Fundamentals or technicals? The last day of the month is already set to be choppy amid last-minute portfolio adjustments, and the contradicting signals between both approaches may cause more confusion. However, two factors may outweigh what the charts show.

First, the greenback is making a comeback and this is set to extend. The dollar suffered from the Federal Reserve’s dovish decision on Wednesday, in which the central bank rejected tapering down its bond-buying scheme, stressed inflation is transitory and said that the economy has a “long way to go.” However, figures published on Thursday showed that way is shorter. Read more…

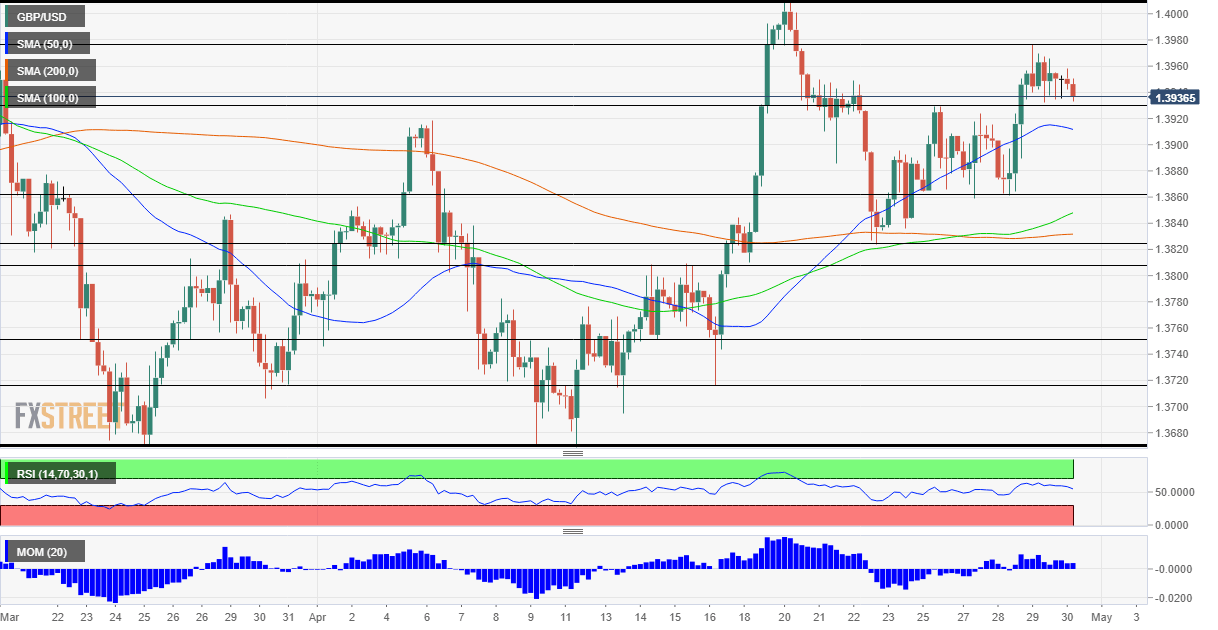

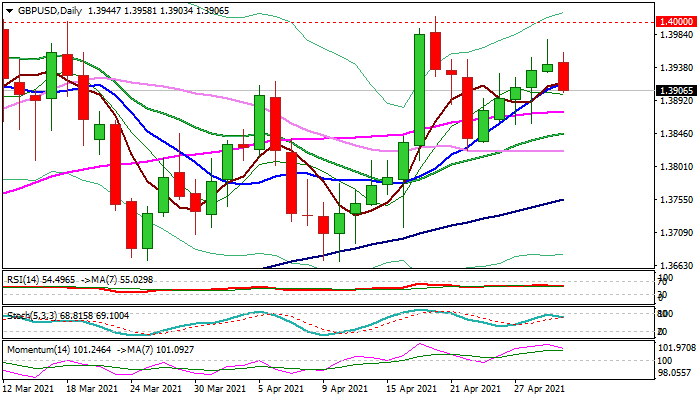

Cable accelerated lower in early Friday, driven by fading risk appetite and a stronger dollar. Five-day rally 1.3823 (Apr 22 trough) showed signs of stall and Thursday’s action formed a shooting star candle, while today’s weakness added to signals of reversal on the daily chart.

Narrowing daily cloud twists next Tuesday (1.3878) and also attracts fresh bears which pressure 1.3900 support (50% retracement of 1.3823/1.3976), with a weekly close below here further weaken near-term structure and risk deeper drop towards 1.3877 (55DMA) and 1.3860 higher bases. Read more…

The GBP/USD pair refreshed daily lows during the early European session, with bears now awaiting a sustained break below the 1.3900 round-figure mark.

The pair extended the previous day’s retracement slide from over one-week tops, around the 1.3975 region, and witnessed some selling on the last trading day of the week. This marked the first day of a negative move in the previous six trading sessions and was sponsored by a modest US dollar strength. Read more…