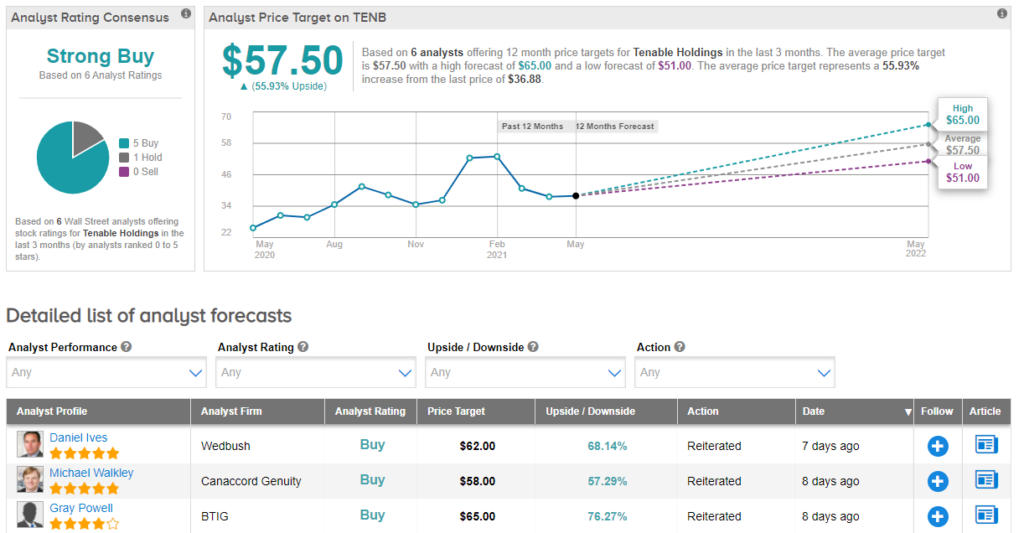

In inventory investing, the sport is all about returns. On the finish of the day, each investor needs to see the portfolio decisions repay, and convey a return on the funding. A smart investor seems to be to steadiness danger in opposition to the return. In right this moment’s atmosphere, with markets usually up – the S&P 500 has gained 12% to this point this 12 months – the principle danger for now takes the type of ‘native’ losses; that’s, quick time period slips in a rising inventory atmosphere. To cowl that danger, traders want to recollect the opposite fact in regards to the inventory market: it’s a long-term play. Don’t count on to appreciate large features rapidly, keep in for the lengthy haul, and search for shares that provide excessive return potential. That’s the important thing to investing success. Utilizing the TipRanks platform, we’ve positioned three shares that provide traders a 40% or higher upside for the 12 months forward, together with a Robust Purchase consensus ranking. They arrive from a spread of inventory sectors, have proven particular person quirks of their current share efficiency – and a few of Wall Avenue’s prime analysts have given them the thumbs up. Let’s discover out why. Tenable Holdings, Inc. (TENB) We’ll begin within the tech sector, the place Tenable is a holding agency that payments itself as ‘the cyber publicity firm.’ Tenable’s flagship product, Nessus, is a vulnerability scanner that enables customers to search out and shut vulnerabilities of their networked programs. Together with its different merchandise, Tenable’s line of publicity safety software program offers clients a threefold benefit: to see, predict, and act. The product line is well-liked, and Tenable boasts over 30,000 organizations in its buyer base, together with greater than half of the Fortune 500 corporations. Together with a big buyer base and a product line that’s rising indispensable within the digital world, Tenable has featured regular monetary development. The corporate has registered quarter-over-quarter income features for the previous 9 quarters, and exhibits no signal of stopping. In the newest reported, 1Q21, Tenable reported $123.2 million on the prime line, up 4% sequentially – however 20% year-over-year. In different key metrics, Tenable reported $38.6 million in money from operations, of which $37.6 million was free money move – a formidable 97% of the corporate’s money move. FCF was up a whopping 864% year-over-year. Tenable additionally reported greater than 330 new enterprise platform clients within the quarter, 29 new clients with internet contracts within the six-figure vary. Tenable has attracted consideration from Daniel Ives, Wedbush’s tech professional rated within the prime 1% of Wall Avenue’s analysts by TipRanks. Ives writes of Tenable, “TENB got here out of the gates swinging within the March quarter as the corporate posted spectacular income/billings upside together with stronger than anticipated steering… We proceed to view Tenable as considered one of our favourite cyber safety names as the corporate’s expanded product portfolio, cloud strategic focus, excessive caliber administration workforce, and danger/reward could be very compelling at present ranges.” Ives offers TENB shares an Outperform (i.e., a Purchase) ranking, together with a $62 worth goal that means a one-year upside of 68%. (To observe Ives’ monitor file, click on right here.) From the Robust Purchase consensus ranking, it’s clear that Wall Avenue usually agrees with Ives. The inventory’s 6 current critiques break down 5 to 1 in favor of Purchase versus Maintain. Shares are priced at $36.88 and the $57.50 common worth goal suggests an upside of 56% within the subsequent 12 months. (See Tenable’s inventory evaluation at TipRanks.) Trulieve Hashish (TCNNF) Let’s shift gears, and take a look at the hashish trade. Hashish has, within the final decade, gone from being an unlawful managed substance to an enormous enterprise, as main nations like Canada and Germany (for medical use solely) have legalized the drug, together with greater than 30 US states which have full or partial legalization. Because the drug has grown extra accepted – and its medical use has change into extra mainstream – a complete community of hashish suppliers has grown as much as meet the demand. Trulieve is among the huge gamers within the US medical hashish sector. Because the drug continues to be unlawful on the US Federal stage, medical hashish corporations within the States should function on a state-by-state foundation. Trulieve has taken a number one place within the Florida marketplace for medical hashish, the place the corporate boasts a 51% market share within the nation’s third largest state – and the second largest state with authorized medical use. Trulieve additionally operates in California, Massachusetts, Connecticut, and Pennsylvania, boasts over 550 particular person objects in its product line, and presents a vertically built-in ‘seed-to-sale’ enterprise mannequin. Whereas the medical hashish enterprise within the US has to adapt to a variety of legality regimes, stopping operations on a very nationwide scale, Trulieve has met the problem and seen three years in a row of profitability. Within the firm’s most up-to-date monetary launch, for 4Q20, the highest line got here in at $168.4 million, up 24% year-over-year to achieve an organization file. For the total 12 months, revenues had been $521.5 million, up 106% yoy. The corporate noticed full-year internet revenue of $63 million, up 19% from 2019, and $99.6 million in money from operations. Matt McGinley, 5-star analyst from Needham, likes Trulieve’s prospects going ahead. He writes, “We count on FL to be 80%+ of Trulieve’s income in ’21, however new states ought to comprise 33% of development. We predict Trulieve’s steadiness sheet is in a robust place to speed up the tempo of M&A, and to concurrently maintain greater ranges of capex…. We imagine that the inventory will price greater on EBITDA development, and imagine the a number of is low for a corporation with such robust working fundamentals.” The analyst’s feedback again up his Purchase ranking on the inventory, and his $60.75 common worth goal signifies confidence in 46% share development for the 12 months forward. (To observe McGinley’s monitor file, click on right here.) With 9 Purchase suggestions on file, the Robust Purchase consensus ranking on TCNNF shares is unanimous. The inventory is buying and selling for $41.37 and has a mean worth goal of $69.61, suggesting an upside of 68% in 2021. (See Trulieve’s inventory evaluation at TipRanks.) Snap, Inc. (SNAP) Final up, Snap, is finest generally known as the mother or father firm of the favored Snapchat app. Together with Snapchat, Snap additionally owns Bitmoji and markets the Spectacles smartglasses. The frequent theme is the mixture of social media and digital camera apps, letting customers play with picture filters, create non permanent tales, and file movies. Snap payments itself as a digital camera firm, that makes use of social tech to reinvent private pictures. Snap reported its 1Q21 earnings final month, and noticed income rise 66% year-over-year, coming in at $770 million for the quarter. Free money move hit $126 million, up $131 million from the year-ago quarter. This was the corporate’s first optimistic free money move print since going public in 2017. The strong monetary show is underpinned by robust person development. The DAU – every day energetic person – quantity grew 22% yoy, to a complete of 280 million. The corporate divides its operations into North America, Europe, and Remainder of World – and DAU was up in all three, each sequentially and year-over-year. This was the primary quarter by which Snap’s Android customers made up a majority of the DAUs. SNAP shares are coated for Wells Fargo by analyst Brian Fitzgerald, who’s rated #9 total by TipRanks. Fitzgerald sees the inventory with loads of potential going ahead, saying of it: “[We] stay bullish given robust utilization/engagement developments and ample monetization runway throughout an array of dimensions (growing advert relevance, new codecs, growing AR adoption, growing share of e-commerce and gaming exercise on platform, and narrowing the home/int’l monetization hole)…. we view shares as attractively valued at present ranges given SNAP’s giant and extremely engaged viewers, improved viewers development, fast income development and enhancing profitability profile.” Together with these feedback, Fitzgerald offers SNAP an Chubby (i.e., Purchase) ranking, and a $91 worth goal to point room for 68% upside within the subsequent 12 months. (To observe Fitzgerald’s monitor file, click on right here.) In current weeks, Snap has picked up 36 analyst critiques. These embrace 29 to Purchase, overbalancing the 6 Holds and 1 Promote, and giving the inventory a Robust Purchase consensus ranking. SNAP sells for $55.78, and at $80.13 its common worth goal suggests a one-year upside of 43%. (See Snap’s inventory evaluation at TipRanks.) To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights. Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.