Corn prices hit a nearly 8-year high Tuesday, part of a broad rally for agricultural commodities that’s stoking inflation fears. There are several drivers behind the move for maize, including strong demand from China.

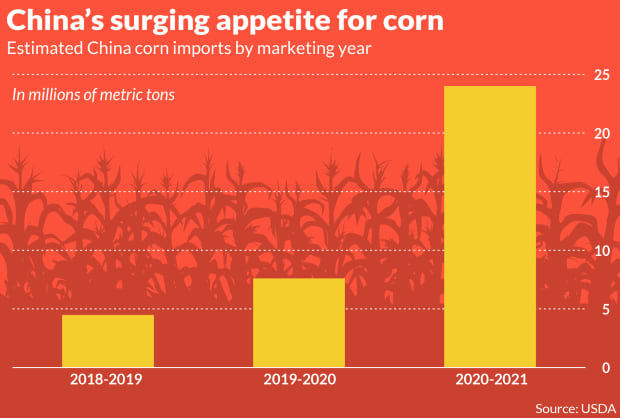

Just how strong? The chart below shows just how much of the yellow stuff that the U.S. Department of Agriculture estimates China is poised to import from around the world this marketing year — 24 million metric tons, or MMT. That’s a huge jump from last year’s estimate of 7.6 MMT and the previous marketing year’s total of just shy of 4.5 MMT tons. The current marketing year ends Aug. 31.

But that estimate, included in the department’s closely watched monthly World Agricultural Supply and Demand Estimates, or WASDE, report earlier this month, may be understating the case. The USDA’s Foreign Agricultural Service’s Beijing office, in an April 16 report, predicted imports would hit 28 MMT.

China is hungry for corn and other feedgrains and feed ingredients as it rebuilds a swine herd that was half wiped out in 2018-19 by African swine fever. China’s agriculture ministry in February said the country’s hog inventory had recovered to 92% of its pre-fever level by the end of 2020 and would be fully back to that level by June 2021, the USDA’s Foreign Agricultural Service said, but added that “significant industry doubt persists.” Meanwhile, “optimistic forecasts are that feed ingredient prices will continue to increase due to strong market demand.”

Corn futures have certainly been on a tear. July corn futures

C00,

-0.19%

CN21,

-0.19%

traded as high as $6.84 a bushel on Tuesday — the highest intraday level for a most actively traded contract since March 28,2013, according to Dow Jones Market Data — but settled with a loss.

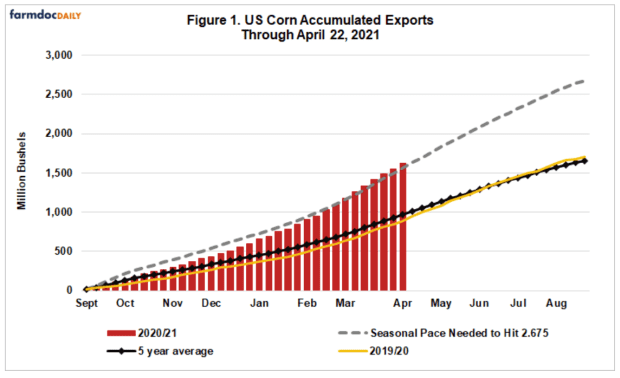

So what does China’s demand mean for the U.S., the world’s largest corn producer? The USDA, in the April WASDE report, boosted its forecast for total U.S. corn exports to a record 2.675 billion bushels for the current marketing year, up from a March estimate of 2.6 billion bushels and a more than 50% increase from 1.778 billion bushels in the 2019-20 marketing year.

So far, data on weekly U.S. corn export inspections are in line with the USDA’s projections, noted Ben Brown, a senior research associate at the University of Missouri’s College of Agriculture, Food and Natural Sciences, in a paper published Tuesday.

Moreover, the chart below underscores how the current pace of U.S. corn exports is outstripping the five-year average and last year’s performance.

farmdocDaily

Indeed, March is expected to have set a monthly record for corn exports at roughly 361 million bushels, beating the previous record set May 2018 of 305 million bushels and the March record of 262 million bushels set in 2017, Brown wrote.

U.S. corn exports could also be boosted if what’s known as Brazil’s safrinha corn harvest disappoints. The term refers to second-crop corn that is planted after Brazil’s first-crop soybean harvest and now exceeds the country’s regular corn crop production.

A late soybean harvest curtailed safrinha acres and will be at risk from subpar rainfall in May, Brown said.

Closer to home, corn-planting intentions by U.S. farmers came in smaller than expected at the end of last month. And cool, wet weather has slowed early planting progress, though forecasts have called for better planting weather ahead.