The meme-stock madness has returned, but it’s a little bit different this time.

First, the similarities. AMC Entertainment

AMC,

+35.58%,

the movie-chain operator, shot up 36% on Thursday, and has more than doubled over the last four days. There is, of course, no fundamental news to drive such a rapid rise, and by contrast, Cineworld Group

CNWGY,

-23.08%,

an operator of U.S. and U.K. theaters, is up 8% over the last five days. Short sellers have lost $1.3 billion on the AMC surge, Bloomberg News reported, citing data from S3 Partners.

And it isn’t just AMC. GameStop

GME,

+4.77%,

the videogame retailer, has climbed 49% over the last five days, and Beyond Meat

BYND,

+12.52%,

the maker of meat substitutes, is up 32% over that time period. Stock-market volume on the New York Stock Exchange and the Nasdaq on Thursday was the strongest since March 19.

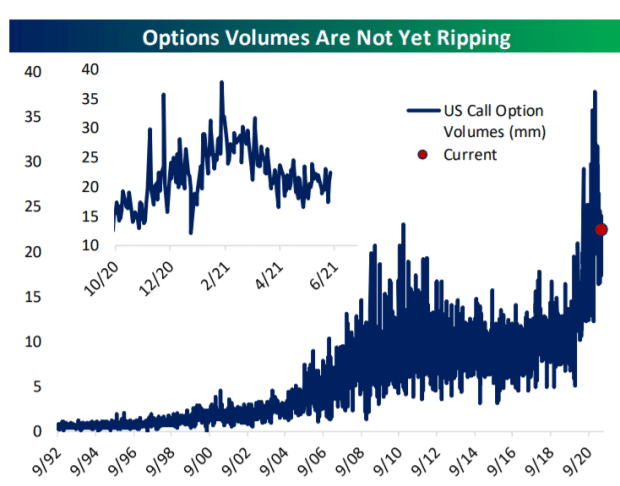

But there are some differences to what happened the last time the stocks that are popular on the Reddit WallStreetBets message board surged in value. For one, a quick look at the app store rankings, for both iPhones and Androids, doesn’t find the likes of Robinhood Markets or any other brokerages at the top. Options activity also isn’t as spectacular — still strong, but far below the February peak, points out George Pearkes, an analyst at Bespoke Investment Group. The Cboe Volatility Index

VIX,

-0.06%,

unlike the situation in February, is restrained.

The broader market has its eyes elsewhere, on the economic rebound and whether surging inflation will cause the Federal Reserve to tap the brakes earlier than it wants. As anyone who has contributed revenue to AMC knows, sequels just don’t pack the same punch.

Inflation data on tap

The Fed’s preferred inflation gauge, the PCE price index, is due for release, along with personal income data for April. There also are preliminary reports on trade and inventories, and Chicago-area manufacturing and consumer sentiment data will be released shortly after the open.

A White House budget is no more than that — just what the executive branch thinks the legislative folks should do, and often the proposals have no bearing on reality. But it is still eye-opening to see the news that President Joe Biden will propose a $6 trillion budget. Treasury Secretary Janet Yellen said the budget proposal will result in lower tax deficits and higher tax revenue in the future.

Investors soured on HP’s

HPQ,

-0.22%

results, despite the computer maker beating earnings expectations and lifting its outlook. By contrast, database software maker Salesforce.com

CRM,

-1.68%

climbed, after topping expectations with both its results and outlook.

Discounter Costco Wholesale

COST,

+0.49%

reported a surge in profit as comparable sales jumped 15% in its fiscal third quarter. Retailer Ollie’s Bargain Outlet Holdings

OLLI,

-0.02%

surged after topping expectations, despite not providing a financial outlook.

The markets

U.S. stock futures

ES00,

+0.36%

NQ00,

+0.31%

were stronger in early action. The yield on the 10-year Treasury

TMUBMUSD10Y,

1.609%

was 1.61%.

The Chinese yuan

CNYUSD,

+0.27%

has climbed to a five-year high against a basket of rivals.

Bitcoin

BTCUSD,

-6.41%

struggled, falling below $36,000.

The chart

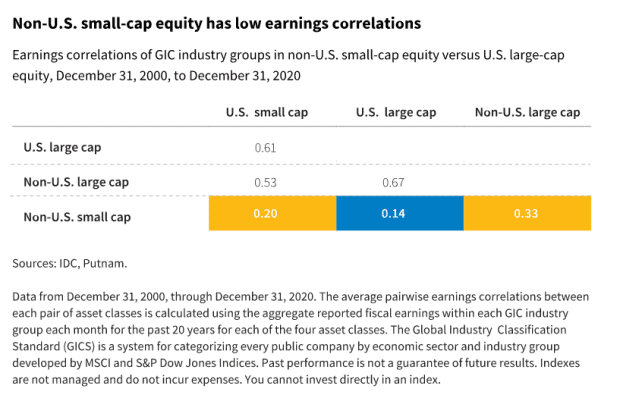

If you’re after diversification, international small-caps may be a source. This table, compiled by Putnam Investments, shows the low earnings correlations between non-U.S. small-caps and other asset classes. The fund manager also notes the low analyst coverage of these stocks, with a median of three sell-side analysts covering each stock, compared with a median of 20 for U.S. large-caps.

Random reads

One Ohio resident was on her way to buy a used car when she found out she won the $1 million vaccine lottery.

Albert Einstein’s theory of general relativity is facing a challenge, after the surprising results from a new map of dark matter.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.