Is this as good as it gets for U.S. stocks?

That’s a question investors would be forgiven for asking each time the S&P 500 index

SPX,

+0.11%

marks new highs — all 32 times this year so far, with another record potentially in the works for Tuesday. According to BlackRock, the answer may be yes, at least for now.

“The potential for higher U.S. taxes, coupled with regulatory risks and shifting growth momentum, tempers our near-term enthusiasm for U.S. equities,” said Wei Li, global chief investment strategist, and a team at BlackRock Investment Institute, in a weekly commentary that published on Tuesday.

The world’s biggest asset manager sees stocks in non-U.S. developed markets as “better positioned to capture the economic restart over the tactical horizon,” as the rest of the world recovers from the coronavirus pandemic.

The White House recently signed onto a bipartisan infrastructure plan, a small part of an original $4 trillion proposal that would be funded in part by higher taxes on corporations and wealthy individuals, noted the manager. That’s as the U.S. is also backing a global minimum tax, which has long been sought by the Organization for Economic Cooperation and Development, which wants rules for taxing cross-border digital services and multinationals that try to shifting profits to lower-tax jurisdictions.

Read: Biden’s long-term spending plans ‘are not about overheating the economy,’ says White House adviser

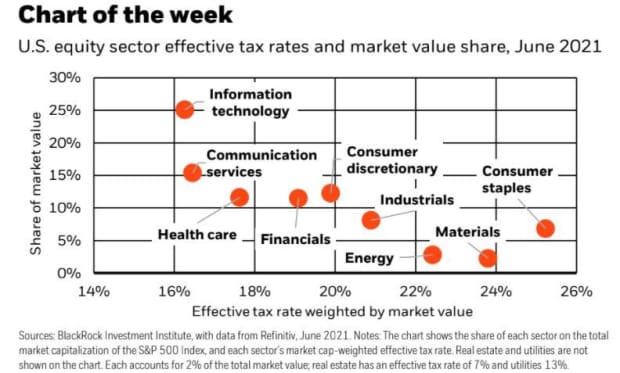

“Higher taxes would have varied sectoral implications,” said Li and the team. “Sectors with the lowest effective tax rates – or the actual rate paid after taking into account various tax breaks and deductions – have the most to lose, all else being equal. Information technology (IT), the largest sector on the S&P 500 index, has a relatively low effective tax rate just under 17%. Energy, materials and consumer staples have tax rates above 20%.”

Large-cap information technology and healthcare stocks, which tend to benefit most when profits can find those lower-tax jurisdictions, could take the biggest hit to earnings should a global minimum tax become a reality. Tax increases that come in less than the administration of President Joe Biden has proposed might “soften the blow,” while the sector’s relatively high profit margins and “supportive structural growth trends,” would also help offset those risks.

Read: A big market transition is coming. Here’s where investors should steer next, says this strategist.

BlackRock

BLK,

-0.26%

does see plenty of uncertainty around any tax plan, saying the bipartisan deal still faces hurdles, so in the end, they expect a spending plan well below the price tag, which means less offsetting tax hikes. But if the tax rises are implemented, Blackrock has an idea of what that might mean for equities.

“If the proposed 28% corporate income-tax rate and a 21% global minimum tax were imposed, we estimate the earnings per share of the S&P 500 index would be 7% lower in 2022 compared with a scenario without tax increases,” said BlackRock.

As for non-U.S. equity markets, BlackRock said Europe and Japan are well-positioned to pick up the baton from a strong U.S.-led economic restart. Those markets already have plenty of taxes and regulations, with little scope for more.

BlackRock also still likes small-and-medium cap U.S. stocks, which strategist said are less likely to be affected by tax hikes and regulations aimed at big corporations. Any higher taxes on individual capital gains could put more focus on after-tax portfolio construction and may drive up demand for tax-efficient strategies that let investors better control timing on capital gains, such as exchange-traded funds and managed accounts, the asset manager said.

“Tax-advantaged U.S. municipal bonds may also benefit from increased demand, even as their valuations look relatively rich to us,” said Li and the team.