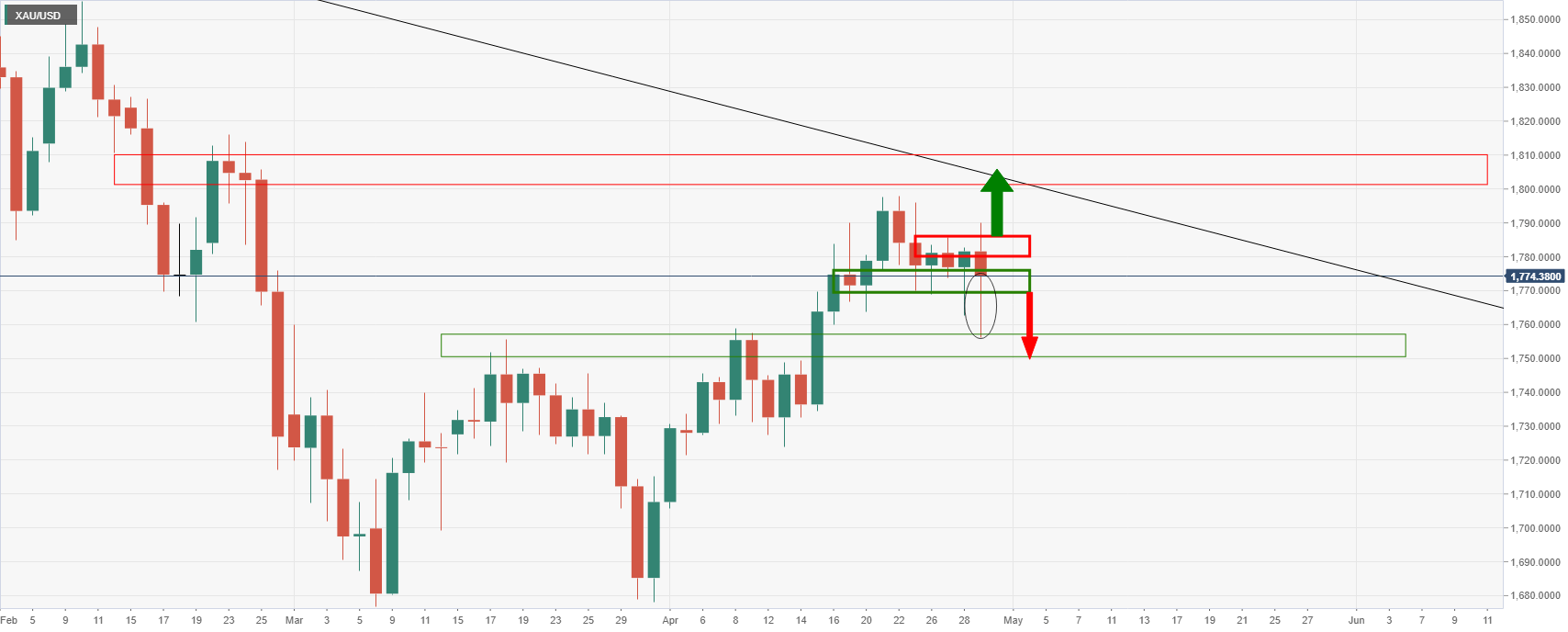

- The support is fragile, but the weekly bullish target is eyed at dynamic trend line resistance.

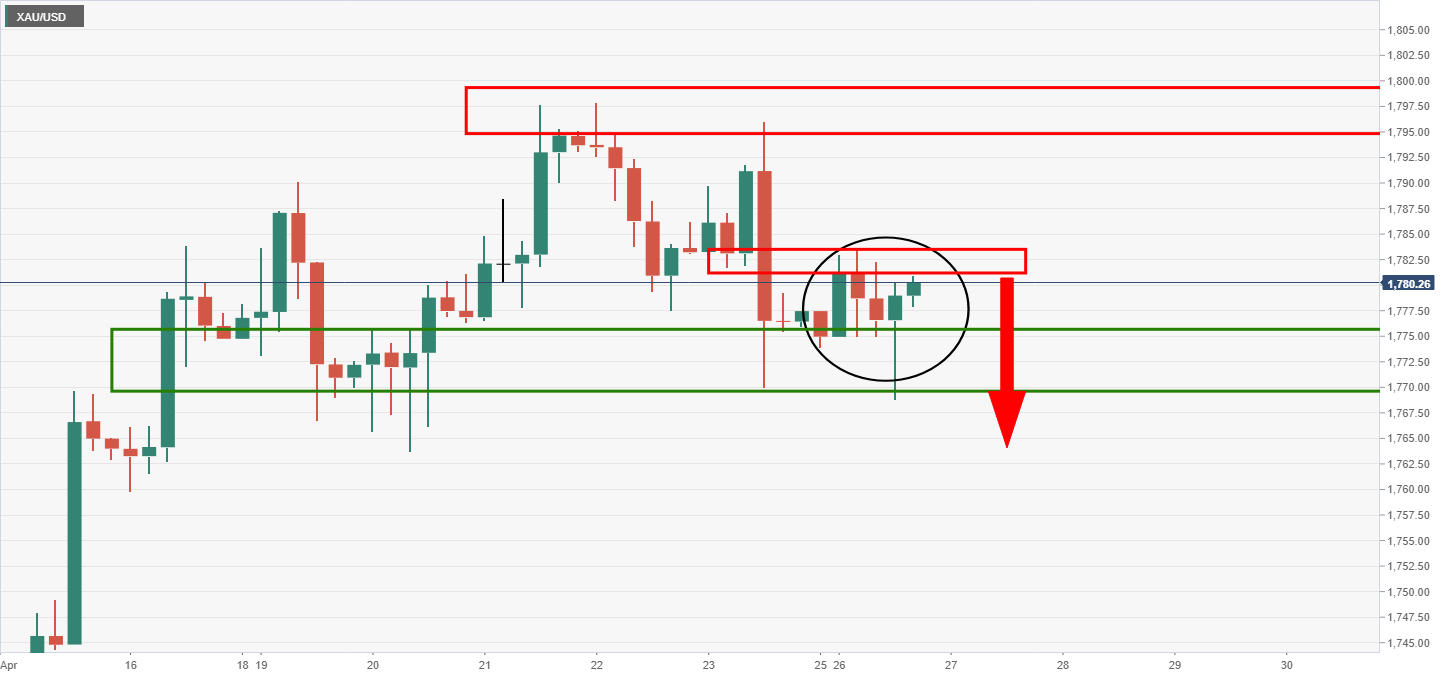

The bulls are tiring at 4-hour resistance in a trapped environment on the daily chart.

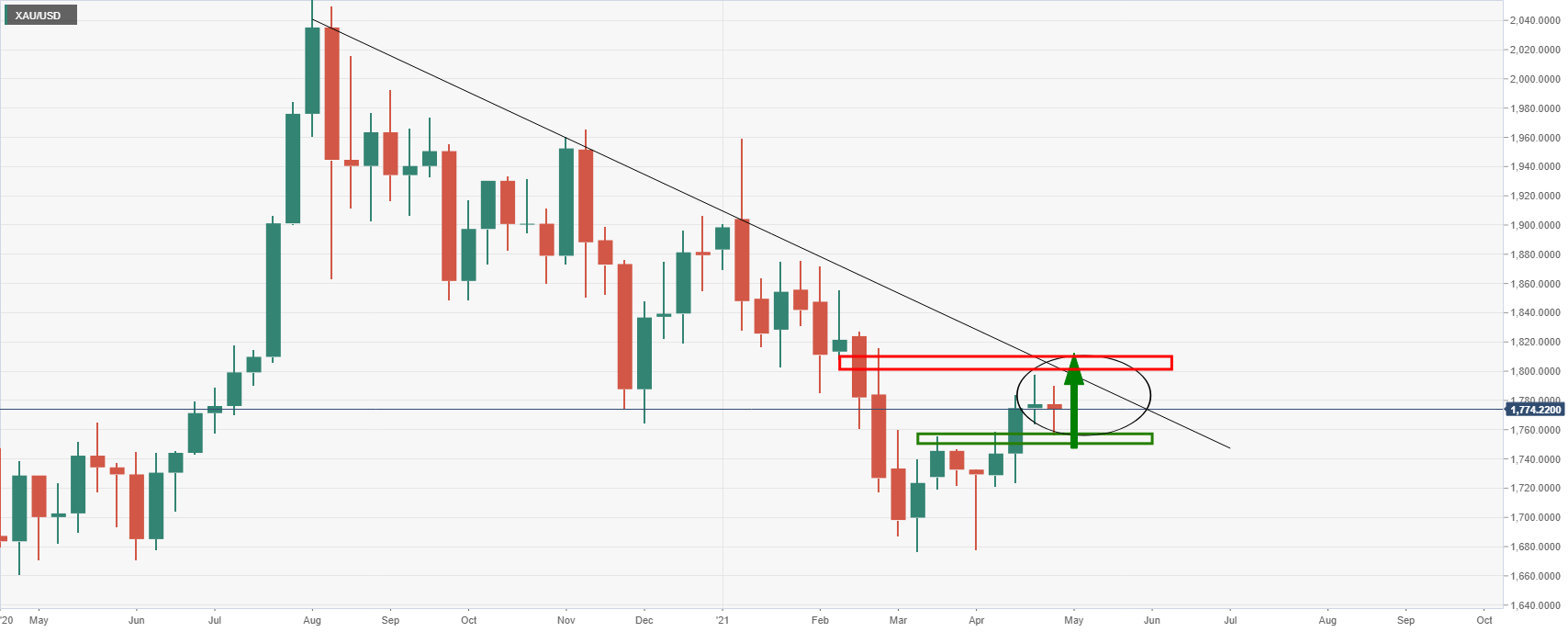

The following analysis illustrates the weekly prospects of a test to the upside if resistance breaks and where the bears need to accumulate for a downside test of the weekly support structure.

As illustrated, the price has indeed moved up to test the resistance and has been rejected.

This leaves scope for a downside continuation if support is broken.

The price has since been rejected by resistance multiple times and created lower lows.

With that being said, there needs to be a close below the lows and support structure on a daily basis.

A weekly outlook is somewhat more encouraging for a test of the dynamic resistance and prior support structure.

From a daily perspective, the trapped environment is blocking a test of the weekly resistance and weekly support.

The daily downside wick is bearish, however, and could well be filled in for a restest of the weekly support ahead of a downward continuation within the broader bearish trend.