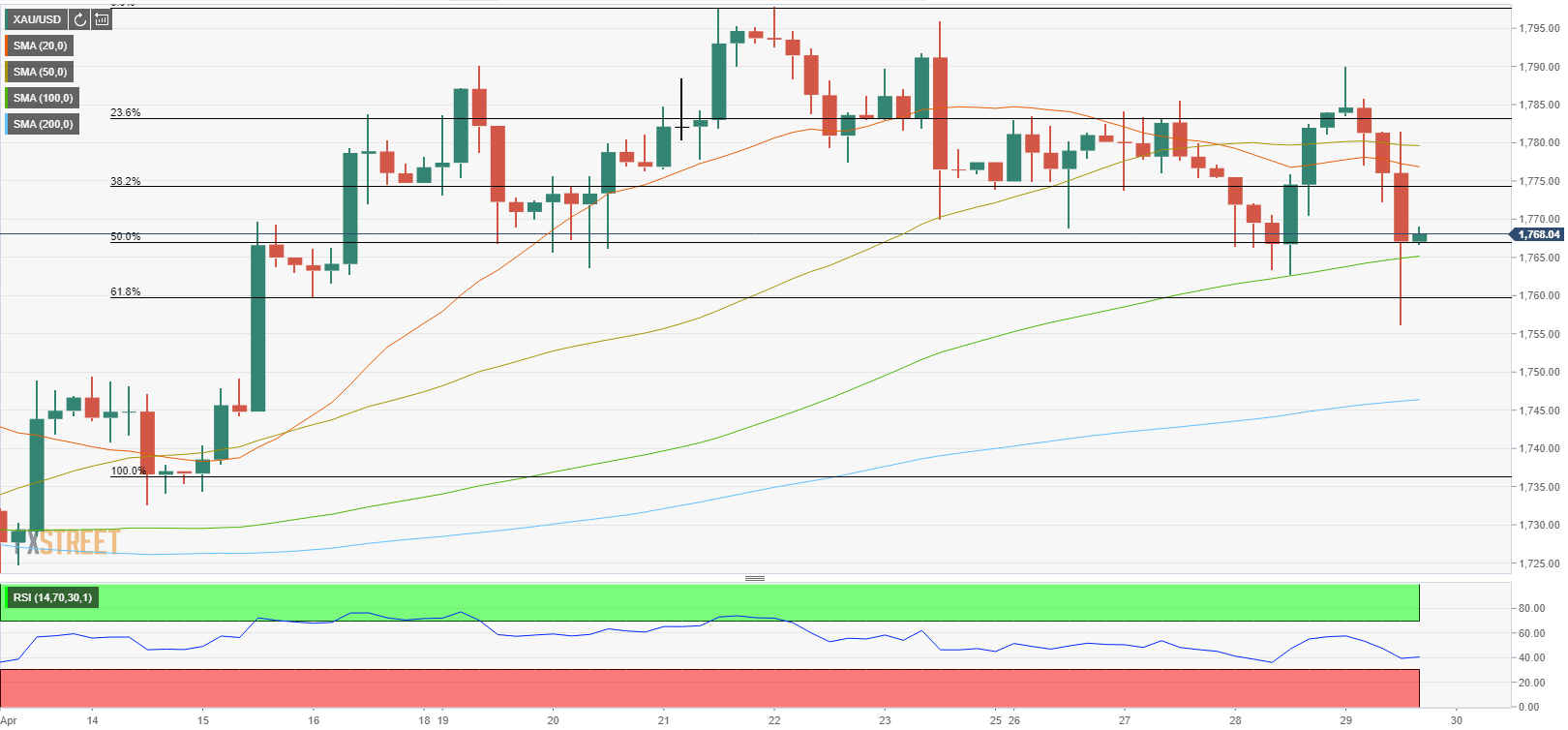

The XAU/USD pair came under strong bearish pressure on Thursday and dropped to its lowest level in two weeks at $1,756. Although the pair managed to erase a small portion of its daily losses, it was last seen losing 0.75% on the day at $1,768. The sharp upsurge witnessed in the 10-year US Treasury bond yields weighed heavily on gold.

The Relative Strength Index on the four-hour chart fell to 40, suggesting that buyers are struggling to retake control of the price. On the downside, the initial support is located at $1,765 (100-period SMA/Fibonacci 50% retracement of the latest uptrend). With a daily close below that level, XAU/USD could retest $1,760 (Fibonacci 61.8% retracement) ahead of $1,747 (200-period SMA).

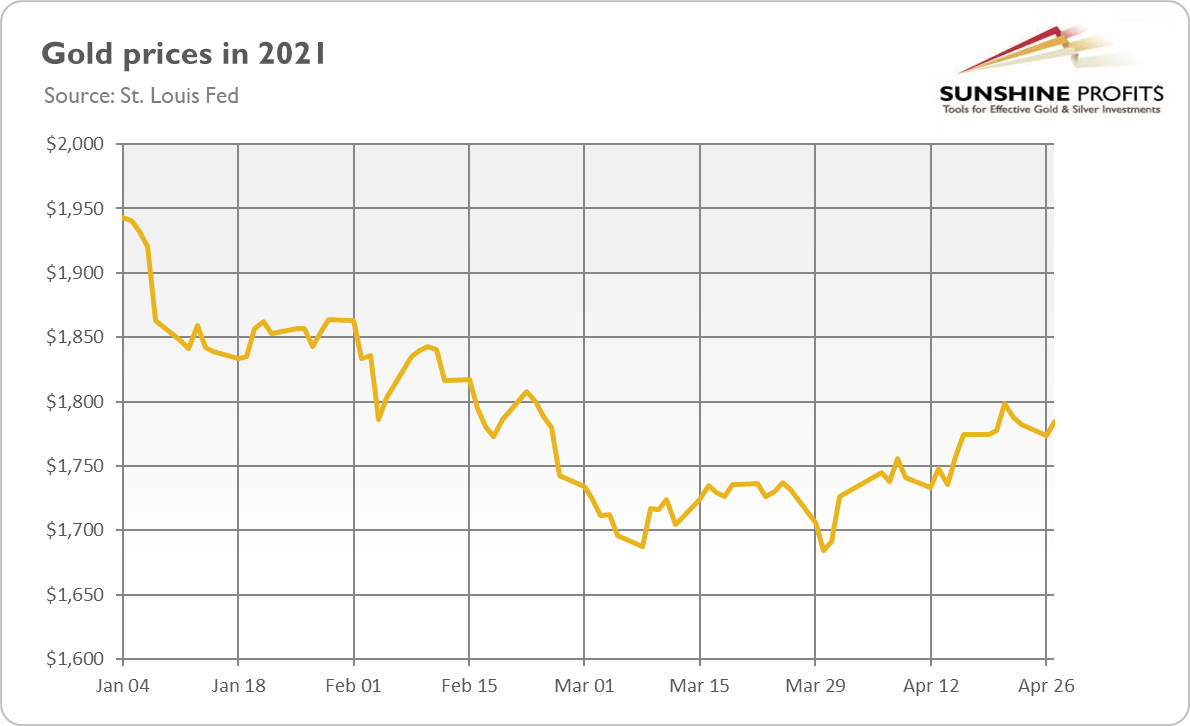

The Fed left its monetary policy unchanged. However, the lack of any action amid economic recovery is dovish – good news for gold.

On Wednesday (Apr. 28), the FOMC has published its newest statement on monetary policy. The statement wasn’t significantly altered. The main change is that the Fed has noticed the progress on vaccinations and strong policy support, and that, in consequence, the economic outlook has improved.

Previously, the US central bank said that indicators of economic activity and employment “have turned up recently, although the sectors most adversely affected by the pandemic remain weak”, while now these indicators “have strengthened”, while “the sectors most adversely affected by the pandemic remain weak but have shown improvement”. So, the Fed acknowledged the fact that the economy has significantly recovered.