Here is what you need to know on Wednesday, June 30:

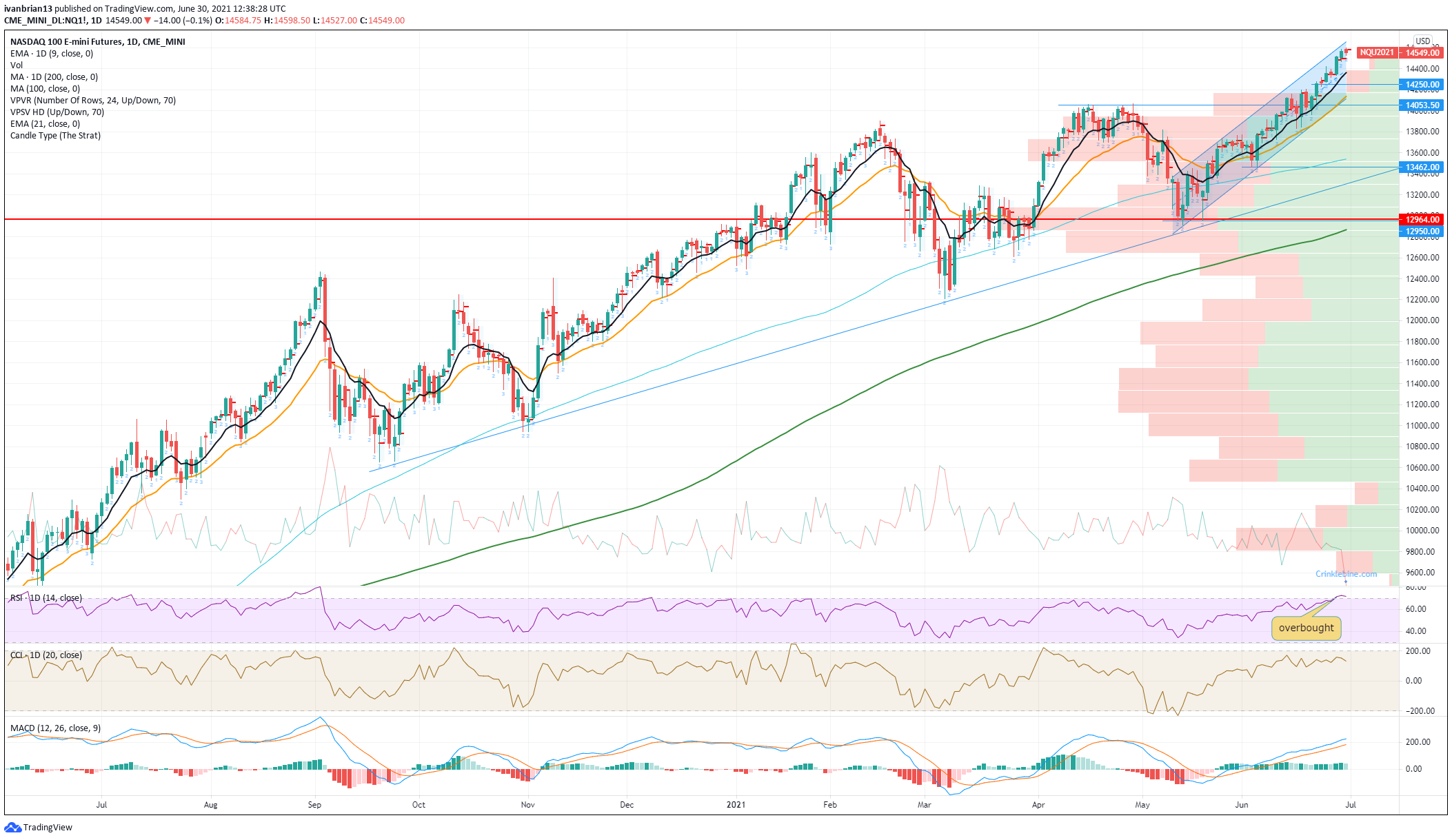

Well, we made it through June, statistically the worst performing period for equities and so far so good. One more day for bears to spoil it then. Delta is giving bears some room thought, the covid variant not the options greek. Europe is already under a new wave and reopenings have been pushed back in several EU countries. It is unclear if this new delta strain is more deadly but it is considerably more contagious than the alpha variant which was 60% more contagious than the original strain. All this is bound to put a strain on equity markets, especially with the Nasdaq putting its RSI into overbought territory. With the latest record rally the writing may be on the chart, below!

The US meanwhile powers on as the latest jobs report adds to the positive slew of recent data (ignoring inflation). ADP Employment came in at 692k jobs added versus 600k expected. Finally, the US is managing to hire but what is more important is if employers had to pay up to get those workers, time will tell.

The dollar remains quiet at 1.1880 versus the euro, Gold is lower at $1,757, Oil up at $74 (WTI) and Bitcoin is lower at $34,600. VIX has increased to just under 17 now so keep an eye. The 10-year yield is lower at 1.45%, a virtual nonfactor now the Fed has done such a good job!

European markets are all lower, Dax -0.7%, FTSE -0.4%, and EuroStoxx -0.6%.

US futures are flat, all flat no change, back to summer mode.

Punchbowl reports that less than 10 Senate Republicans are backing President Biden’s infrastructure bill.

US ADP employment 692k versus 600k.

Fed’s Bostic says long-term inflation predictions from business are unchanged.

Bank of England’s Haldane says uncomfortable with its balance sheet near GBP1 trillion.

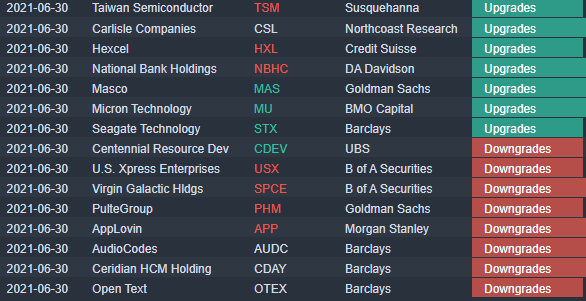

Virgin Galactic (SPCE) Bank of America downgrades to underperform, shares down 5% premarket.

Bed Bath and Beyond (BBBY) misses on EPS but beats on revenue and raises outlook, shares up 7% premarket.

Atea Pharma (AVIR) up 11% premarket on Phase 2 trial results in covid 19 treatment.

Cerevel Thera (CERE) announces offering of 14 million shares, stock down 6% premarket.

MongoDB (MDB) announces upsized stock offering, shares down 5% premarket.

Intellia Thera (NTLA) announces capital raised of $600m at $145 per share. Stock up 1% premarket.

AppLovin (APP) today’s award for best name! but Morgan Stanley downgrades, stock drops 3% premarket.

Xpeng (XPEV) to raise $1.8 billion in Hong Kong IPO according to sources cited by a CNBC report. Shares down 3% premarket.

Constellation Brands (STZ) EPS $2.33 in line with forecasts. Up 1.3% premarket.

PLUG Power, RBC starts coverage with an outperform, shares up 2% premarket.

General Mills (GIS) EPS of $0.91 versus forecasts for $0.84. Shares down 1.6% premarket.

DR Horton (DHI) named as a top pick by Goldman Sachs. Shares flat premarket.

Source: Benzinga Pro

Like this article? Help us with some feedback by answering this survey: