- USD/CAD’s rebound from three-year lows loses steam near 1.2315.

- An uptick in WTI prices offsets the optimism from the US dollar’s bounce.

- The hourly chart shows a potential bear flag ahead of key US data.

USD/CAD is consolidating its tepid recovery from three-year lows of 1.2285, as the bulls have turned cautious heading towards the critical US economic data releases.

The broad-based rebound in the US dollar helped USD/CAD recapture the 1.2300 mark but the renewed uptick in WTI prices offered a fresh zest to the CAD bulls, exposing the downside once again.

The greenback recuperates after being smashed on Fed Chair Powell’s dismissal of tapering calls, as the rise in inflation appears ‘transitory’. Meanwhile, the US oil catches a fresh bid and hits over one-month highs near $64.50, as the Fed’s optimism on the economic outlook boosts hopes for rising fuel demand in the world’s top oil consumer.

Looking ahead, the major will take cues from the US advance Q1 GDP report, the Core PCE Price Index and weekly Jobless Claims, as it will set the tone for the greenback in the coming days, especially after the dovish Fed.

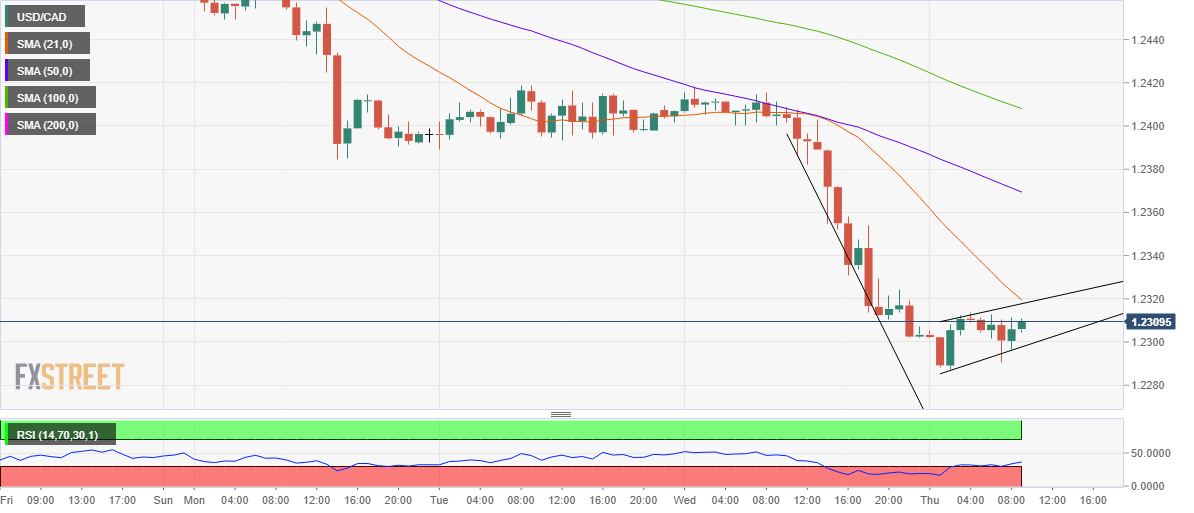

USD/CAD: Hourly chart

A brief period of downside consolidation that followed Wednesday’s sell-off has carved out a potential bear flag formation on the hourly chart.

For the downside to resume, USD/CAD needs an hourly close below the rising trendline support at 1.2292.

The bearish break will open floors towards the psychological support at 1.2250, below which the 1.2200 round number could be challenged.

Meanwhile, the pattern target is measured at 1.2178.

The Relative Strength Index (RSI) has bounced-off lows but remains well below the midline, suggesting that there is additional scope for the bears.

Alternatively, recapturing the 1.2318 barrier is critical to reviving the recovery from multi-year lows. That level is the confluence of the rising trendline resistance and the downward-pointing 21-hourly moving average (HMA).

The buyers will then aim for the mildly bearish 50-HMA at 1.2369.