- AAPL shares outperform the broad market on Monday with a strong move.

- Apple stock finally gets some catalyst as the trend turns bullish.

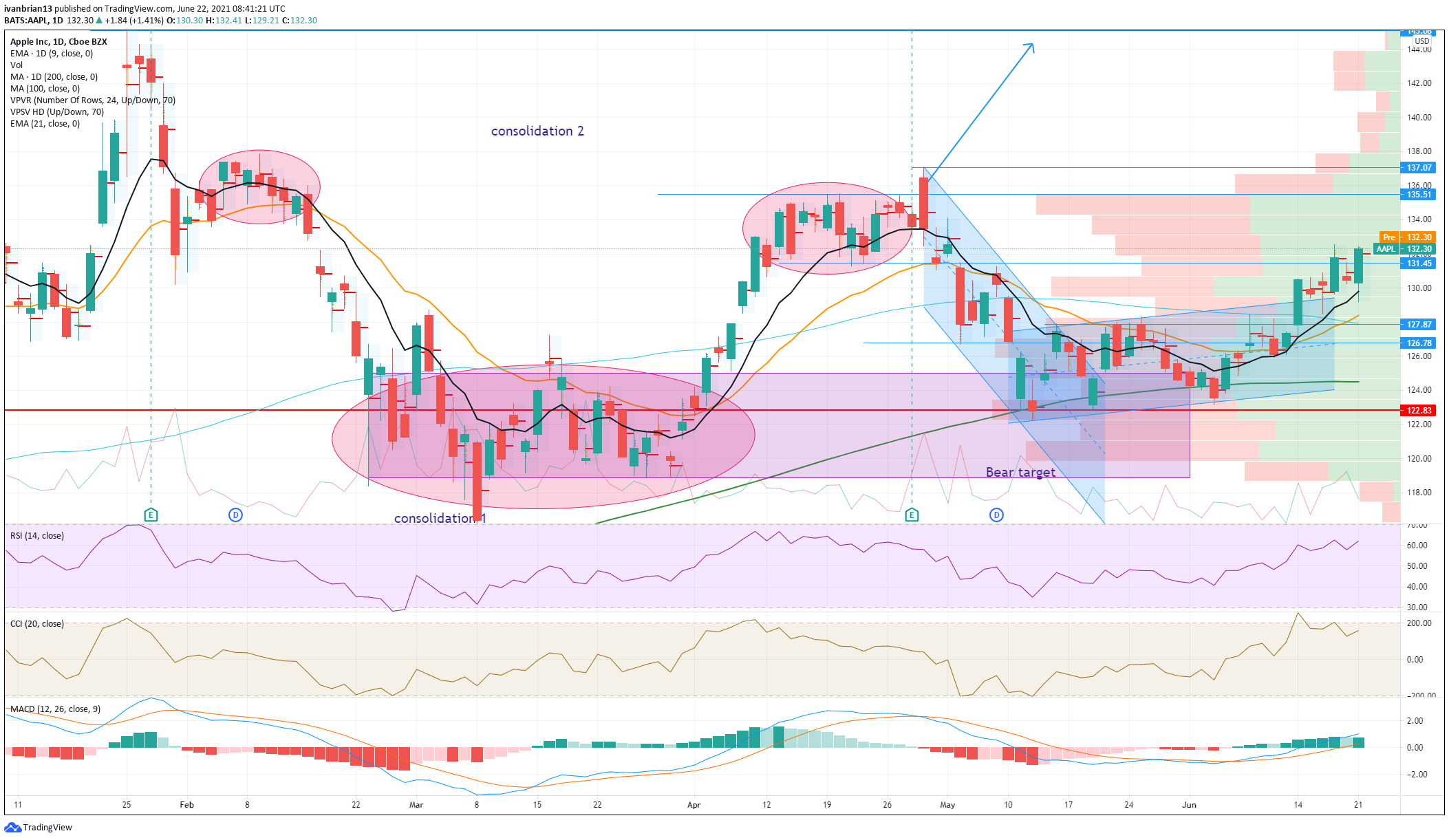

- The $137 mark is the next resistance target, the post results high.

Apple is finally waking from its slumber by posting another solid day on Monday. The giant of the stock market has been languishing ever since it released stellar results at the end of April. Despite the recent pop, AAPL stock is still languishing well below its post-earnings pop in late April, when Apple shares traded up to $137 immediately after the earnings release. Those results were pretty stellar coming in 40% higher than the average Wall Street analyst forecast. Apple also upped its buyback program as well as increasing its dividend. However, May was a tricky month for the Nasdaq and Apple suffered as the month wore on, slipping to $122.

Monday’s price action was positive with most of the volume printing toward the high of the daily range, as the market rallied in the afternoon.

| Market Cap | $2.2 trillion |

| Enterprise Value | $2.1 trillion |

| Price/Earnings (P/E) | 29 |

|

Price/Book |

33 |

| Price/Sales | 8 |

| Gross Margin | 40% |

| Net Margin | 24% |

| EBITDA | $100 billion |

| Average Wall Street rating and price target | Buy $159 |

Monday’s price action confirms the recent bullish tone finally pushing Apple stock higher. It has been a while since it has been coming but the retreat to the strong support zone around $122 has helped awaken some traders and longer-term investors to the fact that Apple has lagged the rest of the market. Facebook posted record highs in early June while Apple remains a long way short. Facebook (FB) also produced strong results but it was rewarded while AAPL was not. The momentum indicators remain trending higher with price and so confirming the move. Relative Strength Index (RSI) and Commodity Channel Index (CCI) have followed the recent price nicely but neither are in overbought territory.

Apple is in a classic short-term bullish trend so this is where the risk-reward continues, to the upside. The shares are trading above both key short-term moving averages, the 9 and 21-day and Monday’s move saw most of the volume print toward the high of the day, the point of control. For those long, the trend still looks set to continue so always use a trailing stop to try and maximize profits.

A break of $137 should see the price accelerate as volume thins out dramatically above this level. So traders looking to enter longs can wait for a bullish break of $137 with a stop near $135. Any pullback can be used to enter longs so long as the 21-day moving average holds.

Like this article? Help us with some feedback by answering this survey:

-637599481647542377.png)