- DXY adds to recent gains and moves closer to 91.00.

- US yields recede from Thursday’s tops near 1.70%.

- Core PCE, final U-Mich Index next of relevance in the US docket.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, keeps the bid tone intact and moves to daily highs near 90.70 at the end of the week.

The index advances for the second session in a row on Friday and manages to retake the 90.70 region on the back of the recent rebound in US yields and renewed market chatter over the US economic recovery.

On the latter, President Biden’s speech last night outlined his plans to boost infrastructure by around $2 trillion and support families, children and students with an extra $1.8 trillion.

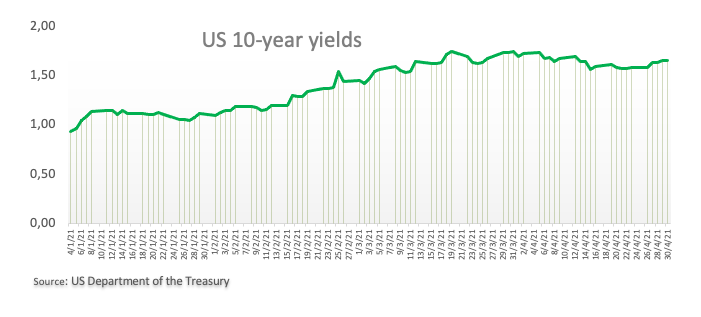

The recent bounce off lows in yields of the US 10-year lent support to the move higher in the dollar and put further distance from 2-month lows recorded on Thursday. Indeed, yields appreciated to the 1.70% vicinity after bottoming out around 1.53% during last week.

In the US docket, inflation figures gauged by the core PCE will take centre stage seconded by the final print of the Consumer Sentiment. In addition, Personal Income/Spending will also be in the limelight.

The April pullback in the dollar remains well and sound despite the ongoing rebound from 2-month lows in the 90.40 region. The move lower in the buck follows the broad-based retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the dollar emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made), and rising optimism on a strong global economic recovery, all morphing into a solid source of support for the riskier assets and a most likely driver of probable weakness in the dollar in the next months.

Key events in the US this week: Core PCE, Personal Income/Spending, final April U-Mich Index.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families worth nearly $4 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

Now, the index is gaining 0.08% at 90.71 and a breakout of 91.42 (high Apr.21) would open the door to 91.66 (50-day SMA) and finally 91.97 (200-day SMA). On the other hand, the next support emerges at 90.42 (monthly low Apr.29) followed by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).