TOKYO, April 1 (Reuters) – Japanese stocks rose on Thursday, as investors snapped up shares of semiconductor-related companies on the first day of the new fiscal year on hopes for robust corporate earnings.

The Nikkei 225 Index ended up 0.72% at 29,388.87, while the broader Topix rose 0.19% to 1,957.64.

The technology sector led the advance after U.S. chipmaker Micron Technology Inc forecast third-quarter revenue above analysts’ forecasts.

“What’s happening with Japanese tech shares is a reflection of what is happening in the United States,” said Takashi Hiroki, chief strategist at Monex Securities.

Sentiment in Japan brightened after the Bank of Japan’s tankan survey showed business sentiment has returned to where it was before the onset of the COVID-19 pandemic.

“We’re in a new fiscal year and a lot of institutional investor money is entering the market. Companies will start releasing earnings at the end of the month, and I expect a lot of forecast upgrades,” Hiroki said.

Tokyo Electron Ltd rose 4.68%, at one point hitting an all-time high, as Micron’s bullish sales forecasts and a gain in U.S. technology shares boosted Japanese semiconductor-related stocks.

In addition, Micron and Western Digital Corp are individually exploring a potential deal for Kioxia Holdings Corp that could value the unlisted Japanese semiconductor firm at around $30 billion, the Wall Street Journal reported on Wednesday.

Investors are flocking to semiconductor makers because a global shortage of chips required for next-generation electric cars and advanced smartphones suggests demand will remain robust for a long time, analysts said.

Chip manufacturing equipment makers Advantest Corp gained 4.13%, while Screen Holdings Co Ltd rose 6.06%.

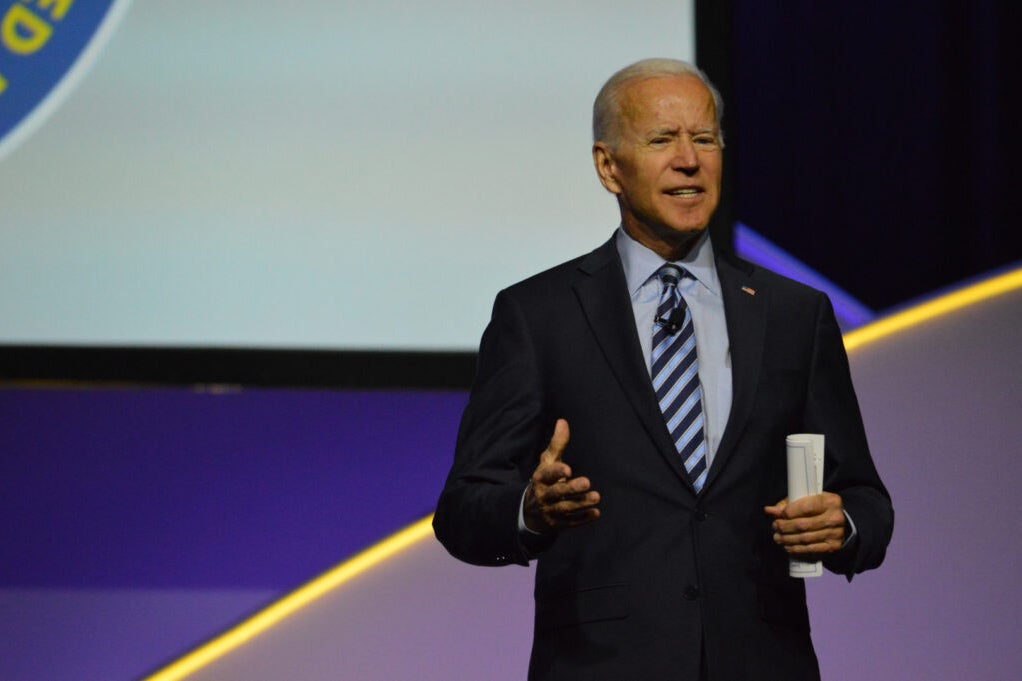

U.S. President Joe Biden’s $2.3 trillion infrastructure plan and a weakening yen also boosted sentiment for Japanese stocks, analysts said.

The underperformers among the Topix 30 were Mitsui & Co Ltd , down 2.41%, followed by Recruit Holdings Co Ltd , off 2.26%. (Reporting by Stanley White; Editing by Shailesh Kuber; Editing by Amy Caren Daniel)