Value-investing aficionados waited more than a decade for a moment back in the sun. Some investors think that moment has now already passed — or even perhaps that the whole notion of value versus growth remains a bit overdone.

Michael Loukas, principal and chief executive of TrueMark Investments, said that even when the Federal Reserve begins to raise interest rates, investors will still be dealing with a “low-yield environment”. This is a backdrop that remains favorable for secular growth stocks, which are shares of companies that are expected to see accelerated earnings and revenue growth regardless of economic conditions.

But Loukas, in a phone interview, said that part of what underpins his expectations around the trade is that investors so often view the market through the lens of a “binary” rotation that clearly favors either growth or value.

“We forget that somewhere in the middle is probably the right result,” he said.

Value stocks — shares of companies viewed as significantly undervalued based on their share price relative to metrics like earnings, revenue or book value — have significantly underperformed growth in recent years. That underperformance accelerated when the pandemic hit, when large-cap, technology stocks of companies best suited to take advantage of the pandemic soared as more cyclically oriented companies and sectors suffered from the global economic shutdown.

The script flipped last fall with the approval of COVID-19 vaccines, with anticipation of an economic reopening sparking significant value outperformance. A rise in U.S. Treasury yields in the fall was bad news for growth stocks, which are more sensitive to rising interest rates.

But value’s outperformance stalled out as yields peaked and then pulled back, allowing growth stocks to stage a bit of a comeback.

Indeed, the Russell 1000 Growth Index

RLG,

+0.87%

is up 6.1% in June, versus a 1.3% fall for the Russell 1000 Value Index

RLV,

-0.49%.

For the year to date, the value gauge remains ahead, up 15.8% versus a 12.4% rise for the growth index.

Zoom out, and it appears more like a standstill.

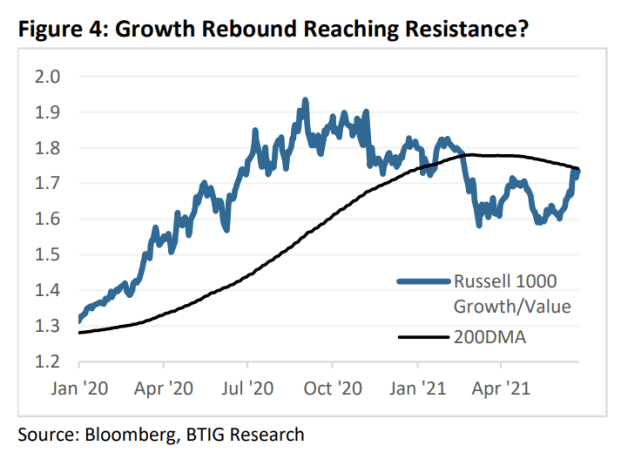

“Moderating long-end interest rates, amid the Fed’s assurances that inflation will prove ‘transitory’ and a hawkish shift, has helped reinvigorate growth

performance in recent weeks — but like many areas of the market, growth vs. value has been searching for overall direction over the past several months,” said Julian Emanuel, chief equity and derivatives strategist at BTIG, in a Monday note that highlighted the chart below.

BTIG

Emanuel noted that the Russell 1000 Growth/Value ratio was testing resistance at its 200-day moving average just as value was expected to get a boost from positive bank stress-test results from the Fed and positive signs around infrastructure talks in Washington.

“BTIG Strategy believes value began a longer-term leadership trend late last year,” he wrote, a shift that came after momentum stocks — shares that have had outsize recent returns and made up a large chunk of growth stocks — suffered a shake-up.

Monday turned out to be another day in favor of growth stocks. The Russell 1000 Growth Index rose 0.9%, while its value counterpart suffered a 0.5% fall. Growth tech-related shares led the Nasdaq Composite up

COMP,

+0.98%

1% and helped the S&P 500

SPX,

+0.23%

to eke out a 0.2% rise, with both indexes scoring all-time highs.

The more cyclically oriented Dow Jones Industrial Average

DJIA,

-0.44%

lost ground, shedding nearly 151 points, or 0.4%.

Meanwhile, Loukas argued that the best opportunities will come from shares of companies participating in the growing digitization of the global economy. That means investors shouldn’t shun all of the tech stock pandemic winners as the economic recovery takes hold.

“During the lockdown, a shift happened where certain tech segments became defensive growth stocks and no one saw it coming because we saw lockdowns as temporary,” he said. Now, investors are coming to grips with permanent changes to the workplace and other elements of the economy.

Part of the reason for the growth rebound stems from the realization that cybersecurity, drug discovery enhanced by artificial intelligence, communications protocols and software-as-a-service “all become exponentially more important when business has become more hybrid,” he said.