Here is what you need to know on Tuesday, June 29:

We need to talk about delta and not the options type normally associated with financial markets. The delta variant of covid-19 is now the dominant strain in the UK and is spreading rapidly and will soon become the dominant strain globally. Current evidence from the UK suggests that the delta variant is considerably more contagious and causes greater hospitalization rates. The WHO says the delta strain is the fastest and fittest strain yet and will pick off the most vulnerable people. Equity markets generally take their time to digest information, acting like a supertanker when turning. Once turned, however, the market can speed alarmingly lower once fear sets in. Is the VIX at 15 the calm before the delta storm? Caution is certainly needed. The put-call ratio surged 20% yesterday, i.e. 20% more puts than calls were bought as investors are taking downside protection.

For now, sentiment remains bullish with the Eurozone sentiment index hitting 117.9 in May, a 21-year high. The dollar once again gathers ground for a push below 1.19 versus the euro, sitting just above at 1.1903. Gold is lower at $1,768, and Bitcoin is higher at $35,600. The 10-year yield is at 1.49%. Oil at $73.26 has retreated as oil traders worry over the spread of the delta variant, so equity traders take note.

European markets are all higher this morning with the Dax leading the way up 0.9%, the FTSE is up 0.1%, and the EuroStoxx is up 0.3%.

US Futures are flat, Nasdaq -0.1%, S&P -0.15 and Dow +0.1%.

German Chief of Staff to Merkel says they are very worried over delta variant spread.

Ireland is due to delay reopening due to fears over delta spread.

ECB member Jens Weidmann says the ECB stimulus program should be scaled back step by step. Weidman is a noted hawk (favours higher rates).

Cathie Wood wants to create a Bitcoin Exchange Traded Fund (EFT). Ticker ARKB.

General Electric (GE), Goldman Sachs names as a top idea.

Tesla (TSLA): UBS cuts price target.

Facebook (FB) joins trillion-dollar market cap club after a favourable antitrust court ruling.

Morgan Stanley (MS) up 3% premarket as it raises its dividend.

Wells Fargo (WFC) plans to double its dividend.

Goldman Sachs (GS), JPMorgan (JPM) and Bank of America (BAC) also increase dividends.

Jefferies Financial (JEF) beat forecasts on revenue and EPS and announced a 25% dividend increase.

Boeing (BA): United (UAL) says it is buying 200 Boeing 737 Max jets.

FedEx (FDX): Bank of America adds to top picks.

Herbalife (HLF) rated new buy at B.Riley Securities.

Iovance Bio (IOVA) down 6% premarket as LN-145 clinical trial data is released.

STEM: Credit Suisse starts coverage with an outperform rating. Entered Russell 2000 on Monday. Stock up 6% premarket.

Kratos Defense (KTOS) up 5% premarket. The company successfully tests turbine engine for cruise missiles.

Canadian Solar (CSIQ) up 4% premarket. Company secures 86 MW in Japan solar auction, investor optimism over President Biden’s infrastructure plan and potential China IPO for a subsidiary.

MSTR, MARA, RIOT all up 4% as Bitcoin recovers.

Carvana (CVNA) downgraded by Piper Sandler, stock down 2% premarket.

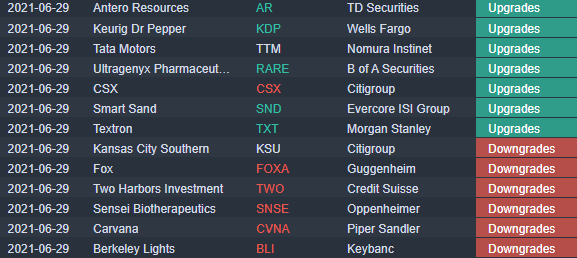

Source: Benzinga Pro

Like this article? Help us with some feedback by answering this survey: