- AUD/JPY bears catch a breather around intraday low after over 20-pip fall on downbeat Australia CPI.

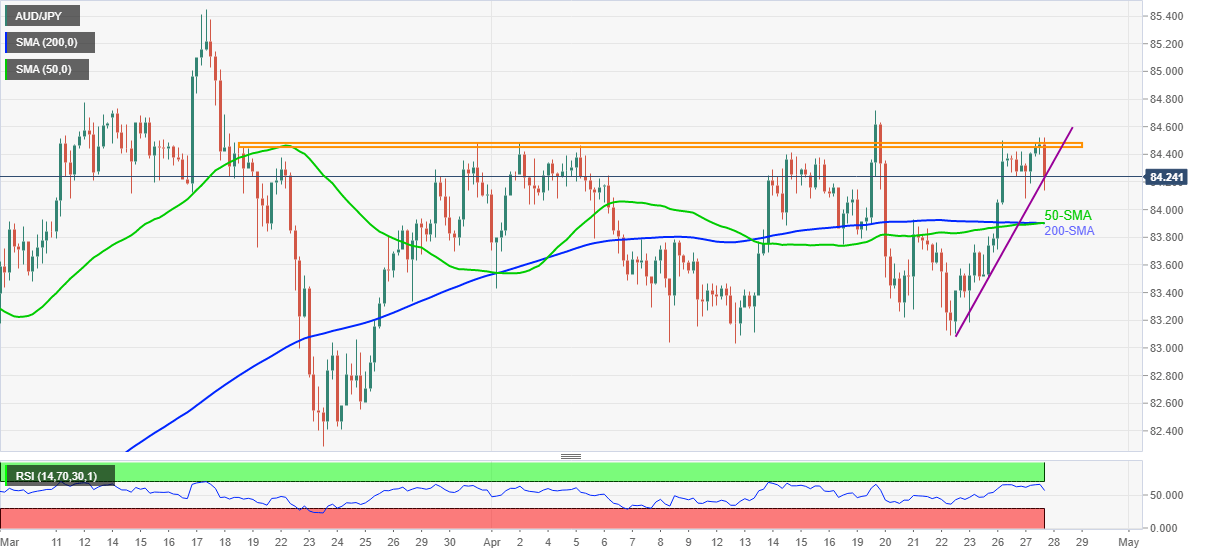

- Downward sloping RSI, multiple failures to cross the key hurdle favor sellers.

- Confluence of 50, 200-SMA becomes strong support to watch during further downside.

AUD/JPY sellers attack 84.00, down 0.21% intraday, after Australia’s Q1 CPI came in weaker than expected during early Wednesday. Even so, the quote is yet to offer a decisive break below the weekly support line.

Not only the headline Consumer Price Index (CPI) but the RBA Trimmed Mean CPI also lagged behind the market consensus during the first quarter (Q1) of 2021. AUD/JPY justifies the reaction to the key data as it takes a U-turn from the two-month-old horizontal area following the release.

Read: Breaking: Aussie CPI mainly in below expectations, AUD pressured

Though, a clear downside break below the short-term rising support line near 84.20 becomes necessary for the AUD/JPY sellers to retest the key 83.90 support including 50 and 200-SMA.

Meanwhile, an upside break of 84.50 should cross the monthly top of 84.71 and March 12 top near 84.80 before directing the AUD/JPY bulls towards the previous month’s top near 85.45.

Overall, AUD/JPY wobbles in a range but the downbeat data can favor odds of a pullback.

Trend: Further weakness expected

.jpg)