Intel Corp (NASDAQ: INTC) has postponed producing one of its newest chips to improve performance, the Wall Street Journal reported.

What Happened: Intel plans to start producing the central processing units for servers in early 2022 from the previously planned in late 2021.

Intel was buying time to improve the chips’ performance, particularly around the highly prized data handling and artificial intelligence processing metrics.

The production is likely to begin in Q1 of 2022 and ramp up in Q2. The delay is the first under CEO Pat Gelsinger, following significant delays in chip-making advances under his predecessor, Bob Swan.

Almost a year ago, Intel said the following generation of more advanced chips with super-small transistors wouldn’t be ready until late next year, about a year later than initially expected.

Why It Matters: Intel generated $5.6 billion in revenue from its data-center business in Q1, roughly a quarter of all sales.

Data-center demand has jumped in recent years with the shift toward cloud computing. The pandemic-driven remote work further intensified the need for server chips.

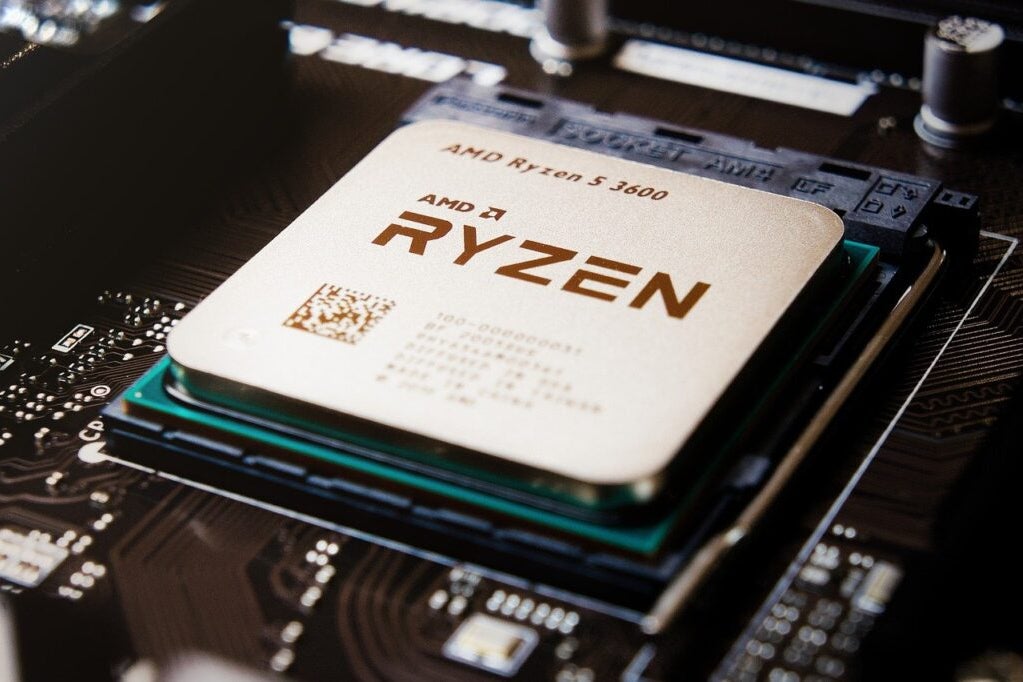

Advanced Micro Devices Inc (NASDAQ: AMD) has succeeded in expanding its data-center chip market share from 1.8% in 2018 to 8.9% in Q1 of 2021. Intel maintained the lead with a 9.1% share.

In April, NVIDIA Corp’s (NASDAQ: NVDA) further added to Intel’s woes by announcing its data-center chip launch plans.

Gelsinger launched a fast-track turnaround program and announced over $20 billion of factory investments in his first few months in the job. The initiatives coincided with U.S. and Europe’s multibillion-dollar subsidies for the semiconductor industry that has primarily migrated to Asia in the past three decades.

The pandemic triggered demand for electronics and chips, and supply-chain disruptions further drove the subsidies. The U.S. Senate recently earmarked $52 billion in grants for the domestic chip industry. The U.S. accounts for just 12% of global production capacity.

Price action: INTC shares traded lower by 1.50% at $55.9 on the last check Wednesday.

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.