Endeavor Group Holdings Inc., the Los Angeles–based entertainment powerhouse and owner of the William Morris Agency, sports and modeling agency IMG and mixed-martial-arts outfit UFC, saw its shares jump 12% in their trading debut Thursday, before paring those gains to trade down about 2%.

The stock recovered those losses and was last up 2.8%.

It was the company’s second effort to complete an initial public offering after a deal was canceled in October of 2019, following pushback from investors who were put off by its complicated finances at a time when other deals were failing.

For a deeper dive into Endeavor’s financials: William Morris parent Endeavor’s IPO: 5 things to know about the entertainment giant

The company

EDR,

+1.67%

sold 21.3 million shares, priced at $24 each, the top of its proposed price range of $23 to $24, raising about $511 million at a valuation of more than $10 billion.

This time around, the company is making a big bet on UFC’s future and intends to use proceeds of the deal and a $1.7 billion private placement with private-equity firms to acquire the 49.9% stake in UFC that it doesn’t already own. It is also adding Tesla Inc.

TSLA,

-3.05%

CEO Elon Musk to its board, in a move expected to play well with retail investors.

Given the company’s strained finances, however, things are not much better than they were in 2019, according to New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings. Endeavor is loss-making and its losses widened to $625 million in 2020 from $530.7 million in 2019, its IPO filing documents show. Revenue shrank to $3.479 billion from $4.571 billion.

“Endeavor will test investors’ appetite for overvalued and over-hyped IPOs,” said New Constructs CEO David Trainer. “No matter how many Elon Musks it

adds to its board, Endeavor’s expected valuation of $10 billion is in nosebleed territory. While Endeavor has been growing revenue, the company is not profitable and doesn’t justify a $10 billion valuation.”

In fact, that valuation implies the company will generate higher revenue than Fox Corp.

FOXA,

-0.66%

and Live Nation

LYV,

-0.28%,

said Trainer, even though its 2020 cash rate was about $1.5 billion and it currently has just enough cash to survive another eight months.

James Gellert, CEO of RapidRatings, a company that assesses the finances of private and public companies, agreed that Endeavor’s finances are not strong but they are highly complex, given the many individual properties the company owns.

A RapidRatings analysis of Endeavor’s financials assigned the company a financial-health rating, or FHR, of 33 out of 100, based on 2020 financials, placing it in the company’s high-risk category. The FHR rating measures short-term probability of default.

The analysis gave the company a core health score, or CHS, of 23, suggesting poor health over the longer-term. The company’s CHS evaluates efficiencies in the business over a two-to-three year perspective.

Gellert listed certain positives for Endeavor, starting with the fact that it’s exposed to a variety of industries that were clobbered by the pandemic but are now positioned to respond well once social-distancing rules are eased and the U.S. starts to move past the pandemic.

See now: DraftKings stock surges after deal to be UFC’s official sportsbook, daily fantasy partner

In addition to UFC, the company owns Professional Bull Riders (PBR), the Miami Open, Frieze Art Fair, New York Fashion Week, and sells sports video programming on behalf of clients including the e International Olympic Committee, the NFL, and NHL.

“The timing is good with the market wide open and people will start returning to live events,” he said. “They also have more cash than before and are now raising more.”

But the company remains highly leveraged with a debt load of about $6 billion and it has never been particularly strong, he said.

“Like other IPOs, the proof is in the pudding. Investors should be asking where they will use new capital to invest in the business and become profitable again and show efficiency that investors can bank on in the future,” he said.

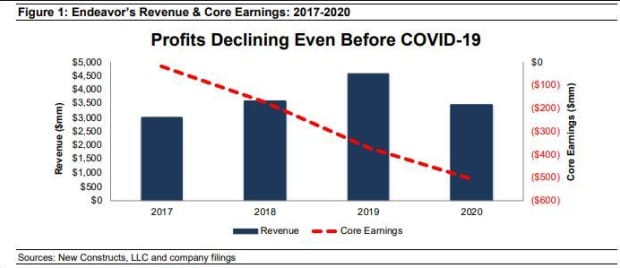

New Constructs’ Trainer noted the company has never managed to turn a profit. In the period from 2017 to 2019, revenue grew 23% compounded annually, he said, but core earnings fell to a negative $371 million from a negative $19 million in the same period. (Core earnings strip out gains and losses that are non-core, non-operating or unusual, in New Constructs’ definition).

In 2020, core earnings fell to an even more negative $509 million and the company has burned through $2.3 billion in free cash flow in the last three years.

Its acquisition strategy has also proven bad for profits, said Trainer. The company has acquired more than 20 properties since 2014 and while IMG and UFC helped grow revenue and expand the asset base, they have not created profits or shareholder value.

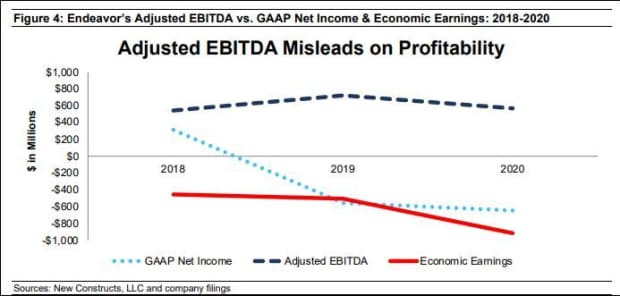

Other potential red flags include a multi-class share structure with different voting rights that will keep control in the hands of senior management and early investors; the fact that Endeavor has had issues with “material weakness in internal controls” as recently as 2019; an emphasis on non-GAAP EBITDA, that strips out many items to offer a far more upbeat view of operations than GAAP earnings, said Trainer.

The Renaissance IPO ETF

IPO,

-2.95%

was down 3.3% Thursday and has fallen 3.4% in the year to date. The ETF is up 98.6% in the last 12 months, while the S&P 500 has gained 42%.