- XPD/USD reaches the $3000 mark for the first time on record.

- Overbought conditions on the daily chart call for a correction.

- Buy-the-dips are likely to be a key strategy for Palladium.

The buying interest in Palladium (XPD/USD) remains unabated, as the white metal reaches fresh record highs at $3,012 in the last hour.

The pair extends its bullish momentum into the second straight session on Friday, shrugging off the broad-based US dollar rebound.

Growing concerns over supply-demand in equilibrium continue to power the gains in the industrial metal. These come amid rising supply disruptions after Russian mining giant and the world’s largest palladium producer, Nornickel, said that mine closures due to flooding are likely to cause the production of platinum group metals to fall by 710,000 ounces this year.

Against this backdrop, the demand prospects for the metal improve as the global economy recovers from the coronavirus crisis while the stimulus from major central banks and governments also helps in ramping up the economic turnaround.

Palladium has wider applications as an industrial metal.

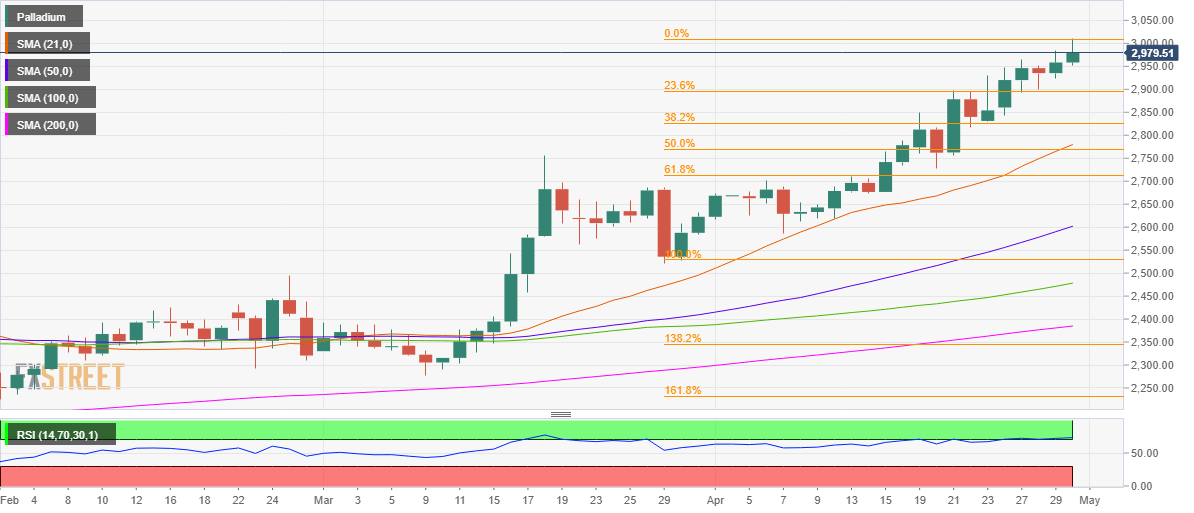

Technically, XPD/USD risks a correction amid overbought conditions on the daily Relative Strength Index (RSI).

Therefore, the latest pullback could extend towards the 23.6% Fibonacci Retracement level of the rally from March 29 lows to record highs. That level aligns at $2,898.

Meanwhile, to the upside, the XPD bulls could retest the all-time high, above which doors open up towards the $3,050 psychological level.

At the time of writing, the metal trades with sizeable gains at $2,980. Every dip could draw bargain hunters, as the fundamental factors remain well in favor of Palladium in the short to medium term.