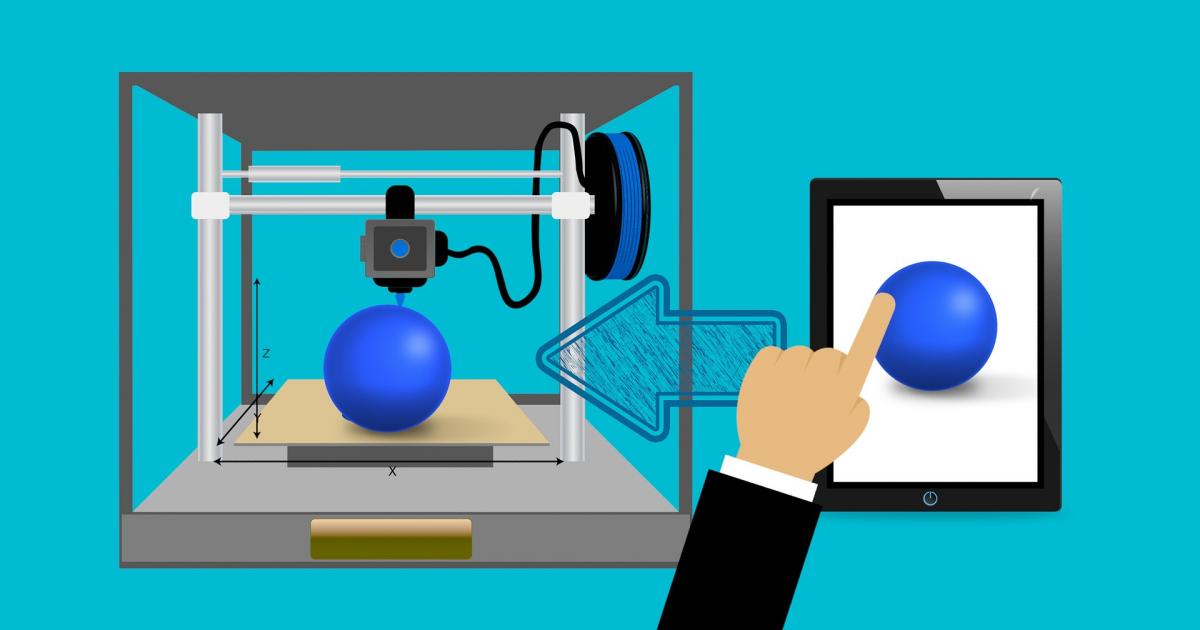

Everything from knickknacks to single-family dwellings has been built with 3D printing, and its potential is endless. Plant-based steaks, reusable rockets, aircraft engines, and a schoolhouse in Malawi are among the most recent product breakthroughs made possible by this technology.

According to Statista Research Department statistics, the global market for 3D printing products and services was valued at $12.6 billion in 2020, and it is expected to rise at a compound annual growth rate of nearly 17% between 2020 and 2023.

Cathie Wood, whose Ark Invest manages an exchange-traded fund that invests in 3D printing, has called it “one of the most high-growth prospective industries in the economy.”

In many ways, the 3D printing industry is still a work in progress, as diverse industries gradually embrace the technology’s full range of uses.

Here are five 3D printing firms to consider whose stocks may be worth paying particular attention to.

Nano Dimension Ltd. is a company that specializes in nanotechnology. (NNDM) (NASDAQ: NNDM) This Israeli firm was created in 2012 and is well known for its unique DragonFly technology, which creates multilayered electronic devices utilizing digital files and simultaneous 3D-printing of dielectric and conductive materials. In May, the technology’s version 2.0 was announced.

The company’s recent developments include the hiring of Sean Patterson, a former Amazon.com Inc. (NASDAQ: AMZN) executive, as president for the Americas, the acquisitions of NanoFabrica Ltd., a provider of 3D micro-printing, and DeepCube Ltd., a provider of machine learning/deep learning, and a joint venture with Germany’s Hensoldt AG to develop the next generation of 3D electronic printing.

Nano Dimensions reported $811,000 in revenue in the first quarter, up from $702,000 the year before, and a net loss of $9.3 million, compared to a loss of $2 million the year before.

Its stock was trading at $7.70 at the time of writing, halfway between its 52-week high of $17.89 and its 52-week low of $1.31.

Proto Labs Inc. is a company that specializes in prototyping (NYSE: PRLB) This digital manufacturing source for prototypes and low-volume production parts manufactured utilizing industrial 3D printing, CNC machining, sheet metal fabrication, and injection molding technologies was founded in 1999 and is situated in Maple Plain, Minnesota.

Proto Labs started the year by acquiring 3D Hubs Inc., an online manufacturing platform for custom parts, and launching a new digital quoting and design analysis platform for US customers to improve project management and transparency (a similar platform was launched for European customers late last year).

Proto Labs reported revenue of $116 million in the first quarter, up from $115 million the year before, and net income of $3.7 million, down from $13.9 million the year before. Its stock is currently trading at $89.10, somewhat lower than its 52-week low of $82.60 and higher than its 52-week high of $286.57.

Stratasys Ltd. (Stratasys): (NASDAQ: SSYS) This company, based in Eden Prairie, Minnesota, supplies 3D printing equipment and materials, as well as operating the online 3D printing industry resources Thingiverse.com and GrabCAD Community.

Stratasys completed the acquisitions of Origin, a San Francisco-based additive manufacturing company, and RP Support Ltd., a UK-based producer of industrial stereolithography 3D printers and solutions, earlier this year. A trio of 3D printing technologies were also unveiled by the company.

Stratasys reported $134.2 million in first-quarter revenue, up from $132.9 million a year ago, and a net loss of $18,911, down from $21,788 in first-quarter 2020. Its stock is presently trading at $23.32, which is lower than its 52-week high of $56.95 but higher than its 52-week low of $11.89.

See also: Ryan Rozbiani’s After Hours: Is There Going To Be A Market Correction?

3D Systems Corporation is a company that manufactures 3D printers (NYSE: DDD) Founded in 1986 and based in Rock Hill, South Carolina, this corporation provides a wide range of hardware, software, materials, and services to a global market, with a particular focus on the healthcare and industrial markets.

The organization has witnessed a combination of expansion initiatives and calculated downsizing during the last two months. It bought Allevi Inc., a 3D bioprinting and bioinks company, and Additive Works GmbH, a German software startup, and announced plans for a 50,000-square-foot expansion of its Denver-area facility, while selling its On Demand Manufacturing business to Trilantic North America for $82 million.

3D Systems reported $146.1 million in revenue in the first quarter, up 7.7% from $135.6 million the year before, and a net income of $45.2 million, compared to a loss of $18.9 million the year before. Its stock was trading at $36.11 at the time of writing, closer to its 52-week high of $56.50 than its 52-week low of $4.60.

3DX Industries Inc. is a company that specializes in 3D printing. (DDDX) (OTC: DDDX) This company, situated in Ferndale, Oregon, was founded in 2008 and focuses on 3D metal and plastic printing, as well as additive and traditional manufacturing services such as product design, engineering, and assembly.

In addition, the company is expanding: It hired inventor and agronomic Anthony J. Bredberg to lead its new research and development division last month, as well as acquiring a patent portfolio to make a more environmentally friendly and friendly end product.

3DX has also hired new executives to help with marketing, identifying distressed and undervalued manufacturing sites for acquisition, and expanding market share on the East Coast.

The task ahead of the incoming leadership team is daunting: The company’s first-quarter revenue was $77,823, down from $87,115 a year ago, and its net income loss of $514,236 was more than the $91,638 loss the prior year. The company pledged to raise “more finance by debt and or equity financing and by other means that it considers essential, aiming to carry forward and sustain a protracted growth in its strategy phases” in its quarterly report.

Still, penny stock aficionados and Reddit apes looking for unusual possibilities should keep an eye on 3DX, whose budget-friendly stock is currently trading at 10 cents, caught between its 52-week high of 23 cents and its 52-week low of 1 cent.

(Photo courtesy of Mohamed Hassan / Pixabay.)

(c) Benzinga.com, 2021. Benzinga does not offer financial advice. All intellectual property rights are reserved./n