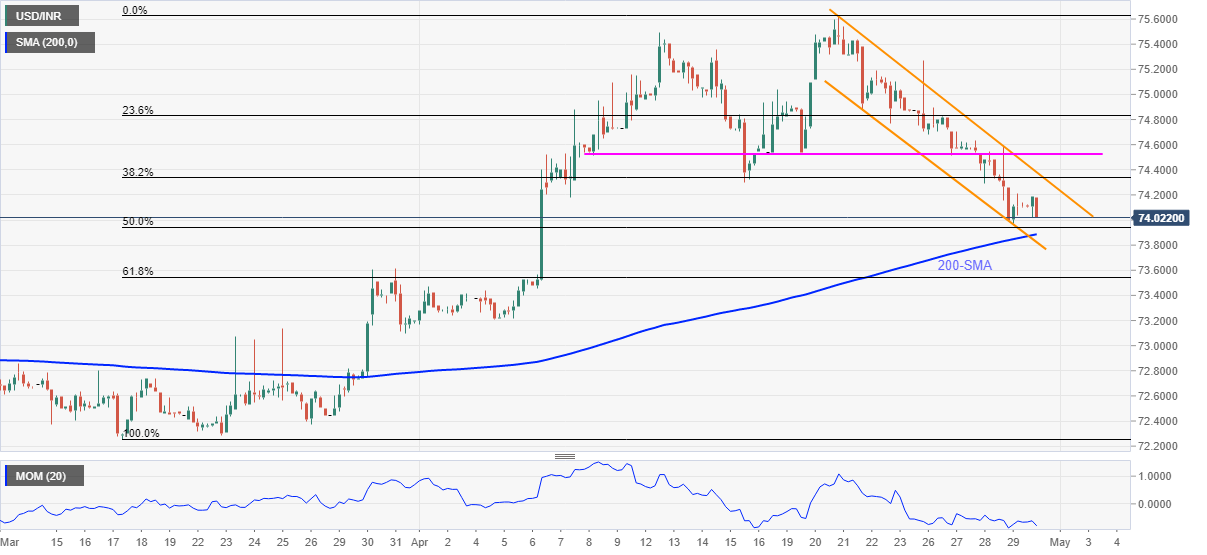

- USD/INR stays pressured around three-week low, inside bearish chart pattern.

- Sluggish momentum, 200-SMA restrict immediate losses, buyers may look for entries beyond 74.40.

USD/INR remains on the back foot, down 0.05% intraday around 74.10 by the press time of early Friday. In doing so, the Indian rupee (INR) pair keeps a seven-day-old bearish chart formation while taking rounds to the early April lows, tested the previous day.

It should, however, be noted that the intraday sellers will have a tough time breaking the 200-SMA level of 73.88 amid a limited downside for Momentum.

Even if the USD/INR bears conquer the key SMA, the support line of the stated channel near 73.80 and 61.8% Fibonacci retracement of March-April upside, close to 73.55, will challenge any further losses.

Meanwhile, a convergence of the channel’s upper line and 38.2% Fibonacci retracement near 74.40 becomes the key upside hurdle to watch during the quote’s corrective pullback.

Also acting as the key resistance is the horizontal trend line stretched from April 09, surrounding 74.55.

Trend: Corrective pullback expected