- NYSE:AMC tumbles 7.65% on Tuesday as meme stocks plunge further.

- Retail investors are trying to initiate another squeeze with #AMCDay trending on social media.

- If record ticket sales can’t save AMC’s stock, there may be little hope left.

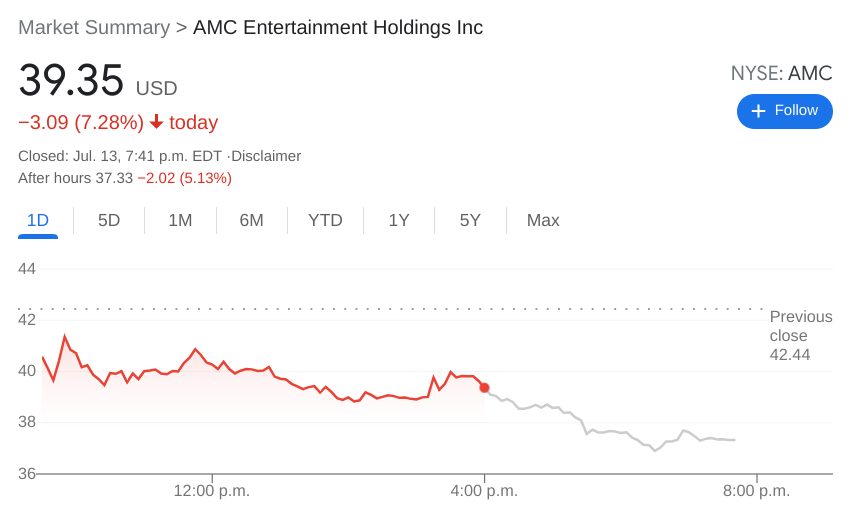

NYSE:AMC investors who were left holding the bag after the recent short squeeze in June are feeling those bags getting heavier by the day. On Tuesday, shares of the world’s largest movie theater chain dropped by 7.65% and closed the session at $39.35, as the stock breached the $40 price level for the first time in weeks. AMC continued to spiral downwards in after hours trading as well with shares losing a further 5% at the time of this writing. Why is AMC plummeting out of control? Lower trading volume and lost momentum from the social media movement seems to have been too much for diamond hands to handle.

Stay up to speed with hot stocks’ news!

Retail investors are trying their best to have history repeat itself, as #AMCDay was trending once again on social media on Tuesday. The last time this happened, Apes were able to coordinate a squeeze up to over $60 at the beginning of June, so time will tell if the latest effort will reap the same rewards. Judging by the stock’s performance on Tuesday, it doesn’t seem like the movement has formed much of a rally the second time around.

AMC reported record ticket sales last weekend after the global premiere of Disney’s (NYSE:DIS) latest Marvel Universe movie, the Black Widow. Despite this, shares of AMC fell on Monday and Tuesday, signalling that even the global reopening at the ticket booth may not be able to save AMC’s stock from remaining overvalued and uber inflated. Streaming services threaten to cut into AMC’s revenues, and even the release of further summer blockbusters may not have the same impact or success that Black Widow had.