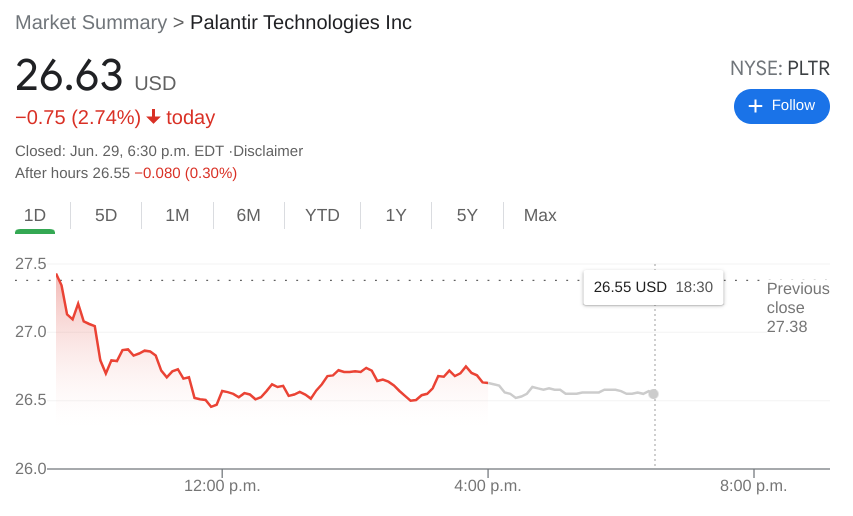

- NYSE:PLTR fell by 2.74% on Tuesday during a flat day for the broader markets.

- Palantir partners with connected vehicle data startup Wejo.

- Palantir’s trend remains bullish as it targets the $30 gap to fill in the short-term.

NYSE:PLTR saw its recent five-day green streak snapped on Tuesday, as shares took a breather from the recent climb. Shares of Palantir fell by 2.74% to close the trading session at $26.63. The stock saw a lower daily trading volume than it has been used to of late, which could be a reason for its decline on Tuesday if there wasn’t enough bullish momentum during the day. Keep in mind the end of the second quarter is fast approaching this week, so fund reallocation and profit taking is a normal course of action that could have a direct effect on stock price.

Stay up to speed with hot stocks’ news!

Another day, another partnership for Palantir as it announced it is joining forces with some heavyweight companies to back a new startup called Wejo. The soon to be SPAC IPO merger deals in the vehicle data analytics industry, and has had Palantir as an early investor in the company alongside other notable firms like General Motors (NYSE:GM) and Microsoft (NASDAQ:MSFT). Palantir actually had a joint venture with Japanese insurance company Sompo, which added in Wejo to provide vehicle data for the Asia-Pacific region.

Despite the drop on Tuesday, the trend for Palantir in the short-term remains bullish as the stock uses the 8-day simple moving average as a support to launch higher. If Palantir can break through the resistance at $27.47, the next leg higher is in the gap to fill at $30.00, and a new point of resistance at around $30.44. It should be noted that options flow for Palantir has been extremely bullish as of late, so don’t be surprised if that gap is filled sooner rather than later.