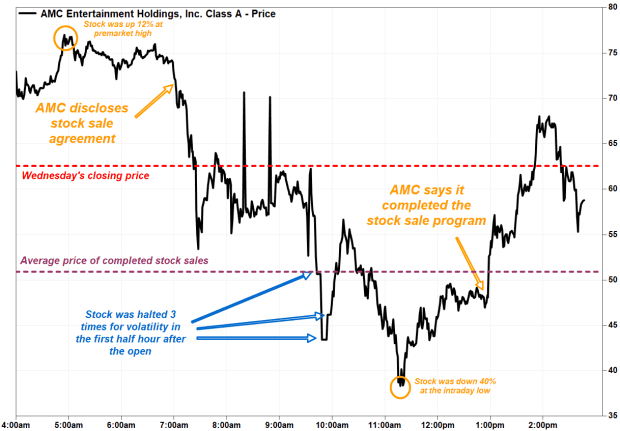

Shares of AMC Entertainment Holdings Inc. bounced Thursday, turning briefly positive in volatile trade, after the move theater operator said it completed the 11.55 million stock sale program about six hours after it was announced, as the company took advantage of the recent trading frenzy to raise cash.

The stock

AMC,

-8.19%

climbed dropped 8.3% in afternoon trading, as it erased earlier losses of as much as 39.8%, and a gain of as much as 10.0% in recent trading. The seesaw session comes after the stock had rocketed 95.2% on Wednesday, and 417.8% over the previous seven sessions, amid renewed interest in meme stocks.

The stock was halted three times for volatility Thursday, all within the first half-hour after the open.

“

“We believe the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last.”

”

— AMC statement in 8-K filing with SEC

AMC said in a statement released at 12:58 a.m. Eastern that it completed the “at-the-market” (ATM) program that was disclosed in a 7:04 a.m. 8-K filing with the Securities and Exchange Commission.

The stock was down about 23% just before AMC announced the completion the stock sale program.

FactSet, MarketWatch

The company said it raised about $587.4 million from the stock sales, which were made an at average price of $50.85. While that price was about 11% below current levels, it was 25.9% above the intraday low of $37.66. The price was closer to the volume-weighted average price of $53.62 at the time of this writing, according to FactSet.

“Bringing in an additional $587.4 million of new equity, on top of the $658.5 million already raised this quarter, results in a total equity raise in the second quarter of $1.246 billion, substantially strengthening and improving AMC’s balance sheet, providing valuable flexibility to respond to potential challenges and capitalize on attractive opportunities in the future,” Chief Executive Adam Aron said.

The stock has soared 461.7% quarter to date, while shares of fellow movie theater operator Cinemark Holdings Inc.

CNK,

-5.39%

have gained 15.0% and the S&P 500 index

SPX,

-0.36%

has tacked on 5.6%.

AMC had entered into the ATM agreement with sales agents B. Riley Securities Inc. and Citigroup Global markets Inc. The company said it would pay the sales agents a commission of up to 2.5% of the sales price of the stock, which would equate to about $14.7 million.

The sales represented about 2.6% of the shares outstanding.

Don’t miss: AMC’s new free popcorn for retail investors is just latest move by increasingly flirty meme stock execs.

The company said it plans to use the proceeds from the share sales for general corporate purposes, which could include repayment of debt, acquisition of theater assets or capital expenditures.

AMC acknowledged in its 8-K filing that recent “extreme fluctuations” in its stock have been accompanied by reports of “strong and atypical retail investor interest, including on social media and online forums.” As a result, AMC’s stock sale plan comes with a warning for retail investors:

“We believe the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last,” the company said in a statement. “Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.”