getty

Even before I was an entrepreneur, I have always been a fan of the show Shark Tank. In each episode a handful of business owners pitch their ideas to the Sharks, a panel of successful business people the likes of Mark Cuban and Daymond John, and ask them for capital in exchange for partial ownership in their company. I love learning about how people come up with their ideas and how they make their businesses work, sometimes through many adversities. And I must admit, it’s just plain fun to watch the Sharks negotiate a deal.

You may have heard like I have, that if you are party to a negotiation, you should never be the first one to make an offer. Conventional wisdom is that if you make the first offer, it might be lower than what the other party is willing to pay, and you could wind up walking away with less than if you would have let them state their number first. But is that true?

Three academics from Duke, the University of Michigan, and the University of Houston recently set out to determine if making the first offer was beneficial or detrimental in a negotiation. Their study found that while people who made the first offer had increased anxiety, they also ended up better off financially. Being the first one to propose terms helped them yield a higher benefit from the deal.

While this information might be helpful to you the next time you walk into a car dealership or a job interview, the concept behind how to negotiate is much farther reaching than that. Fundamentally, the question about how best to negotiate is about how best to exploit the anchoring effect. The anchoring effect is a cognitive bias, or an automatic error in thinking, to which our brains are susceptible, and we can observe it in just about any setting that requires decision making.

When we are presented with a choice to make, we will base our decision most heavily on the first piece of information we get, such that the outcome is skewed by what information is presented first.

MORE FOR YOU

In the case of a negotiation, making the first offer can be to our advantage because we decide what the first piece of information presented will be. For example, by asking for a $10,000 raise we set the point around which the rest of the negotiation will be based. Consider the difference between how we (and our employer) might feel about a $7,500 raise if we asked for $10,000 and a $7,500 raise had we asked for $5,000. One will seem like a win and the other a loss, all depending on the number to which we anchored from the start.

The anchoring effect impacts our buying decisions as well. If the car you want is $25,000 but it sits next to another car on the lot selling for $45,000, it is likely to seem more reasonably priced. Conversely, if it was next to a car selling for $15,000, it might seem expensive. The price tag never changes but the way we feel about it, and thus the decision we make about it, changes based on the cost relative to the anchor.

There are endless ways in which the anchoring effect plays out in our financial lives. We may refuse to sell an investment because we are anchored to the price that we paid for it, regardless of whether the investment continues to be appropriate for our portfolio. We might list our house based on the sale price of the house down the street regardless of whether the properties are of comparable value. We might insist on having a certain amount of money before retiring and continue to work even if doing so is unnecessary.

The anchoring effect can also impact what we do during stock market turmoil. During periods like the one we are in now, in which investment portfolios and housing prices have continued to climb, it is natural to look at how much we are worth on paper and anchor to that new higher number. From that point forward, if the values of our assets decline, we are likely to view this as a loss. If values decline drastically, this perceived loss might feel especially painful and lead us to believe there is something wrong with our investment strategy.

Consider how you might feel if your net worth recently surpassed $1,000,000. Now consider how you might feel if in a few months that number dropped to $750,000. Did the words disappointed, confused, or scared come to mind? Now consider if you had anchored to your net worth two years ago, when you were worth $700,000. Suddenly $750,000 doesn’t feel so bad. You might not be entirely satisfied with a $50,000 gain but it would feel meaningfully different than a perceived loss of $250,000.

The difference between anchoring to these two numbers, $1M versus $700,000, is not just about putting a cheerful spin on volatile markets. It is about helping ourselves manage the negative emotions that occur when markets go through their inevitable periods of decline. If we continually anchor to our highest net worth, we are more likely to experience negative emotions that could drive us to change our investment strategy in the middle of a downturn, when it is the most detrimental to sell stocks. Choosing a better anchor could help us ride out the downturns and stick with our strategy, which ultimately helps our portfolio recover more quickly.

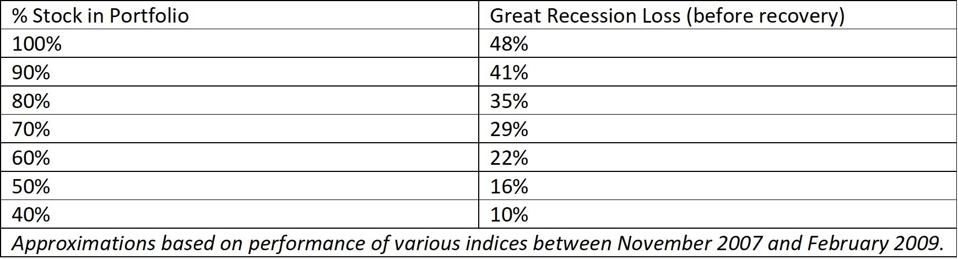

So, how do we pick the right anchor? I suggest basing it on the risk profile of your investments. Using the table below, if you have a portfolio with 70% stock, you might consider shaving off 29% of your investment values to calculate your anchor. In other words, if you have one million dollars invested 70% in stock, you might anchor to a number closer to $710,000. For someone with less stock, who would typically experience lower volatility, making a more modest adjustment to your anchor would be reasonable.

Danielle Seurkamp

At its core, the anchoring effect is about the relative nature of our decision-making based on the data to which we attach our expectations. In today’s environment of record-high stock and home prices, it’s especially important to manage our expectations and to know when to drop anchor.

/https://specials-images.forbesimg.com/imageserve/60b13ec8f699e73b2c5f6bbe/0x0.jpg?cropX1=0&cropX2=2361&cropY1=119&cropY2=1447)