GBP/USD – 1.3874.. Although cable rose FM 1.3877 in Asia Mon to 1.3939 in Europe Mon after UK govt. said on track to lift COVID restrictions, the price quickly retreated n later ratcheted lower on selling in sterling to 1.3871.

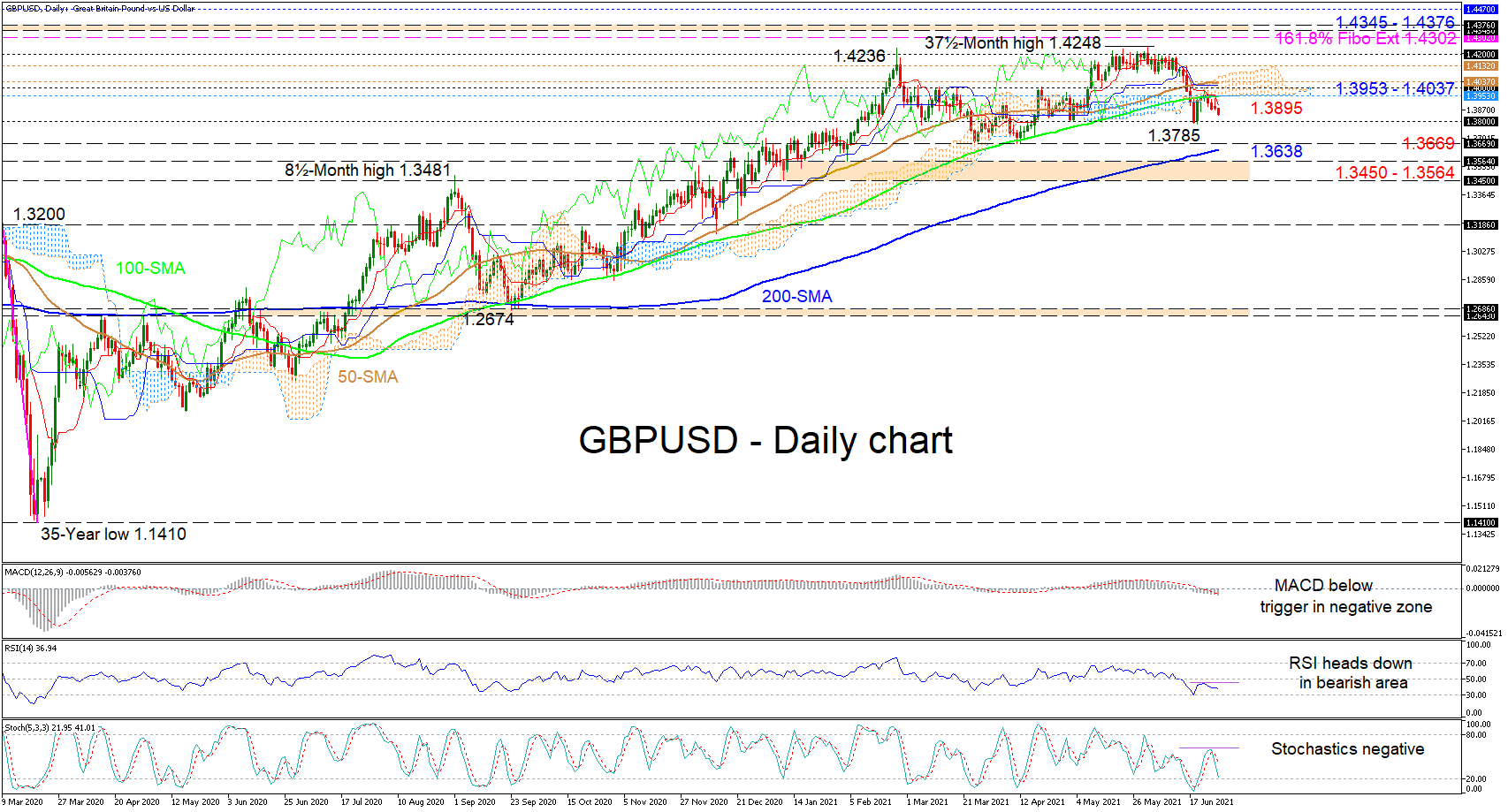

On the bigger picture, despite cable’s brief break of 2016 post-Brexit low of 1.1491 to a near 35-year trough of 1.1412 in mid-Mar 2020 on safe-haven USD’s demand following free fall in global stocks, price rallied to 1.3686 on the last trading day of 2020 following a last-minute EU-UK trade deal, then to a near 34-month, 1.4241 peak in late Feb suggests a major low is made. Read more…

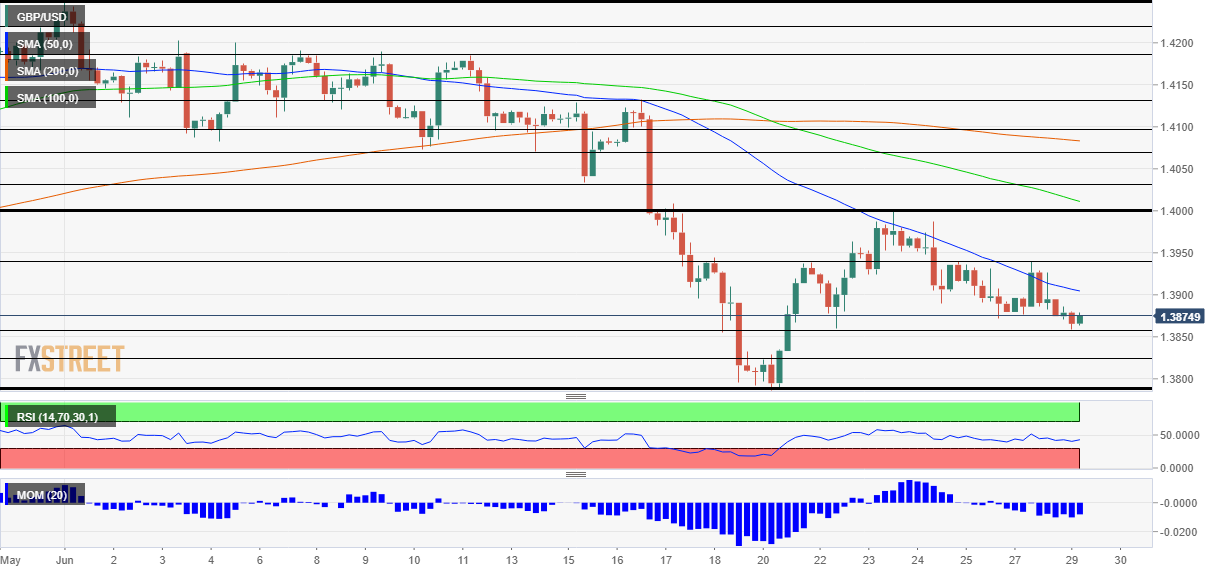

GBPUSD is edging lower underneath its red Tenkan-sen line around 1.3895 after its latest bounce around the 1.3800 handles was curbed by the 100-day SMA and the cloud’s lower surface. The simple moving averages (SMAs) are maintaining a bullish bearing, signaling that negative forces have yet to take full command.

That said, the Ichimoku lines are indicating that negative momentum is a slight step ahead, while the short-term oscillators are conveying a subtle tilt to the downside. The MACD, not that far below zero, is flattening towards its red trigger line, while the RSI is gliding lower in bearish territory. The negatively charged stochastic oscillator is promoting the recent loss of power in the pair. Read more…

“No date we chose comes with zero risk for covid – these words by the newly installed UK Health Secretary Sajid Javid have failed to keep cable from falling. Javid wants to stick with the new reopening date of July 19 and insists that a return to normal is needed.

His words come on the backdrop of a surge in coronavirus infections – 22,868 reported on Monday, the highest since late January. However, Britain’s hospitals have been only seeing a minor increase in admissions, while deaths remain depressed as well. So far, vaccinations have proven efficient in breaking the link between contracting the virus and serious illness. Read more…