- MVIS shares rally on Wednesday by over 4% as risk is back on.

- MVIS fails to breach the previous high and closes near the daily low.

- MVIS releases Q1 results after the close today, Thursday.

Microvision is a Washington-based technology company making sensors and microdisplays. The primary business is developing laser beam scanning technology. The company has a market cap of $3.2 billion and a high short interest of 20%. Sound familiar? Yes, it is the standard r/WallStreetBets model. As they say, “If it ain’t broke, don’t fix it.”

Stay up to speed with hot stocks’ news!

MVIS has been the top trending stock on r/WallStreetBets this week, and with price swings like this, it is easy to see why. MVIS shares are up 274% in 2021. MVIS is up 94% in the last week, 726% in the last 6 months and, wait for it, 7,909% in the last year.

MVIS has overtaken GameStop on r/WallStreetBets this week with 2,451 mentions against GameStop’s 918, according to data from Quiver Quantitative.

MVIS shares put in a decent shift on Wednesday, rising 4% but failing to recapture the high from Tuesday. Generally, a bearish sign, but MVIS shares do have some hope in that they report results after the close on Thursday. This may prove a catalyst or it may prove a disappointment and allow bears to take back control of the narrative.

Given how poorly MVIS performs, not having turned a profit in the last five years and counting, it is unlikely anything extremely bullish will be released. Earnings per share (EPS) are expected to be a loss of $0.02 for the first quarter of 2021, and revenue is expected to be $600,000, fairly small numbers when you consider MVIS has a market cap now of $3.3 billion.

MVIS shares pushed higher on Wednesday after the company announced its lidar sensor demonstration was complete. Microvision said, “A version of this lidar sensor could be available for sale, in initial quantities, in the third or fourth quarter of 2021.”

This was enough to send social media buzzing once again over MVIS. A look at Microvision and financials would not give too much confidence in the sales process though as revenue has steadily been decreasing over the last five years, according to Refinitiv data.

| Year | 2020 | 2019 | 2018 | 2017 | 2016 |

| Revenue | 3.09m | 8.89m | 17.61m | 9.63m | 14.76m |

| Operating Income | -13.62m | -26.47m | -27.22m | -25.48m | -16.46m |

This is clearly not a Buffet-style, long-term investment. But then not many of the current retail meme stocks are. This one is highly volatile, which is what the short-term players want.

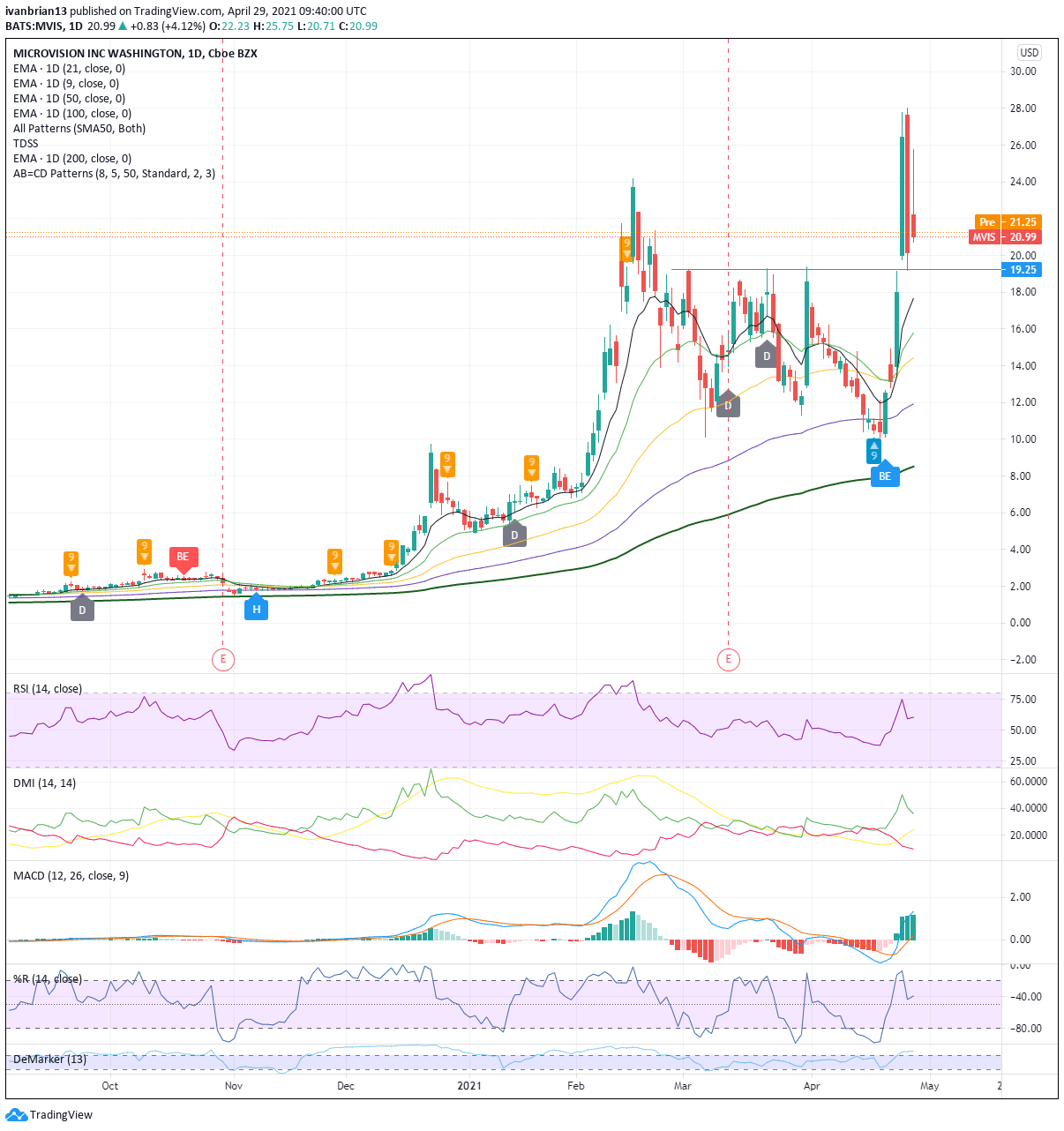

To stay bullish, MVIS really needs to stay above $19.25 where MVIS broke out from, as we can see in the chart below. Remaining above this level would see a buy-the-dips strategy with tight stops to help counter the volatile price movements. The 9 and 21-day moving averages are also key to the short-term trends and can be used as buy levels.

The picture will become a bit clearer after the results and the conference call after the market closes on Thursday. The conference call starts at 1700 EST on Thursday, details here.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.