This week has produced an eclectic mix of trending stocks thus far, as one company after another finds itself trading in all directions despite current odds, fierce competition, and even themselves.

IBM is down in the face of a new partnership with the University of Illinois; Nikola is up despite being a business plan with no products to show for it a year after their IPO; and Alibaba was slapped with a harsh penalty from the Chinese government that slashed their quarterly earnings report to shreds.

What else is lurking beneath the curtain for today’s trending stock list?

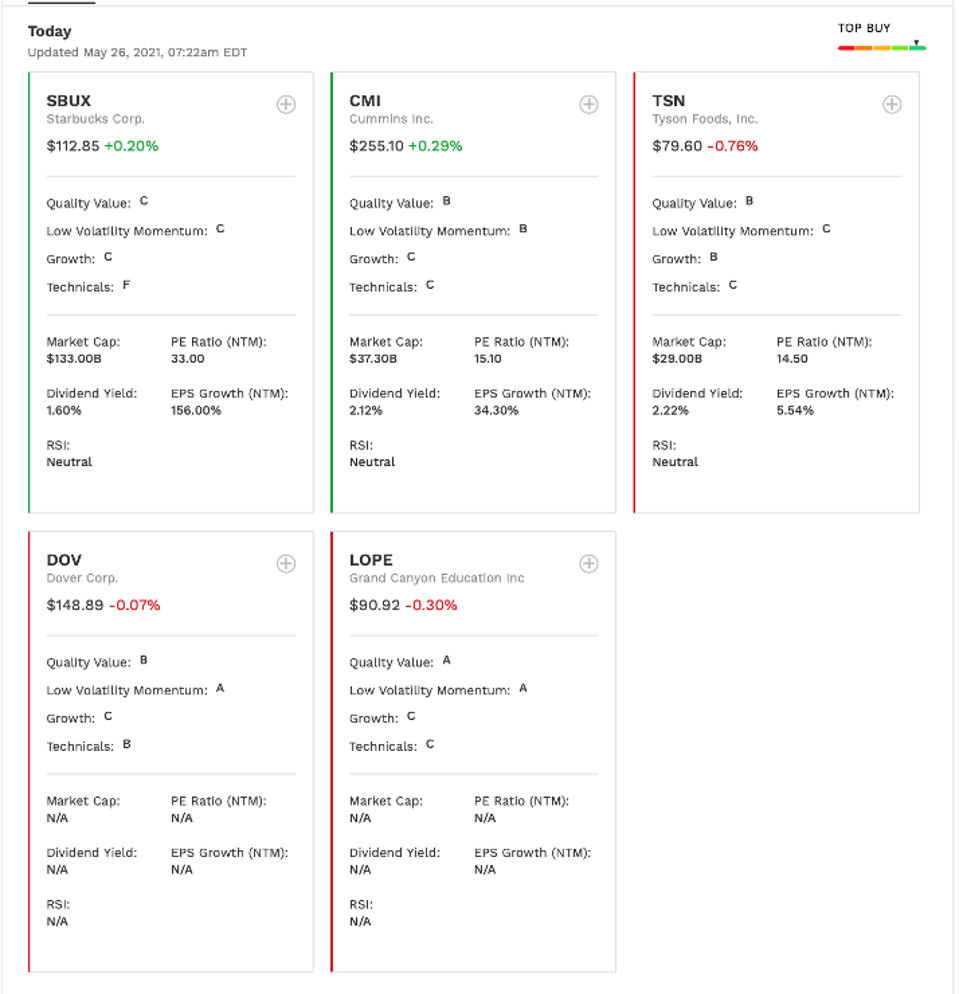

Q.ai runs daily factor models to get the most up-to-date reading on stocks and ETFs. Our deep-learning algorithms use Artificial Intelligence (AI) technology to provide an in-depth, intelligence-based look at a company – so you don’t have to do the digging yourself.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

MORE FOR YOU

Intel Corporation (INTC)

Intel Corporation

INTC

edged down 0.16% on Tuesday to $56.87 per share, ending the day with 22.3 million trades and 14% up for the year.

The world’s largest chip producer has been prioritizing high-end CPUs during the global chip shortage, giving it an edge in the market as competitor AMD finally inched its way into the top 15 chip producers. And despite recent production woes with its 10- and 14nm chips, Intel remains the largest provider of core processors for x86 PCs and servers.

Forbes AI Investor

In the last three fiscal years, Intel’s revenue has grown almost 9.7%, up from $70.8 billion to $77.87 billion. However, operating income has held steady, with virtually no change over the last three years, while EPS crawled up from $4.48 to $4.94. At the same time, ROE slipped down from 29.3% to 26.4%. Currently, Intel is trading forward 12-month earnings of 13.3x.

Thanks in large part to the company’s stagnation – and edged on by its prospects during the global chip shortage – Intel is not a recommended by for investors at this time. In fact, our deep-learning AI algorithm rates Intel C in Low Volatility Momentum and Quality Value, D in Growth, and F in Technicals.

Nordstrom, Inc (JWN)

Nordstrom, Inc

JWN

announced its Q1 earnings after the closing bell on Tuesday, disappointing shareholders as the company announced losses of $1.05 per share, doubling Wall Street’s expected losses. This represents a total decline of $166 million in the period, as elevated labor and shipping costs, as well as supply chain constraints, continue to plague the clothing giant. Still, sales topped out at $3.01 billion, beating estimates of $2.86 billion, bolstered by consumer optimism that a pandemic-free summer is on its way.

But Nordstrom wasn’t doing too well before the closing bell, either, closing down 2.85% to $36.48 per share. The company saw almost 5 million trades for the day as the price fell below the 22-day average of $38.52, although it’s still up 16.9% YTD.

Forbes AI Investor

In the last fiscal year, Nordstrom’s revenue grew 8.3% to $10.7 billion, though this is only two-thirds of its $15.86 billion revenue three years ago. In the same three-year period, operating income slipped from $837 million to $822 million, though per-share earnings leaped from $3.32 to $4.39. The company’s ROE ballooned significantly in the 36-month period from 61% to 107.5%.

Currently, Nordstrom is trading at forward earnings of 20x, suggesting that the clothing retailer’s stock may be overvalued. Forward revenue is only expected to see growth around 1.8% over the next year.

Additionally, our AI is wary that Nordstrom will be able to recover its stock price to pre-pandemic highs anytime soon, especially seeing as the last time the stock broached $50 was in 2018. As such, our deep-learning algorithms have rated Nordstrom C in Technicals, Growth, and Low Volatility Momentum, with a D in Quality Value.

Nikola Corporation (NKLA)

The Nikola Corporation is a new kid on the block, only launching its IPO on 4 June 2020 – in the middle of a pandemic, nonetheless. The company, which has been around since 2016, is dedicated to developing and advancing zero-emission truck solutions, primarily through its electric vehicles and fuel cell-powered offerings.

However, Nikola remains an electric vehicle company with a business plan and no products for sale. This has led some, such as Hindenburg Research, to question the legitimacy of the stock market newcomer. That said, investors saw some reason for optimism in its Q1 2021 results on 7 May, as the company noted that construction of its Arizona factory is on track. Nikola management also noted that it plans to ship the first Nikola Tre battery electric vehicles (BEV) sometime in Q4 2021.

Forbes AI Investor

Nikola Corporation closed up 1.8% on Tuesday to $12.32 per share, ending the day with almost 7.5 million trades on the books. The stock is down 19.3% YTD – a reflection of shareholder disinterest after the company has yet to produce a single vehicle for sale.

However, the company has shown some propensity for growth as, essentially, a startup on the public stage. While revenue dropped from $170k to $100k in the last three years, operating income exploded almost 550% in the last three years from $70.5 million to over $368 million. Per-share earnings boomed 367% in the same period, from $0.28 initially to $1.19. Additionally, forward 12-month revenue is expected to grow 141%.

That said, our AI is wary of a corporation with minimal revenue, big plans, and no products yet to show for it. And with a paltry balance sheet and little upward momentum to speak of, Nikola Corporation is rated B in Growth, D in Technicals and Low Volatility Momentum, and F in Quality Value.

Alibaba Group Holding Limited (BABA)

Alibaba Group Holding Limited closed up 0.33% on Tuesday to $211.13 per share. The Chinese multinational tech company saw over 14.1 million trades throughout the day as prices began to inch up toward the 22-day average of $221 and change. Still, Alibaba is down 9.3% YTD.

Despite releasing stellar Q1 results in the first half of May, Alibaba continues to struggle this year, as the e-commerce, retail, and internet giant flails against competitors willing to eat losses to get ahead in the market. And although Q1 revenue rose 64% YOY, the company sustained a quarterly operating loss of $1.17 billion due to a $2.11 billion penalty from the Chinese government.

Forbes AI Investor

However, Alibaba fared much better in the last three fiscal years than its most recent quarter. For instance, revenue leaped 90% from $377 billion to $717 billion, and operating income jumped 45.6% to $89.7 billion. In the same period, EPS ballooned almost 64% to $54.68 in per-share earnings. Currently, Alibaba is trading at 20.5x earnings.

And although our AI is skeptical of Alibaba’s underlying technicals, it notes that the company holds solid across the rest of the board. As such, Aliababa is rated A in Quality Value, B in Growth and Low Volatility Momentum, and D in Technicals.

International Business Machines Corporation (IBM)

International Business Machines Corporation

IBM

nudged down 0.64% on Tuesday, closing out at $143.79 per share with 3.9 million trades to its name. The stock is up 14.2% YTD.

Although IBM is currently trading down, the company may have reason to celebrate soon, as it recently announced a ten-year collaborative deal with the Grainger College of Engineering at the University of Illinois Urbana-Champaign. Through this partnership – which carries a total investment of $200 million in ten years – academia and industry will combine to spur breakthroughs in emerging technology.

In particular, the new IBM-Illinois Discovery Accelerator Institute will focus on hybrid cloud and AI, quantum information science and technology, sustainability, and accelerated materials discovery.

Forbes AI Investor

In the last fiscal year, IBM experienced revenue growth of 0.2%, though this is a small recovery as the company’s $73.6 billion cash flow is still lower than $79.6 billion three years ago. Operating income is down from $13.2 billion to $8.58 billion in the same period, while per-share earnings have been slashed from $9.52 to $6.23. ROE plummeted, as well, from 50.3% to 26.4%.

Currently, IBM is trading at discount forward earnings of 12.7x, compared to the industry’s 32x. The next twelve months are expected to yield revenue growth around 0.6%.

Despite the company’s rather dour balance sheet, not to mention its low forward-facing P/E, our AI is optimistic that IBM isn’t a bad investment altogether. International Business Machines has earned its rating of B in Low Volatility Momentum and Quality Value and C in Technicals and Growth.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.

/https://specials-images.forbesimg.com/imageserve/60183605484e484a8b57356a/0x0.jpg)