- NYSE:AMC dropped by 7.75% on Monday as the downward spiral continues.

- Marvel’s Black Widow dominates at the box office and breaks pandemic records.

- AI-powered ETF surprisingly buys AMC after selling off some mega-cap winners.

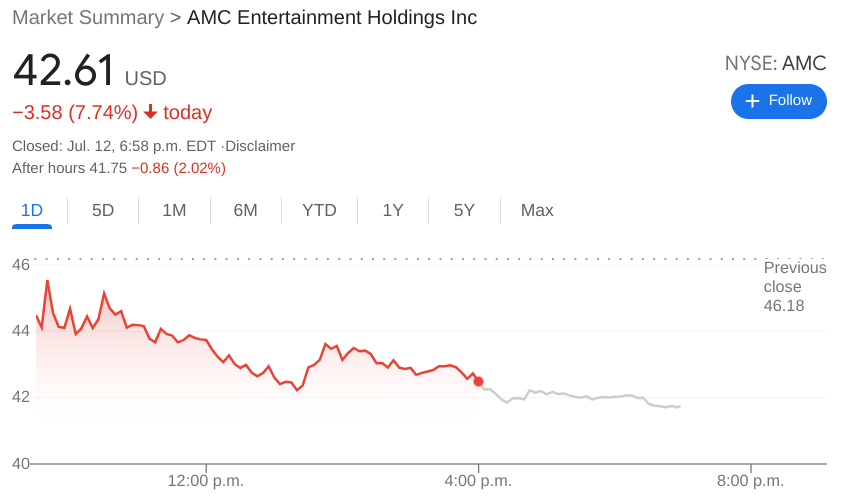

NYSE:AMC shareholders couldn’t even be saved by the best weekend of ticket sales for theaters since before the pandemic started. On Monday, shares of AMC tumbled by 7.75% to close the trading session at $42.61, and fell a further 2% in after hours trading at the time of this writing. The fall extends AMC’s slide as it is now trading well below its 50-day moving average, on a day where both the NASDAQ and S&P 500 hit fresh new all-time highs. Are AMC Apes showing paper hands? More likely the momentum of the short squeeze is merely dying off, the same as it did back in January for GameStop (NYSE:GME).

Stay up to speed with hot stocks’ news!

The big weekend at the box office was brought on by the latest Marvel blockbuster, the Black Widow. The Walt Disney (NYSE:DIS) owned franchise did $80 million in ticket revenue during its first weekend in theaters, and did an additional $60 million in revenues through its Disney+ streaming service. The latter point may be the reason that investors are down on AMC on Monday, as Disney+ and other streaming services threaten to take future business from AMC and other movie theater chains.

In a more interesting anecdote, the QRANT AI-Enhanced Large Cap Momentum ETF that was made famous for accurately trading Tesla’s (NASDAQ:TSLA) ups and downs, has sold off shares of Facebook (NASDAQ:FB) and WalMart (NYSE:WMT) and bought AMC. Is this a bullish sign? Not really. The Artificial Intelligence takes into account previous stock performance and has most likely honed in on the fact that AMC is still up over 2,000% this year.

/stock-market-graph-and-office-work-gm538992537-58716016_Large.jpg)