- XAU/USD remains on track to post small daily losses on Tuesday.

- Rising US Treasury bond yields weigh on gold.

- Technical outlook stays neutral as price fluctuates between key Fibonacci levels.

The XAU/USD pair managed to close the first day of the week in the positive territory but struggled to gather bullish momentum on Tuesday. In the absence of significant fundamental drivers, rising US Treasury bond yields seem to be making it difficult for gold to find demand. At the moment, the pair is losing 0.25% on the day at $1,777 and the benchmark 10-year US T-bond yield is up 1%.

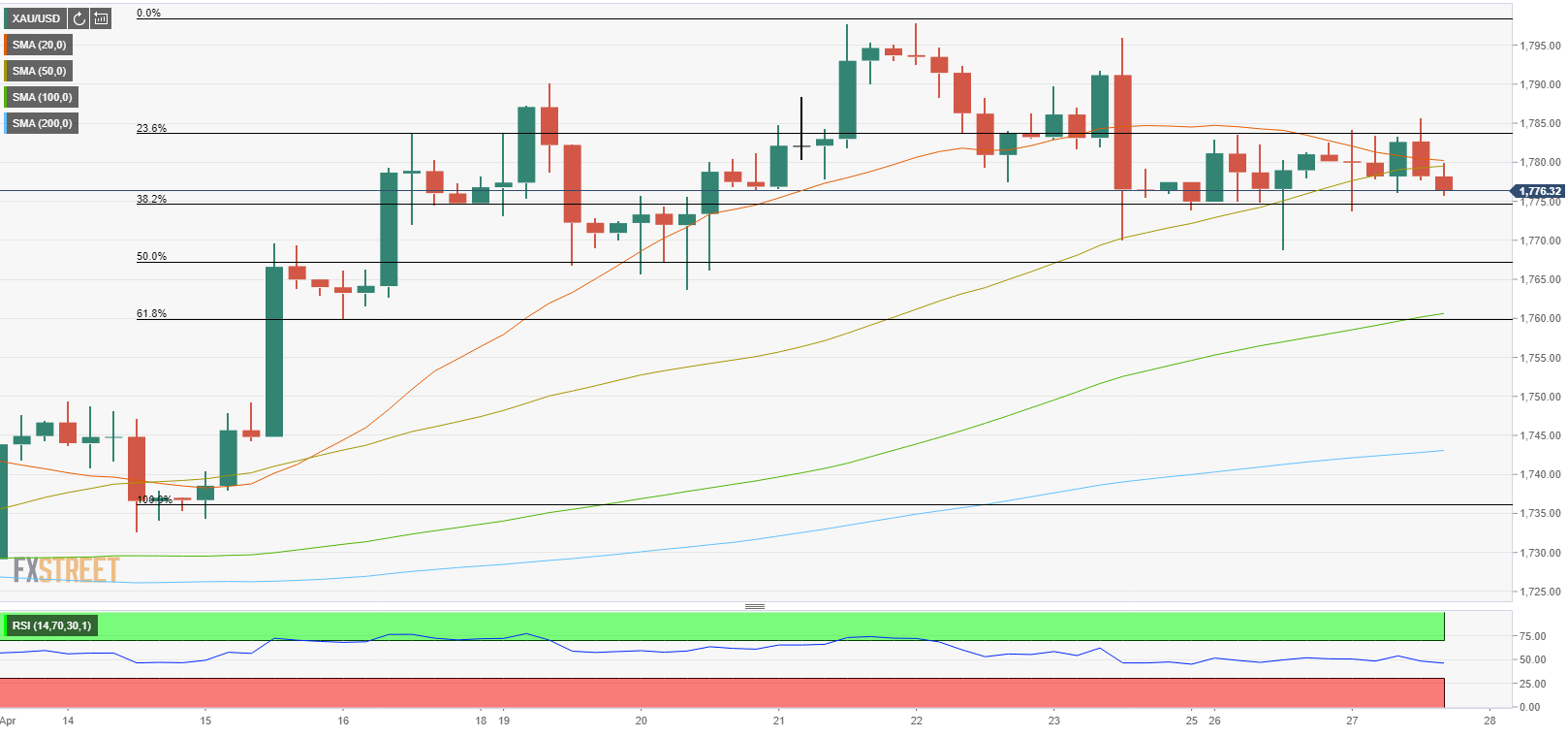

Despite Tuesday’s modest decline, the technical indicators do not point to a buildup in the bearish momentum. On the four-hour chart, the Relative Strength Index (RSI) indicator continues to move sideways around 50, reaffirming XAU/USD’s indecisiveness.

Furthermore, the recent price action seems to have formed a horizontal channel on the same chart, suggesting that gold’s next directional clue will be received if the price manages to make a four-hour close outside of that trading band.

On the downside, the initial support is located at $1,775 (Fibonacci 61.8% retracement of the latest uptrend) ahead of $1,760 (Fibonacci 61.8% retracement/100-period SMA). Resistances, on the other hand, are located at $1,780 (20-period SMA/50-period SMA), $1,783 (Fibonacci 23.6% retracement).